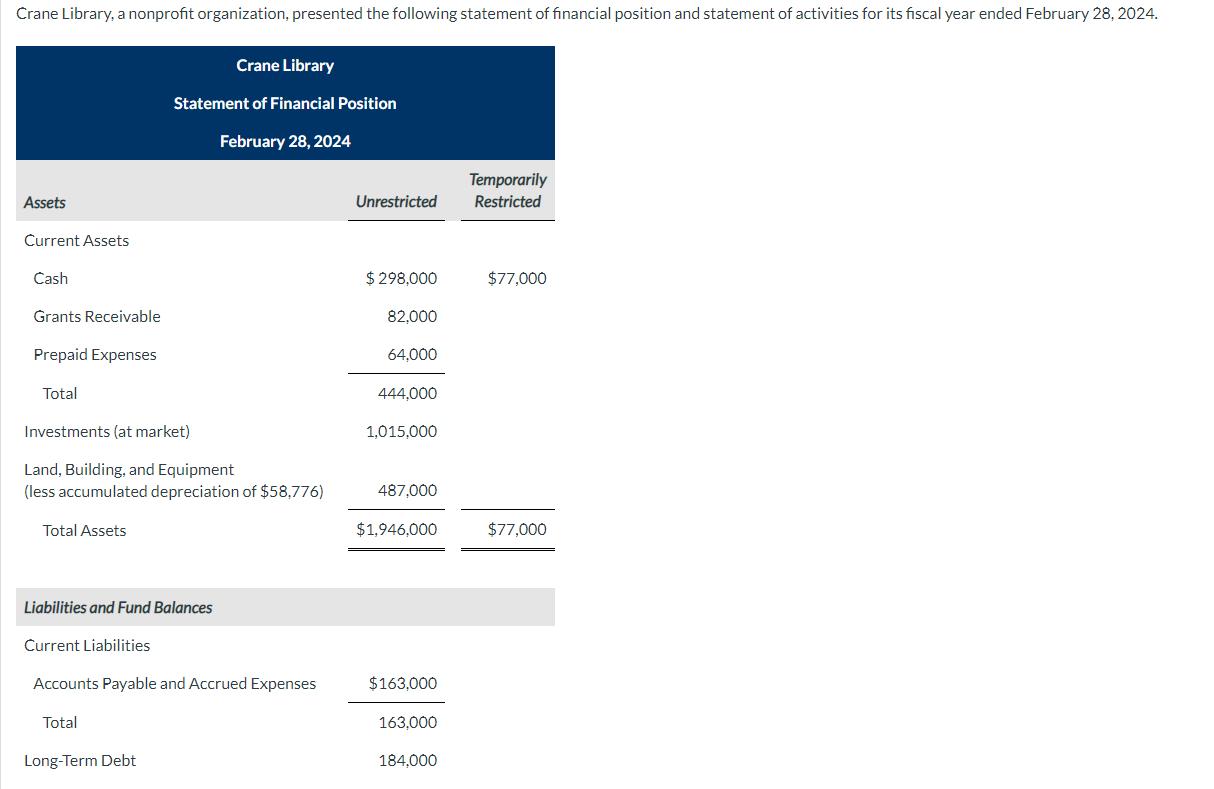

Crane Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28, 2024.

