Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Determine I.N. Vestor's net income for tax purposes as a result of the above information. Provide explanation for all items omitted and show all

Required:

Determine I.N. Vestor's net income for tax purposes as a result of the above information. Provide explanation for all items omitted and show all calculations whether or not necessary to the final answer.

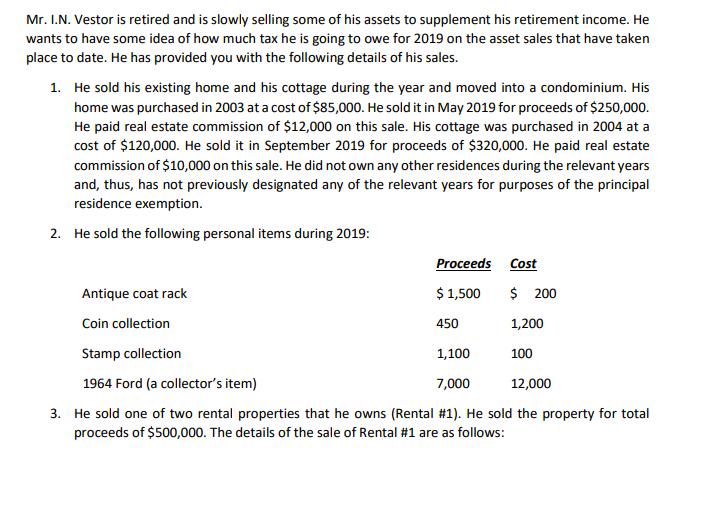

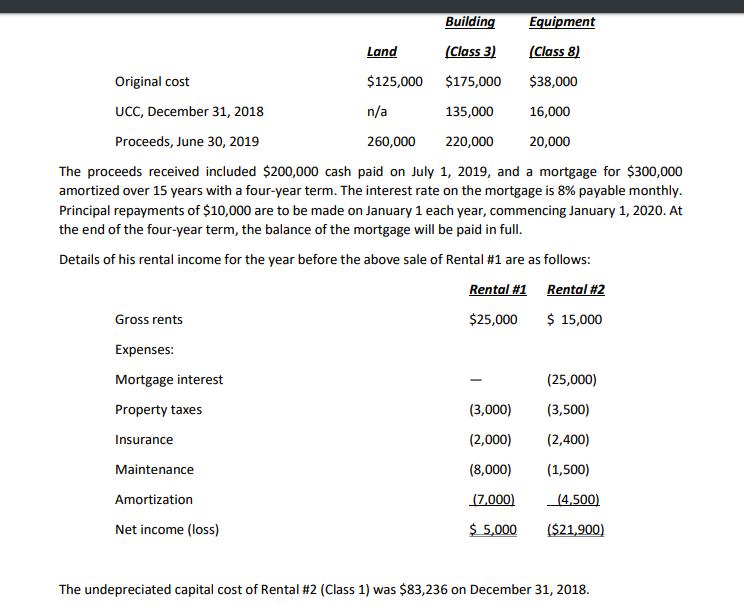

Mr. I.N. Vestor is retired and is slowly selling some of his assets to supplement his retirement income. He wants to have some idea of how much tax he is going to owe for 2019 on the asset sales that have taken place to date. He has provided you with the following details of his sales. 1. He sold his existing home and his cottage during the year and moved into a condominium. His home was purchased in 2003 at a cost of $85,000. He sold it in May 2019 for proceeds of $250,000. He paid real estate commission of $12,000 on this sale. His cottage was purchased in 2004 at a cost of $120,000. He sold it in September 2019 for proceeds of $320,000. He paid real estate commission of $10,000 on this sale. He did not own any other residences during the relevant years and, thus, has not previously designated any of the relevant years for purposes of the principal residence exemption. 2. He sold the following personal items during 2019: Proceeds Cost Antique coat rack $ 1,500 $ 200 Coin collection 450 1,200 Stamp collection 1,100 100 1964 Ford (a collector's item) 7,000 12,000 3. He sold one of two rental properties that he owns (Rental #1). He sold the property for total proceeds of $500,000. The details of the sale of Rental #1 are as follows:

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started