Answered step by step

Verified Expert Solution

Question

1 Approved Answer

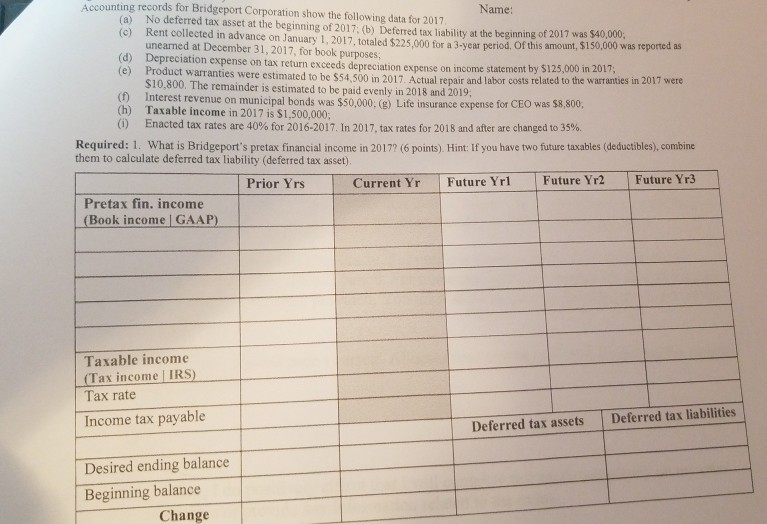

Accounting records for Bridgeport Corporation show the following data for 2017 Name: (a) No deferred tax asset at the beginning of 2017. (b) Deferred tax

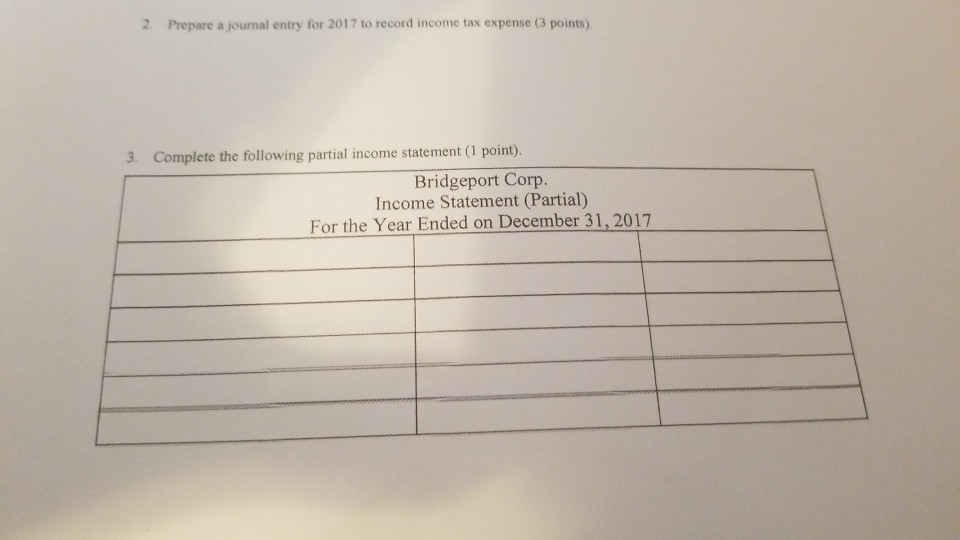

Accounting records for Bridgeport Corporation show the following data for 2017 Name: (a) No deferred tax asset at the beginning of 2017. (b) Deferred tax liability at the beginning of 2017 was (c) Rent collected in advance on January 1, 2017, totaled $225,000 for a 3-year period. Of this amount, $150 unearned at December 31, 2017, for book purposes (d) Depreciation expense on tax return exceeds depreciation expense on income statement (e) Product warranties were estimated to be $$4,500 in 2017. Actual repair and labor costs related to the wan by $125,000 in 2017; $10,800. The remainder is estimated to be paid evenly in 2018 and 2019 Interest revenue on municipal bonds was $50,000: (g) Life insurance expense for CEO was $8,800, Taxable income in 2017 is $1,500,000 Enacted tax rates are 40%for2016-2017 In 2017 tax rates for 2018and after are changed to 35% (h) (i) Required: 1. What is Bridgeport's pretax financial income in 2017? (6 points). Hint: If you have two future taxables (deductibles), combine them to calculate deferred tax liability (deferred tax asset) Prior Yrs Current Yr Future Yrl Future Yr2 Future Yr3 Pretax fin. income (Book income GAAP) Taxable income (Tax income | IRS) Tax rate Income tax payable Deferred tax assets Deferred tax liabilities Desired ending balance Beginning balance Change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started