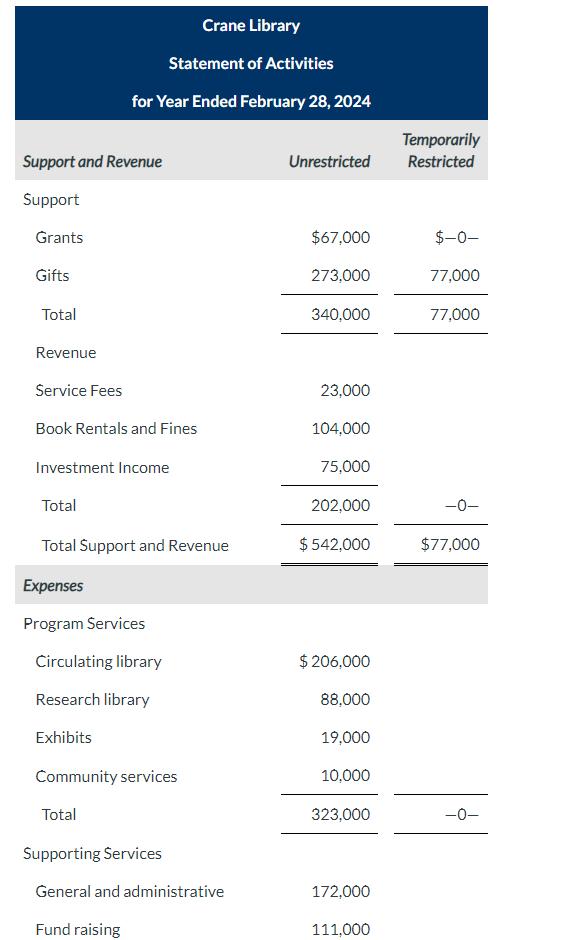

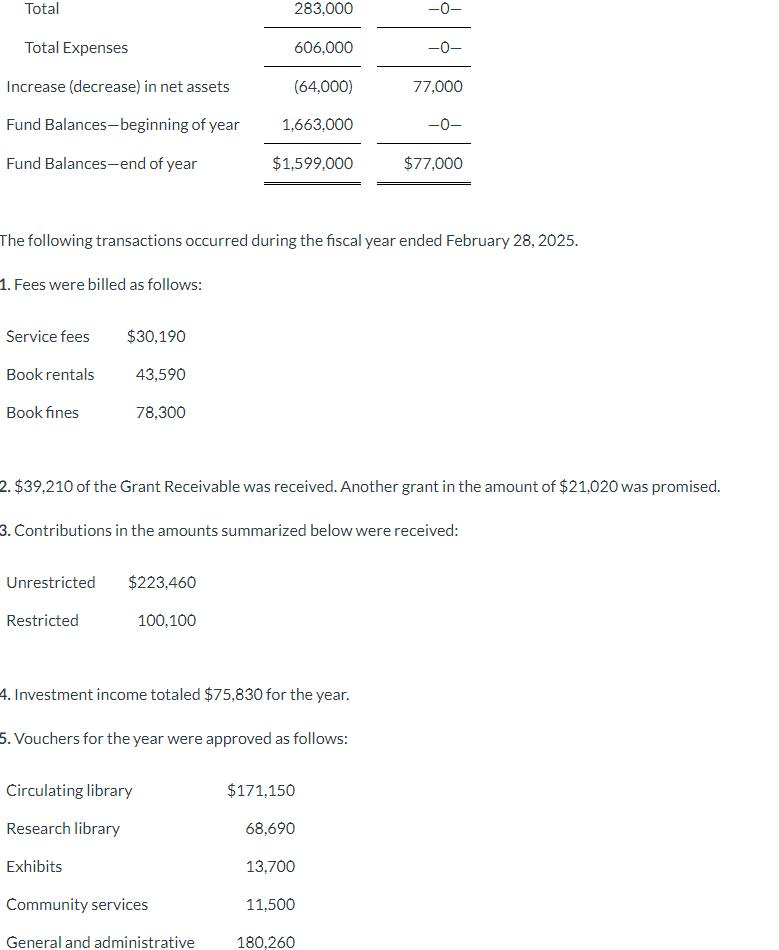

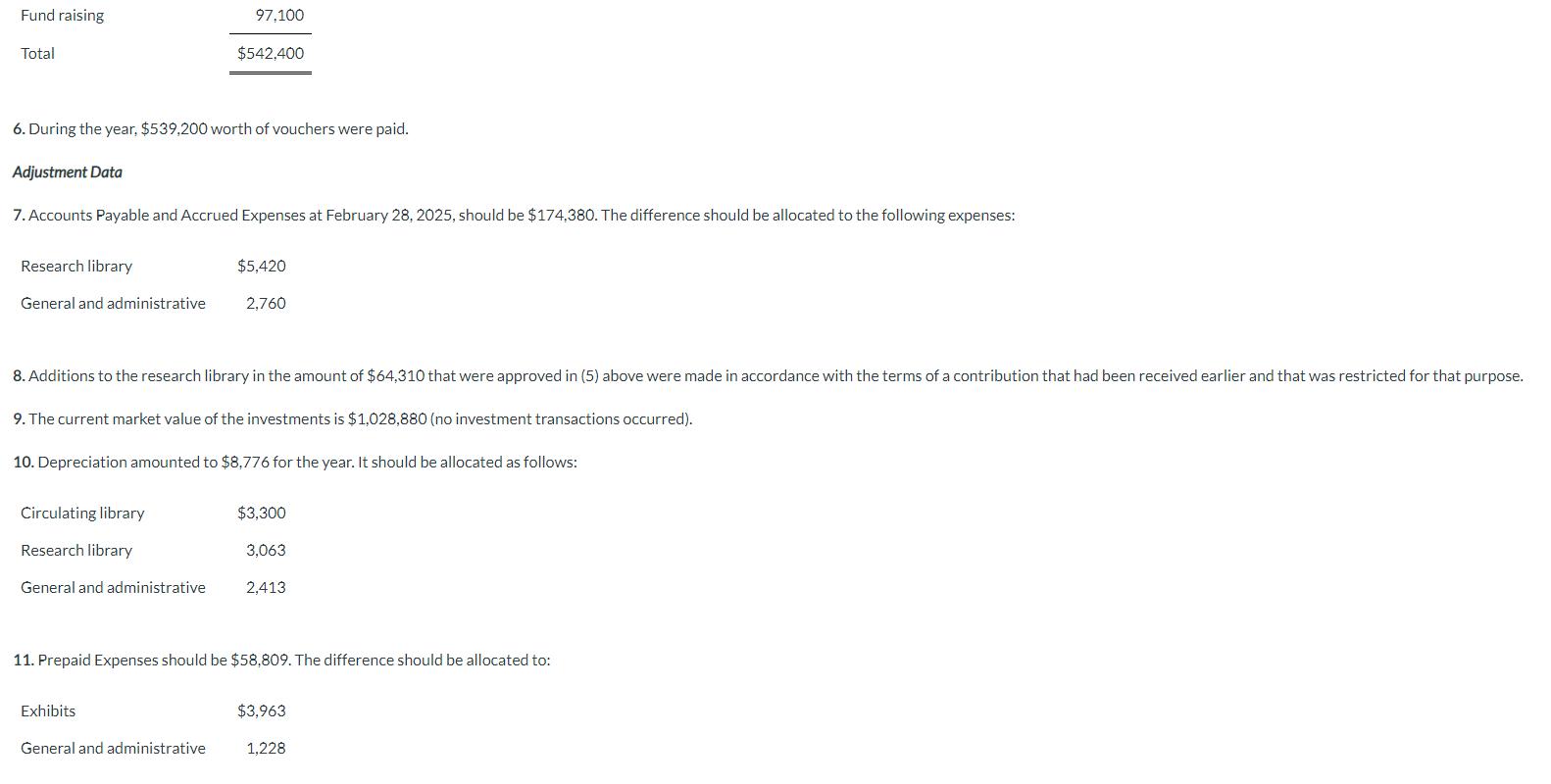

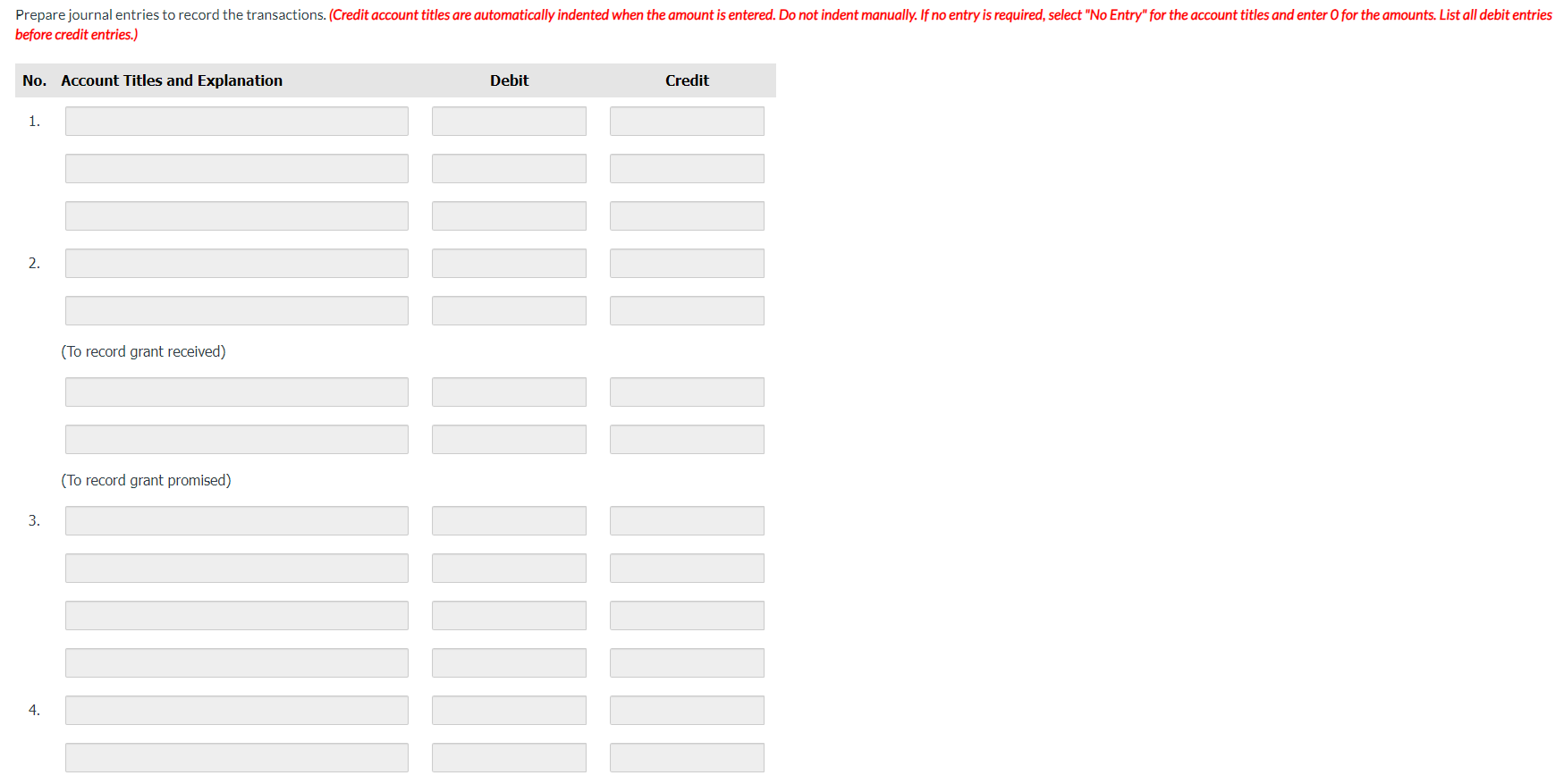

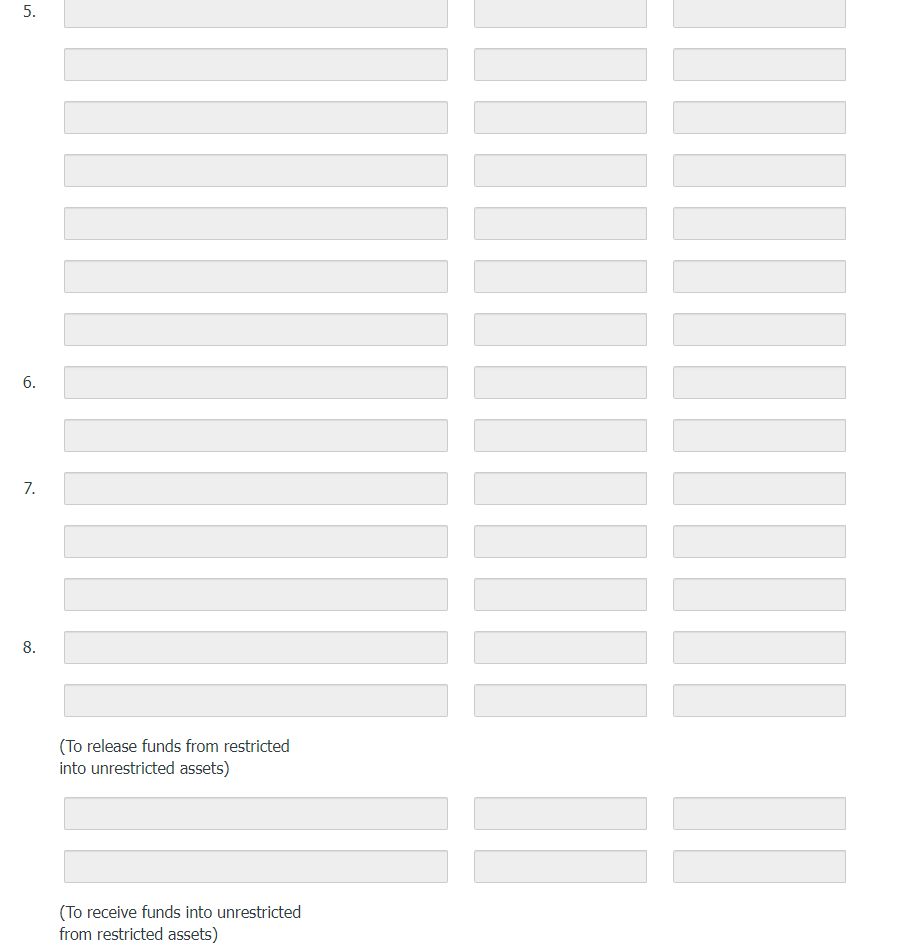

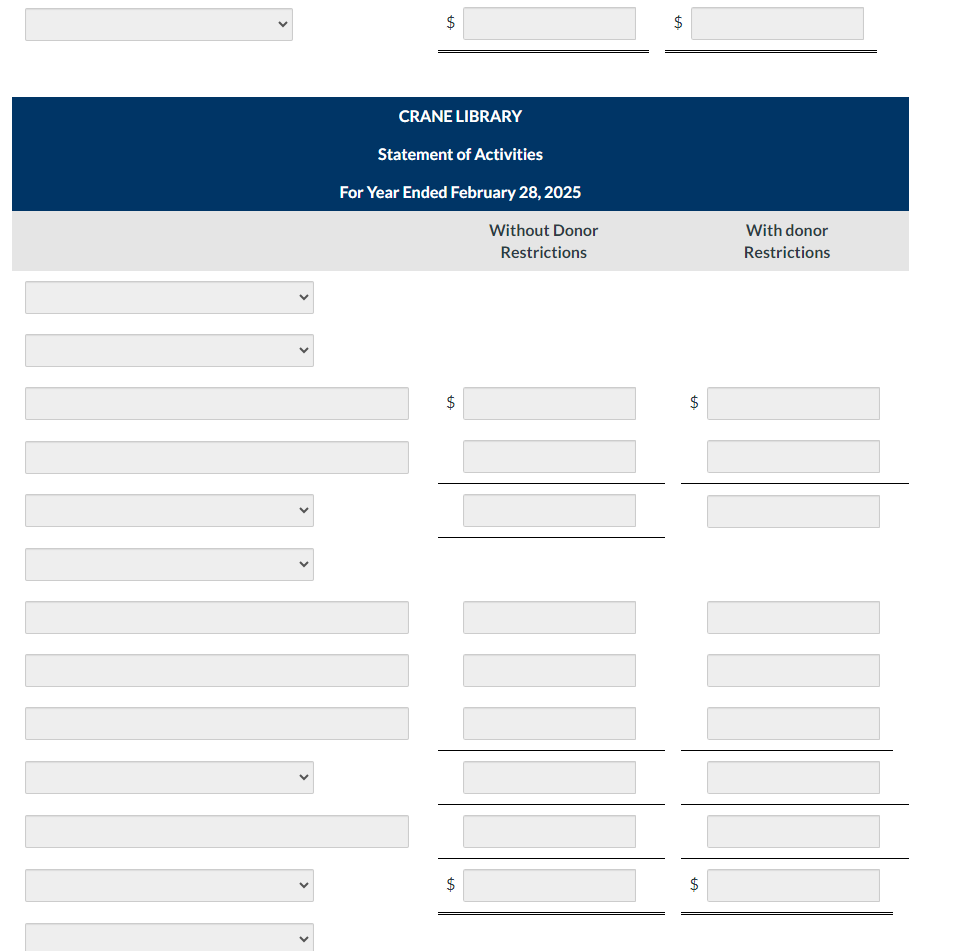

Crane Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28, 2024. Assets Current Assets Cash Grants Receivable Prepaid Expenses Total Investments (at market) Land, Building, and Equipment (less accumulated depreciation of $58,776) Total Assets Liabilities and Fund Balances Current Liabilities Crane Library Statement of Financial Position February 28, 2024 Accounts Payable and Accrued Expenses Total Long-Term Debt Unrestricted $ 298,000 82,000 64,000 444,000 1,015,000 487,000 $1,946,000 $163,000 163,000 184,000 Temporarily Restricted $77,000 $77,000 Support and Revenue Support Grants Gifts Total Revenue Crane Library Statement of Activities for Year Ended February 28, 2024 Service Fees Book Rentals and Fines Investment Income Total Total Support and Revenue Expenses Program Services Circulating library Research library Exhibits Community services Total Supporting Services General and administrative Fund raising Unrestricted $67,000 273,000 340,000 23,000 104,000 75,000 202,000 $ 542,000 $ 206,000 88,000 19,000 10,000 323,000 172,000 111,000 Temporarily Restricted $-0- 77,000 77,000 -0- $77,000 Total Total Expenses Increase (decrease) in net assets Fund Balances-beginning of year Fund Balances-end of year Service fees Book rentals Book fines $30,190 43,590 78,300 Unrestricted Restricted $223,460 The following transactions occurred during the fiscal year ended February 28, 2025. 1. Fees were billed as follows: 100,100 Circulating library Research library Exhibits 283,000 606,000 (64,000) 1,663,000 $1,599,000 Community services General and administrative 2. $39,210 of the Grant Receivable was received. Another grant in the amount of $21,020 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $75,830 for the year. 5. Vouchers for the year were approved as follows: $171,150 11,500 68,690 13,700 -0- -0- 180,260 77,000 $77,000 Fund raising Total Research library General and administrative 6. During the year, $539,200 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28, 2025, should be $174,380. The difference should be allocated to the following expenses: Circulating library Research library General and administrative 97,100 8. Additions to the research library in the amount of $64,310 that were approved in (5) above were made in accordance with the terms of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,028,880 (no investment transactions occurred). 10. Depreciation amounted to $8,776 for the year. It should be allocated as follows: $542,400 Exhibits General and administrative $5,420 2,760 $3,300 3,063 11. Prepaid Expenses should be $58,809. The difference should be allocated to: 2,413 $3,963 1,228 Prepare journal entries to record the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation 1. 2. 3. 4. (To record grant received) (To record grant promised) Debit Credit |||| 5. 6. 7. 8. (To release funds from restricted into unrestricted assets) (To receive funds into unrestricted from restricted assets) ||----------- ------------ 9. 10. 11. ///////// $ CRANE LIBRARY Statement of Activities For Year Ended February 28, 2025 $ Without Donor Restrictions $ $ With donor Restrictions $ $ T $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets prepare the journal entries to record the transactions 1 Fees were billed as follows Service fees Book rentals Book fines plaintext No Account Ti...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started