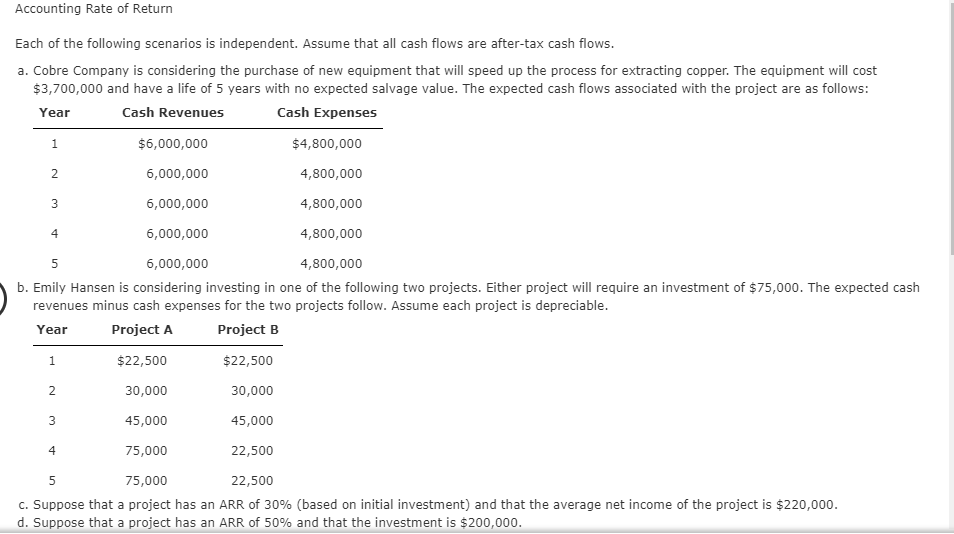

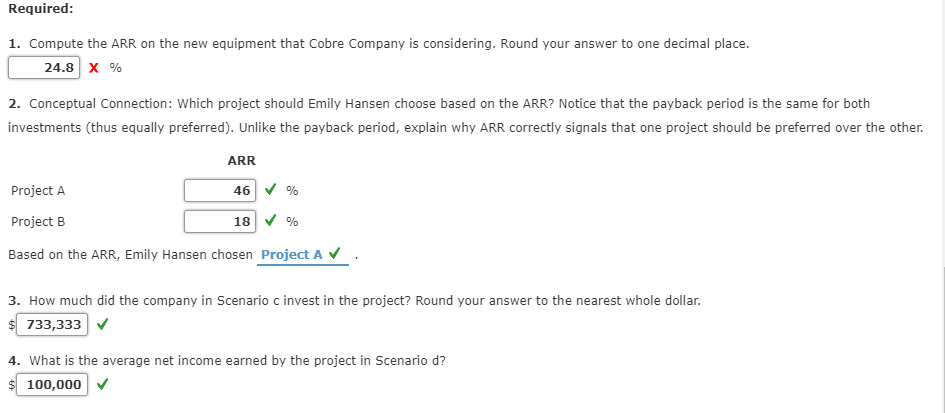

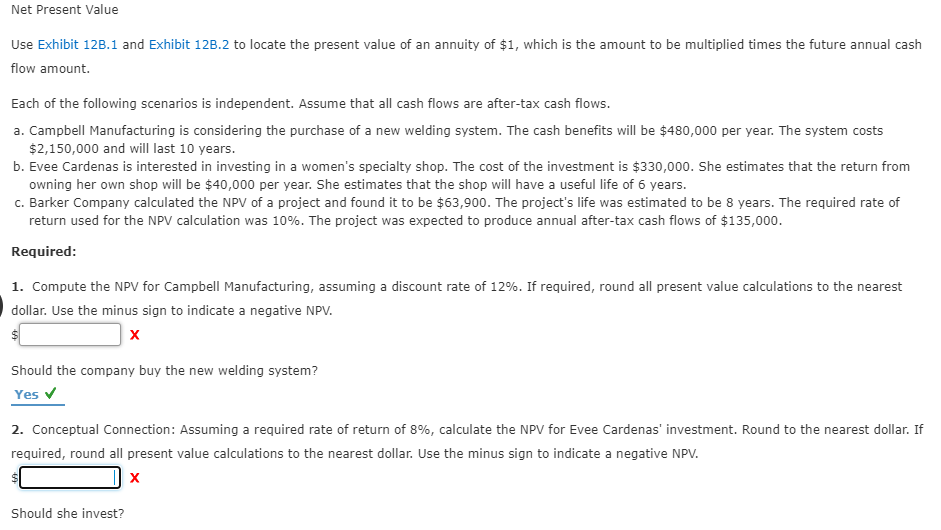

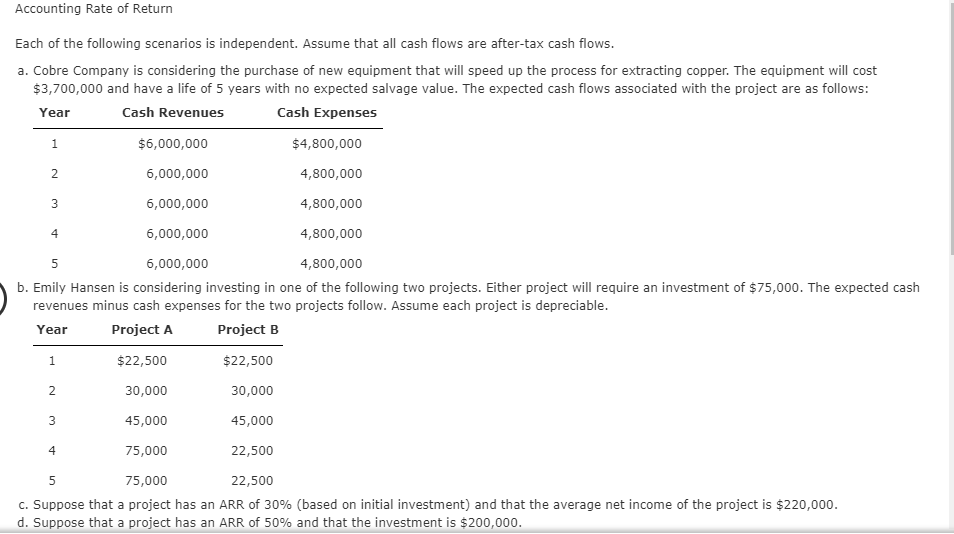

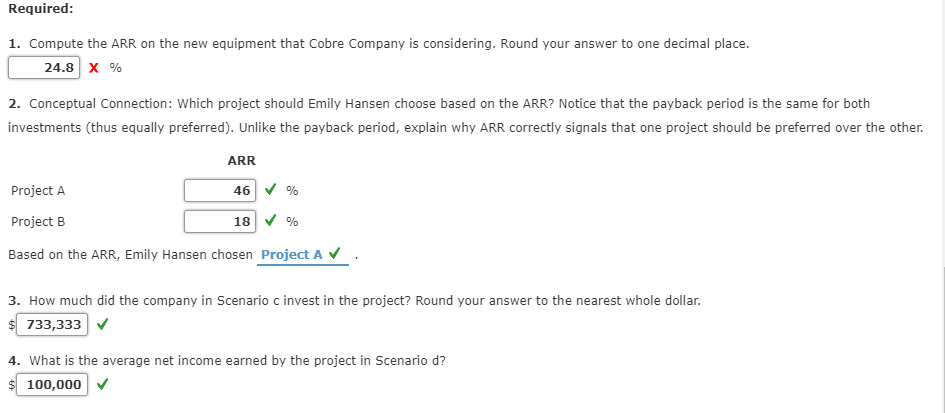

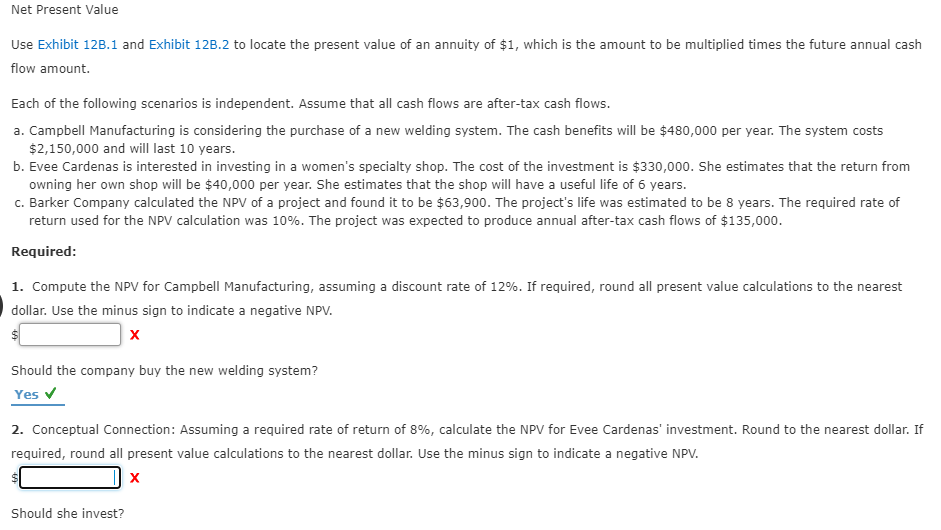

Accounting Rate of Return Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Cobre Company is considering the purchase of new equipment that will speed up the process for extracting copper. The equipment will cost $3,700,000 and have a life of 5 years with no expected salvage value. The expected cash flows associated with the project are as follows: Year Cash Revenues Cash Expenses 1 $6,000,000 $4,800,000 N 6,000,000 4,800,000 3 6,000,000 4,800,000 4 5 6,000,000 4,800,000 6,000,000 4,800,000 b. Emily Hansen is considering investing in one of the following two projects. Either project will require an investment of $75,000. The expected cash revenues minus cash expenses for the two projects follow. Assume each project is depreciable. Year Project A Project B 1 $22,500 $22,500 2 30,000 30,000 3 45,000 45,000 4 75,000 22,500 5 75,000 22,500 C. Suppose that a project has an ARR of 30% (based on initial investment) and