Answered step by step

Verified Expert Solution

Question

1 Approved Answer

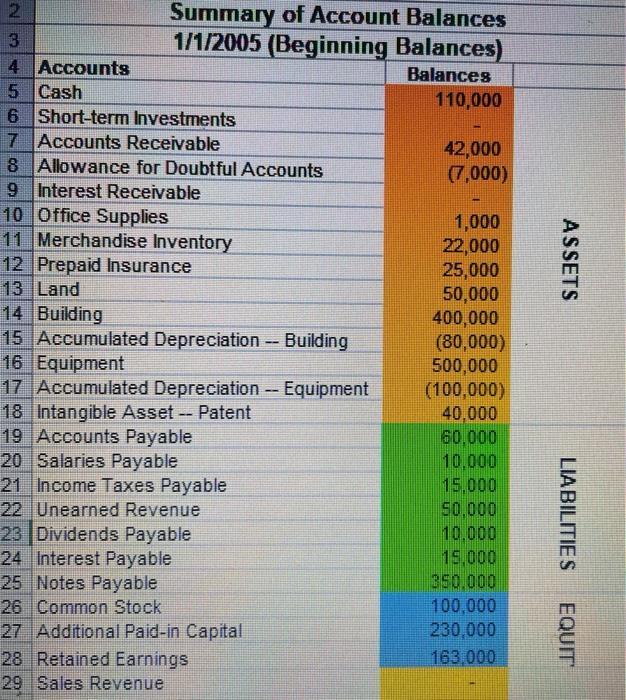

Record transactions terms for assets: cash, short term investments, A/R, allowance for doubtful Acc, interest receivable, merchandise inventory, office supplies, prepaid insurance, land, building, Accumulated

Record transactions

terms for assets: cash, short term investments, A/R, allowance for doubtful Acc, interest receivable, merchandise inventory, office supplies, prepaid insurance, land, building, Accumulated building, intangible asset.terms for liabilities: A/P, salaries payable, income tax payable, interest payable, unearned revenue, dividends payable, notes payable

terms for equity: common stock, additional paid in capital, retained earnings

terms for revenues: sales revenue, sales discount, sales allowance, service revenue, interest income

terms for expenses: COGS, salaries expense, advertising expense, office supplies exp.,utilities exp,bad debts exp, depreciation exp, amortization exp, miscellaneous exp, interest exp, income tax exp.

A/R balance at January 1,2005

needed info=

Lao Che industries...$15,000(current)

temple of doom co...$5,500(90 day past due)

Asp Co........................$10,000(current)

Ark of the covenant.....$11,500(current)

Beginning Balance:

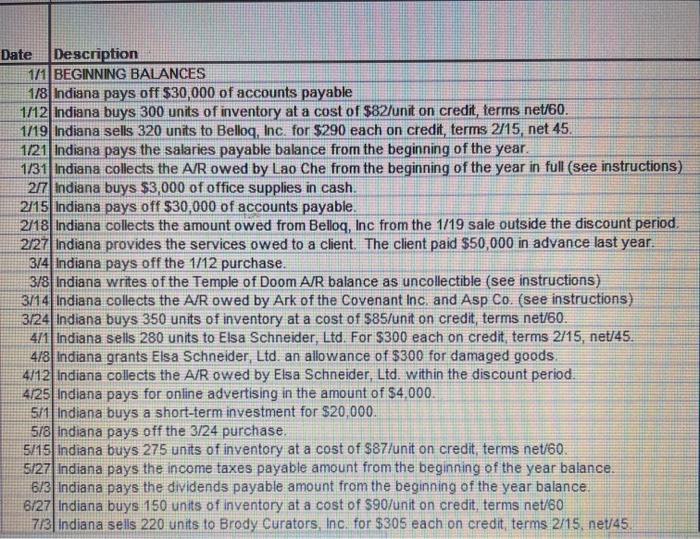

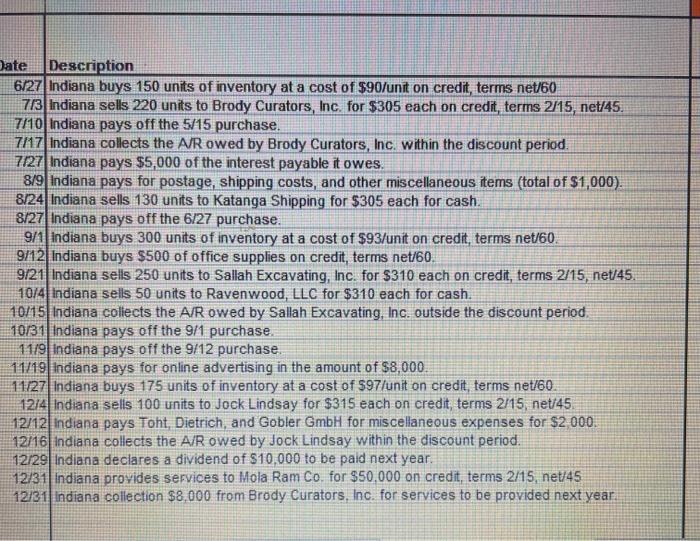

Date Description 1/1 BEGINNING BALANCES 1/8 Indiana pays off $30,000 of accounts payable 1/12 Indiana buys 300 units of inventory at a cost of $82/unit on credit, terms net/60. 1/19 Indiana sells 320 units to Belloq, Inc. for $290 each on credit, terms 2/15, net 45. 1/21 Indiana pays the salaries payable balance from the beginning of the year. 1/31 Indiana collects the A/R owed by Lao Che from the beginning of the year in full (see instructions) 2/7 Indiana buys $3,000 of office supplies in cash. 2/15 Indiana pays off $30,000 of accounts payable. 2/18 Indiana collects the amount owed from Belloq, Inc from the 1/19 sale outside the discount period. 2/27 Indiana provides the services owed to a client. The client paid $50,000 in advance last year. 3/4 Indiana pays off the 1/12 purchase. 3/8 Indiana writes of the Temple of Doom A/R balance as uncollectible (see instructions) 3/14 Indiana collects the A/R owed by Ark of the Covenant Inc. and Asp Co. (see instructions) 3/24 Indiana buys 350 units of inventory at a cost of $85/unit on credit, terms net/60. 4/1 Indiana sells 280 units to Elsa Schneider, Ltd. For $300 each on credit, terms 2/15, net/45. 4/8 Indiana grants Elsa Schneider, Ltd. an allowance of $300 for damaged goods. 4/12 Indiana collects the A/R owed by Elsa Schneider, Ltd. within the discount period. 4/25 Indiana pays for online advertising in the amount of $4,000. 5/1 Indiana buys a short-term investment for $20,000. 5/8 Indiana pays off the 3/24 purchase. 5/15 Indiana buys 275 units of inventory at a cost of $87/unit on credit, terms net/60. 5/27 Indiana pays the income taxes payable amount from the beginning of the year balance. 6/3 Indiana pays the dividends payable amount from the beginning of the year balance. 6/27 Indiana buys 150 units of inventory at a cost of $90/unit on credit, terms net/60 7/3 Indiana sells 220 units to Brody Curators, Inc. for $305 each on credit, terms 2/15, net/45

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started