Answered step by step

Verified Expert Solution

Question

1 Approved Answer

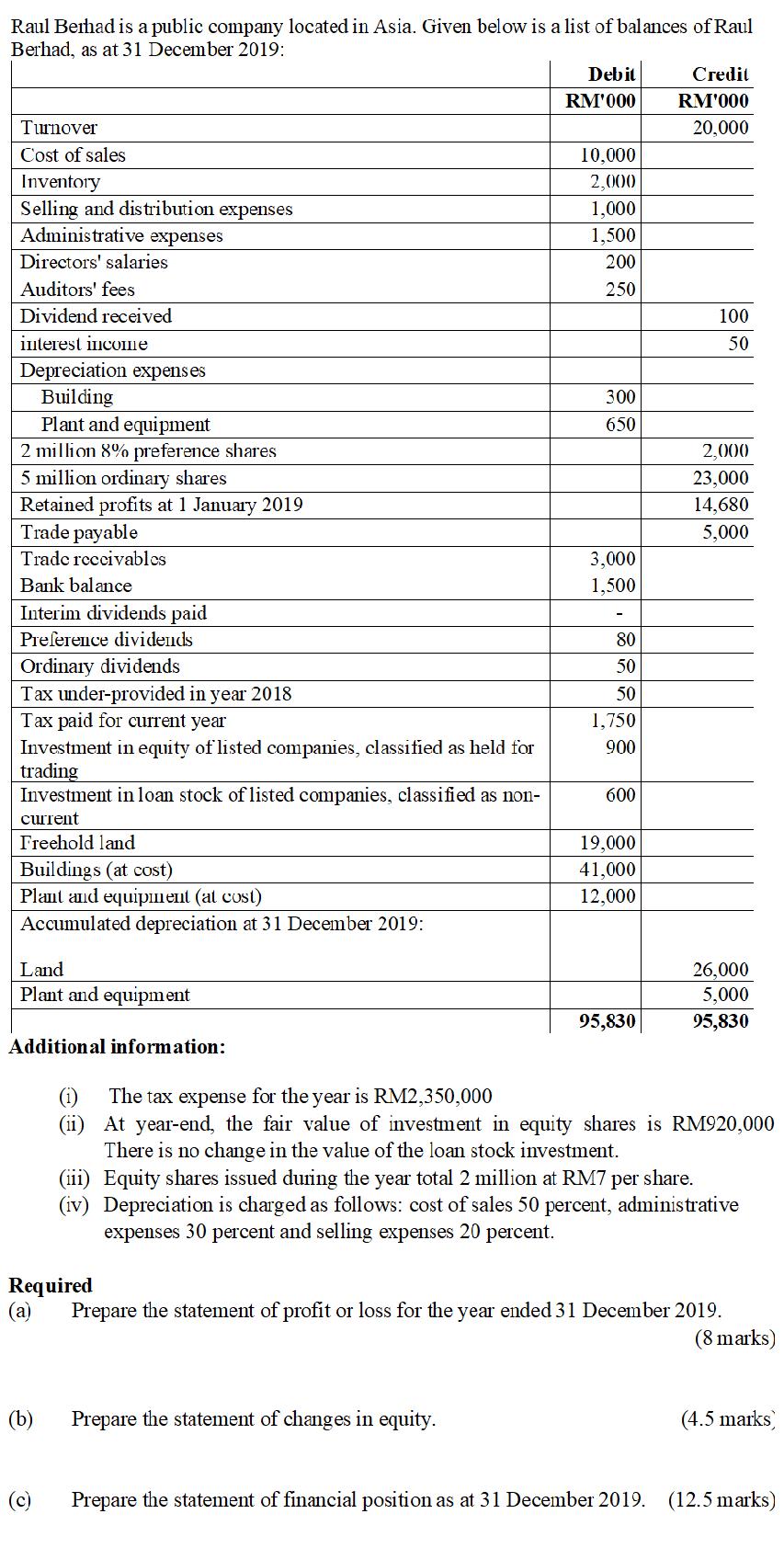

rn Raul Berhad is a public company located in Asia. Given below is a list of balances of Raul Berhad, as at 31 December 2019:

rn

rn

Raul Berhad is a public company located in Asia. Given below is a list of balances of Raul Berhad, as at 31 December 2019: Debit Credit RM'000 RM'000 Turnover 20,000 Cost of sales 10,000 Inventory Selling and distribution expenses Administrative expenses 2,000 1,000 1,500 Directors' salaries 200 Auditors' fees 250 Dividend received 100 interest incoIme 50 Depreciation expenses Building Plant and equipment 2 million 8% preference shares 5 million ordinary shares Retained profits at 1 January 2019 Trade payable 300 650 2,000 23,000 14,680 5,000 Trade reccivablcs 3,000 Bank balance 1,500 Interim dividends paid Preference dividends 80 Ordinary dividends Tax under-provided in year 2018 Tax paid for current year 50 50 1,750 900 Investment in equity of listed companies, classified as held for trading Investment in loan stock of listed companies, classified as non- 600 current Freehold land 19,000 Buildings (at cost) Plant and equipiment (at cost) 41,000 12,000 Accumulated depreciation at 31 December 2019: Land 26,000 5,000 Plant and equipment 95,830 95,830 Additional information: The tax expense for the year is RM2,350,000 (ii) At year-end, the fair value of investment in equity shares is RM920,000 There is no change in the value of the loan stock investment. (iii) Equity shares issued during the year total 2 million at RM7 per share. (iv) Depreciation is charged as follows: cost of sales 50 percent, administrative expenses 30 percent and selling expenses 20 percent. Required (a) Prepare the statement of profit or loss for the year ended 31 December 2019. (8 marks) (b) Prepare the statement of changes in equity. (4.5 marks) (c) Prepare the statement of financial position as at 31 December 2019. (12.5 marks)

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

There is no ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started