that the average net income of the project is $220,000. d. Suppose that a project has an ARR of 50% and that the investment is $200,000. Required: 1. Compute the ARR on the new equipment that Cobre Company is considering. Round your answer to one decimal place. 24.8 x % 2. Conceptual Connection: Which project should Emily Hansen choose based on the ARR? Notice that the payback period is the same for both investments (thus equally preferred). Unlike the payback period, explain why ARR correctly signals that one project should be preferred over the other. ARR Project A 46 % Project B 18 % Based on the ARR, Emily Hansen chosen Project AV 3. How much did the company in Scenario c invest in the project? Round your answer to the nearest whole dollar. $ 733,333 4. What is the average net income earned by the project in Scenario d? $ 100,000 Net Present Value Use Exhibit 123.1 and Exhibit 123.2 to locate the present value of an annuity of $1, which is the amount to be multiplied times the future annual cash flow amount Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,150,000 and will last 10 years. b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $330,000. She estimates that the return from owning her own shop will be $40,000 per year. She estimates that the shop will have a useful life of 6 years. C. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Compute the NPV for Campbell Manufacturing, assuming a discount rate of 12%. If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a negative NPV. X Should the company buy the new welding system? Yes 2. Conceptual Connection: Assuming a required rate of return of 8%, calculate the NPV for Evee Cardenas' investment. Round to the nearest dollar. If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a negative NPV. X Should she invest? Should she invest? No What if the estimated return was $135,000 per year? Calculate the new NPV for Evee Cardenas' investment. Would this affect the decision? What does this tell you about your analysis? Round to the nearest dollar. The shop should now be purchased. This reveals that the decision to accept or reject in this case is affected by differences in estimated cash flow 3. What was the required investment for Barker Company's project? Round to the nearest dollar. If required, round all present value calculations to the nearest dollar