Answered step by step

Verified Expert Solution

Question

1 Approved Answer

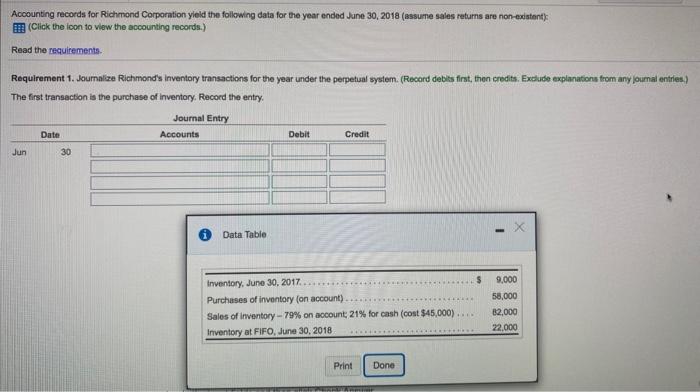

Accounting records for Richmond Corporation yield the following data for the year ended June 30, 2018 (assume sales returns are non-existent): (Click the icon

Accounting records for Richmond Corporation yield the following data for the year ended June 30, 2018 (assume sales returns are non-existent): (Click the icon to view the accounting records.) Read the requirements. Requirement 1. Journalize Richmond's inventory transactions for the year under the perpetual system. (Record debits first, then credits. Exclude explanations from any journal entries.) The first transaction is the purchase of inventory. Record the entry. Jun Date 30 Journal Entry Accounts Data Table Debit Credit Inventory, June 30, 2017..... Purchases of inventory (on account). Sales of inventory-79% on account; 21% for cash (cost $45,000). Inventory at FIFO, June 30, 2018 Print Done - $ 9,000 58,000 82,000 22,000

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Richmond Corporation Requirement 1 Journal Enteries Trans Particulars 1 2 Inventory ac Inven...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started