Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate, for the 2020 taxation year, your minimum Net Income for Tax Purposes as per the Section 3 ordering rules. Case: Taxpayer Information Jana Larson

Calculate, for the 2020 taxation year, your minimum Net Income for Tax Purposes as per the Section 3 ordering rules.

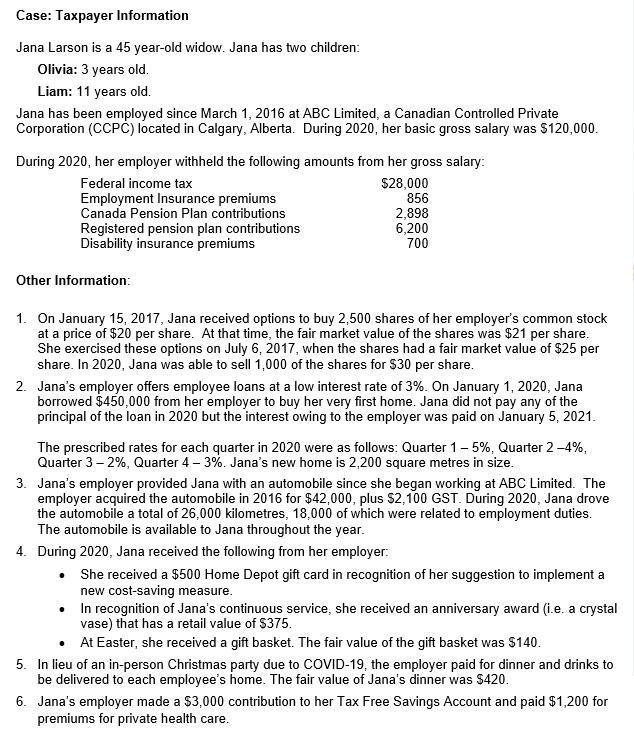

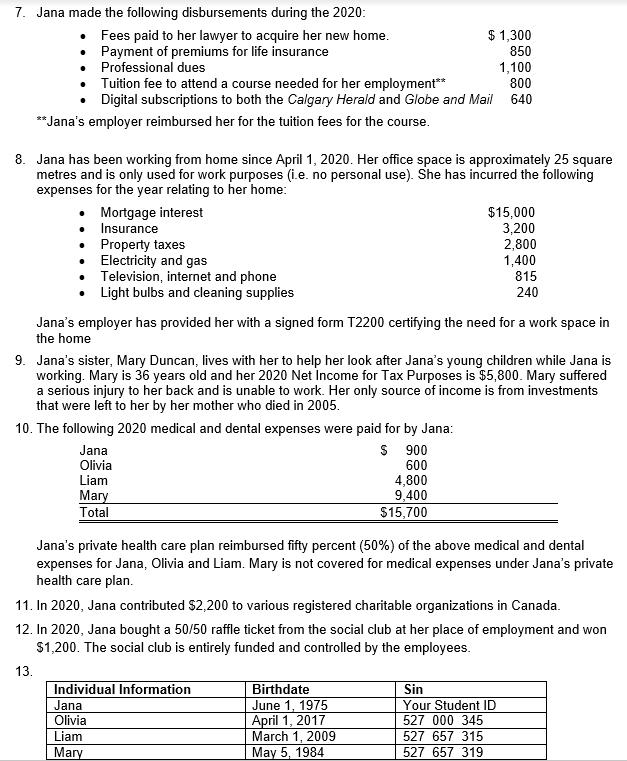

Case: Taxpayer Information Jana Larson is a 45 year-old widow. Jana has two children: Olivia: 3 years old. Liam: 11 years old. Jana has been employed since March 1, 2016 at ABC Limited, a Canadian Controlled Private Corporation (CCP) located in Calgary, Alberta. During 2020, her basic gross salary was $120,000. During 2020, her employer withheld the following amounts from her gross salary: Federal income tax Employment Insurance premiums Canada Pension Plan contributions Registered pension plan contributions Disability insurance premiums $28,000 856 2,898 6,200 700 Other Information: 1. On January 15, 2017, Jana received options to buy 2,500 shares of her employer's common stock at a price of $20 per share. At that time, the fair market value of the shares was $21 per share. She exercised these options on July 6, 2017, when the shares had a fair market value of $25 per share. In 2020, Jana was able to sell 1,000 of the shares for $30 per share. 2. Jana's employer offers employee loans at a low interest rate of 3%. On January 1, 2020, Jana borrowed $450,000 from her employer to buy her very first home. Jana did not pay any of the principal of the loan in 2020 but the interest owing to the employer was paid on January 5, 2021. The prescribed rates for each quarter in 2020 were as follows: Quarter 1- 5%, Quarter 2 -4%, Quarter 3 - 2%, Quarter 4 - 3%. Jana's new home is 2,200 square metres in size. 3. Jana's employer provided Jana with an automobile since she began working at ABC Limited. The employer acquired the automobile in 2016 for $42,000, plus S2,100 GST. During 2020, Jana drove the automobile a total of 26,000 kilometres, 18,000 of which were related to employment duties. The automobile is available to Jana throughout the year. 4. During 2020, Jana received the following from her employer: She received a $500 Home Depot gift card in recognition of her suggestion to implement a new cost-saving measure. In recognition of Jana's continuous service, she received an anniversary award (i.e. a crystal vase) that has a retail value of $375. At Easter, she received a gift basket. The fair value of the gift basket was $140. 5. In lieu of an in-person Christmas party due to COVID-19, the employer paid for dinner and drinks to be delivered to each employee's home. The fair value of Jana's dinner was $420. 6. Jana's employer made a $3,000 contribution to her Tax Free Savings Account and paid $1,200 for premiums for private health care.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Janas Net Income for Tax Purposes 120000 Olivias Net Income for Tax Purposes 3200 Liams Net I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started