accounting questions please help

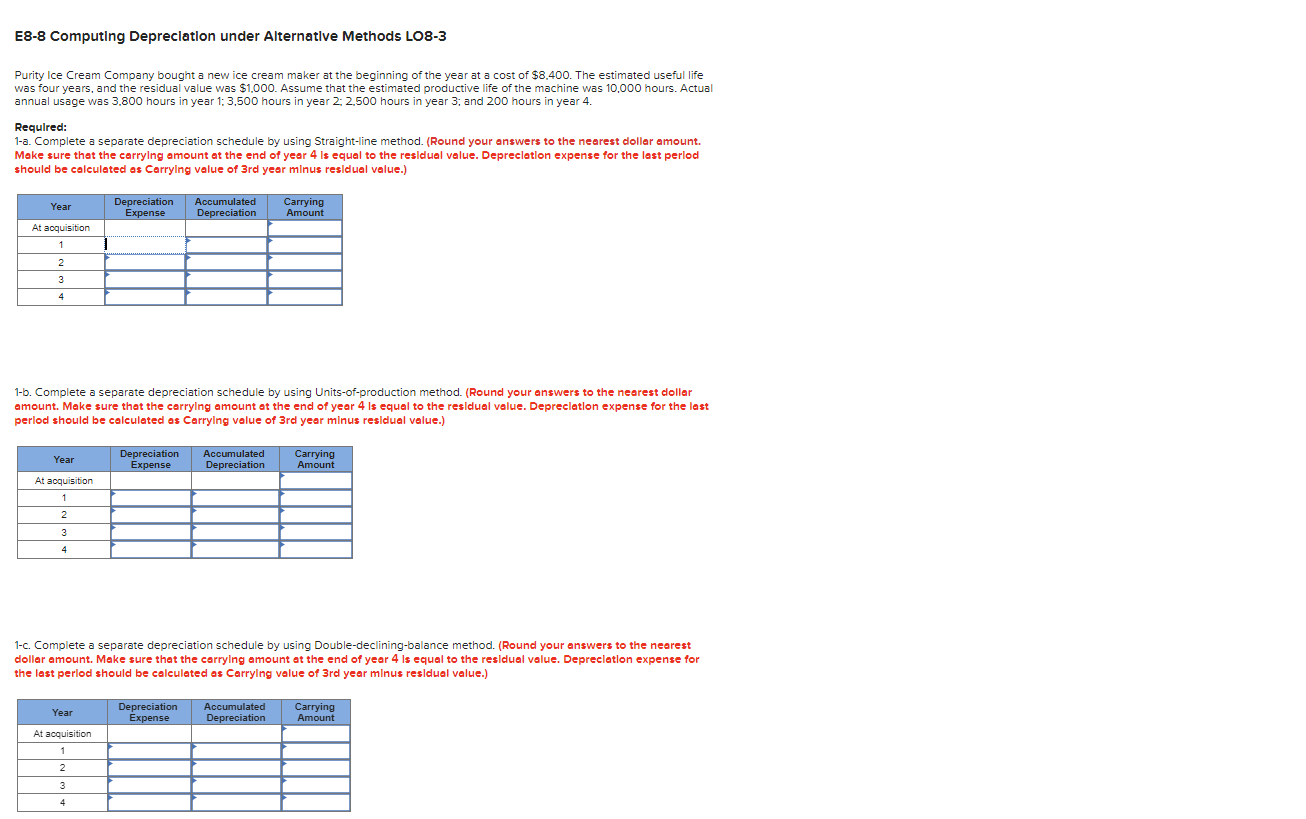

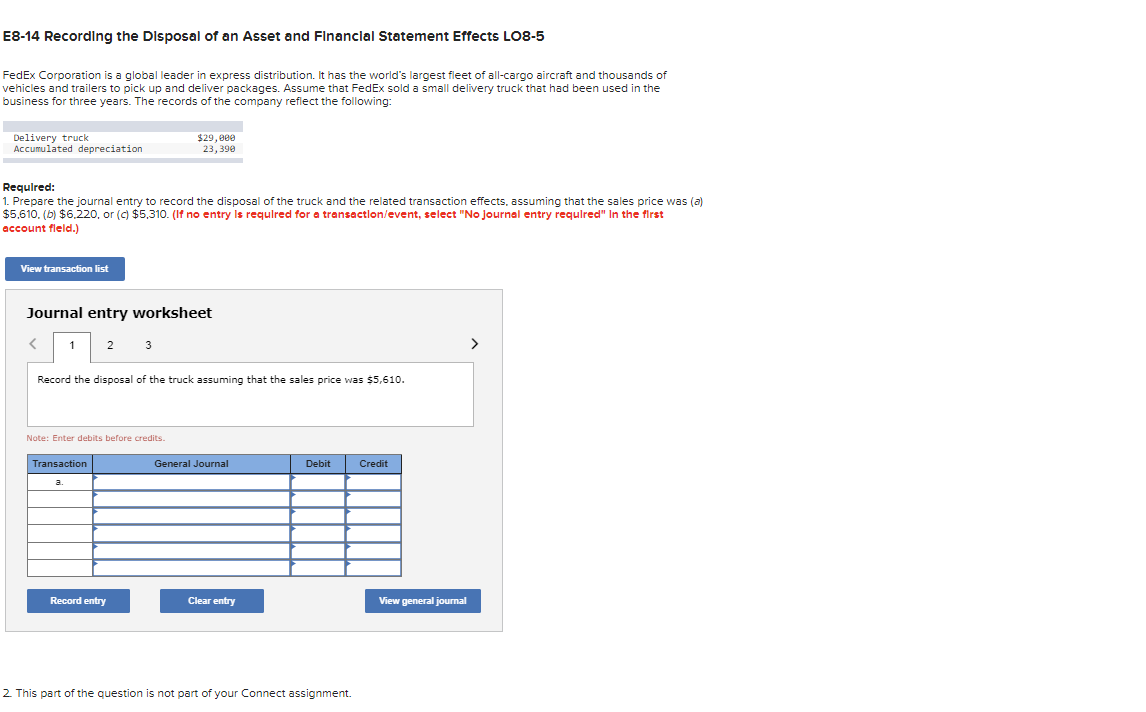

E8-8 Computing Depreclation under Alternative Methods LO8-3 Purity Ice Cream Company bought a new ice cream maker at the beginning of the year at a cost of $8,400. The estimated useful life was four years, and the residual value was $1,000. Assume that the estimated productive life of the machine was 10,000 hours. Actual annual usage was 3,800 hours in year 1;3,500 hours in year 2; 2,500 hours in year 3 ; and 200 hours in year 4. Requlred: 1-a. Complete a separate depreciation schedule by using Straight-line method. (Round your answers to the nearest dollar amount. Make sure that the carrylng amount at the end of year 4 is equal to the resldual value. Deprecletlon expense for the last perlod should be calculated as Carrylng value of 3 rd year minus residual value.) 1-b. Complete a separate depreciation schedule by using Units-of-production method. (Round your answers to the nearest dollar amount. Make sure that the carrylng amount at the end of year 4 is equal to the resldual value. Depreclatlon expense for the last perlod should be coleulated as Carrylng value of 3 rd year minus residual value.) 1-c. Complete a separate depreciation schedule by using Double-declining-balance method. (Round your answers to the neorest dollar amount. Make sure that the carrylng amount at the end of year 4 is equal to the residual value. Depreclation expense for the last perlod should be calculated as Carrylng value of 3 rd year minus residual value.) E8-14 Recording the Disposal of an Asset and Financlal Statement Effects LO8-5 FedEx Corporation is a global leader in express distribution. It has the world's largest fleet of all-cargo aircraft and thousands of vehicles and trailers to pick up and deliver packages. Assume that FedEx sold a small delivery truck that had been used in the business for three years. The records of the company reflect the following: Requlred: 1. Prepare the journal entry to record the disposal of the truck and the related transaction effects, assuming that the sales price was (a) $5,610, (b) $6,220, or (c) $5,310. (If no entry ls requlred for a transecton/event, select "No Journal entry requlred" In the flrst account fleld.) Journal entry worksheet Record the disposal of the truck assuming that the sales price was $5,610. Note: Enter debits before credits. 2. This part of the question is not part of your Connect assignment