Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dorothy, an independent contractor who lives and works in Cleveland, obtains a large contract that will require her to live and work in Atlanta

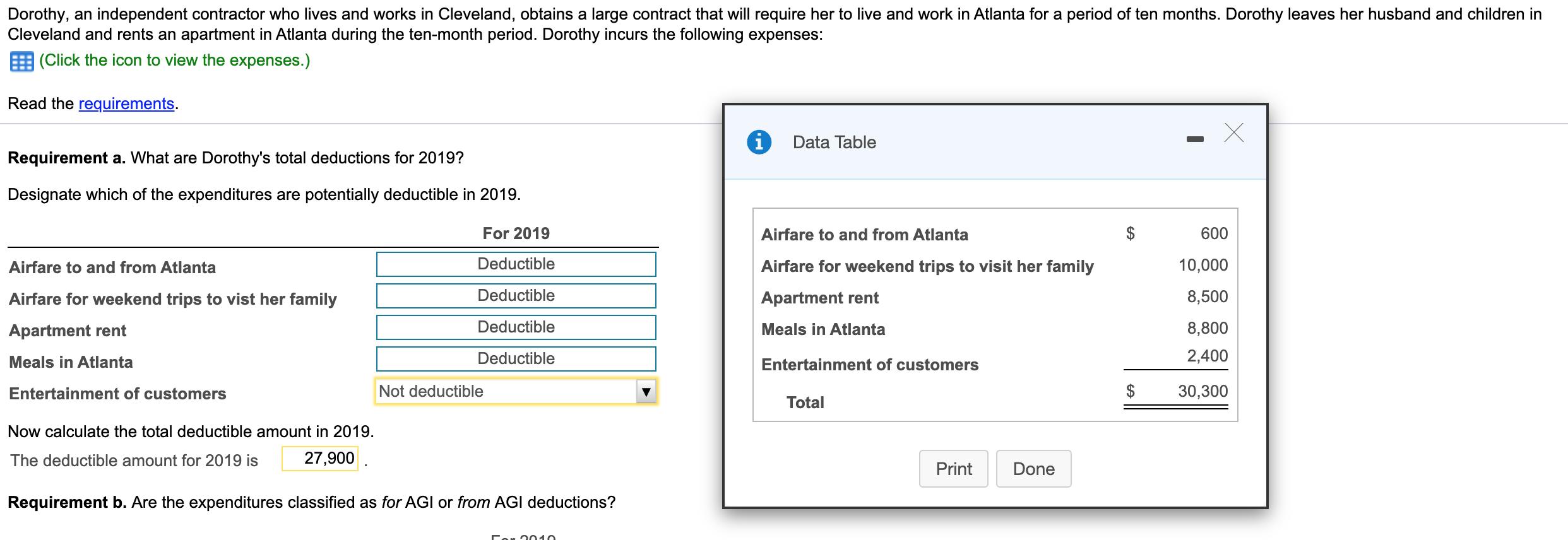

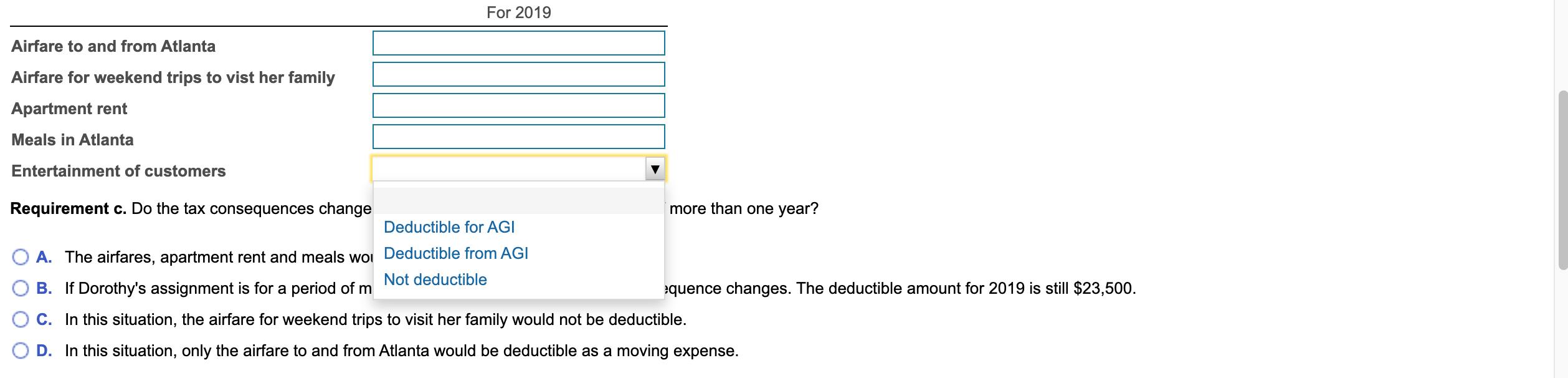

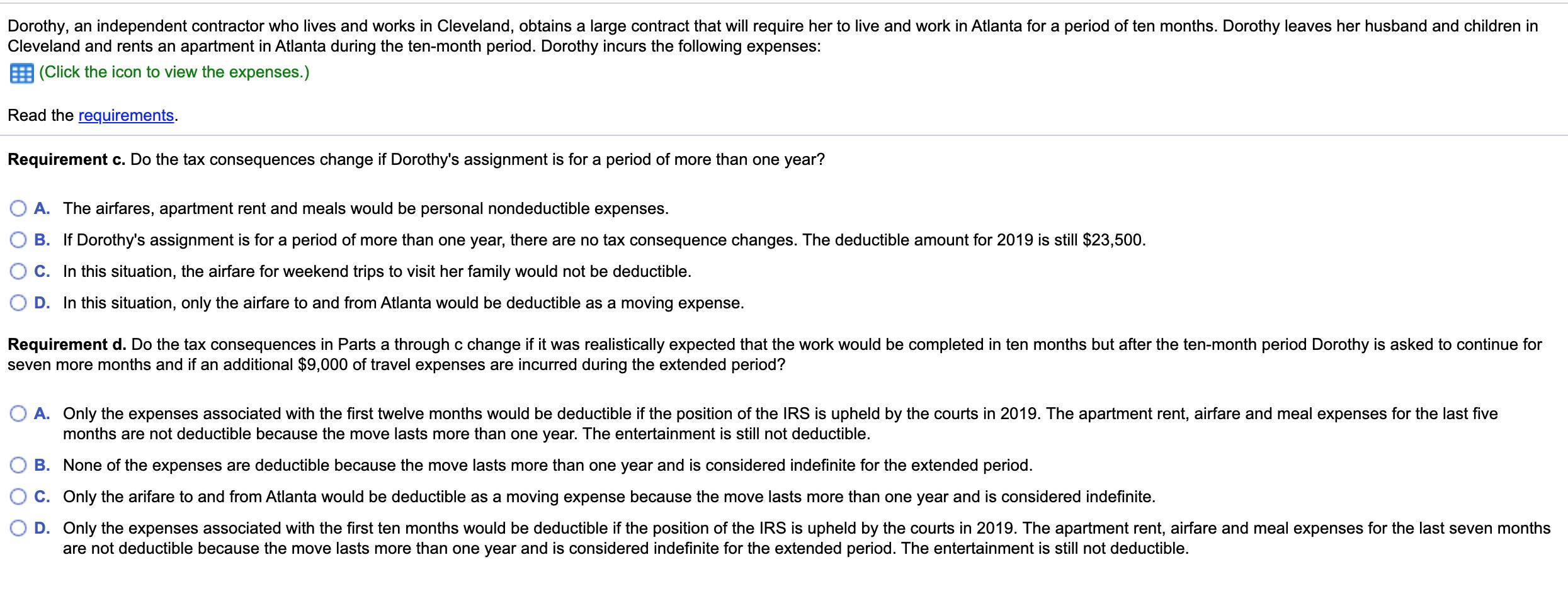

Dorothy, an independent contractor who lives and works in Cleveland, obtains a large contract that will require her to live and work in Atlanta for a period of ten months. Dorothy leaves her husband and children in Cleveland and rents an apartment in Atlanta during the ten-month period. Dorothy incurs the following expenses: (Click the icon to view the expenses.) Read the requirements. Data Table Requirement a. What are Dorothy's total deductions for 2019? Designate which of the expenditures are potentially deductible in 2019. For 2019 Airfare to and from Atlanta 600 Airfare to and from Atlanta Deductible Airfare for weekend trips to visit her family 10,000 Airfare for weekend trips to vist her family Deductible Apartment rent 8,500 Apartment rent Deductible Meals in Atlanta 8,800 Meals in Atlanta Deductible Entertainment of customers 2,400 Entertainment of customers Not deductible 2$ 30,300 Total Now calculate the total deductible amount in 2019. The deductible amount for 2019 is 27,900 . Print Done Requirement b. Are the expenditures classified as for AGI or from AGI deductions? Cor 2010 For 2019 Airfare to and from Atlanta Airfare for weekend trips to vist her family Apartment rent Meals in Atlanta Entertainment of customers Requirement c. Do the tax consequences change more than one year? Deductible for AGI O A. The airfares, apartment rent and meals woi Deductible from AGI Not deductible B. If Dorothy's assignment is for a period of m equence changes. The deductible amount for 2019 is still $23,500. C. In this situation, the airfare for weekend trips to visit her family would not be deductible. D. In this situation, only the airfare to and from Atlanta would be deductible as a moving expense. Dorothy, an independent contractor who lives and works in Cleveland, obtains a large contract that will require her to live and work in Atlanta for a period of ten months. Dorothy leaves her husband and children in Cleveland and rents an apartment in Atlanta during the ten-month period. Dorothy incurs the following expenses: (Click the icon to view the expenses.) Read the requirements. Requirement c. Do the tax consequences change if Dorothy's assignment is for a period of more than one year? A. The airfares, apartment rent and meals would be personal nondeductible expenses. B. If Dorothy's assignment is for a period of more than one year, there are no tax consequence changes. The deductible amount for 2019 is still $23,500. C. In this situation, the airfare for weekend trips to visit her family would not be deductible. D. In this situation, only the airfare to and from Atlanta would be deductible as a moving expense. Requirement d. Do the tax consequences in Parts a through c change if it was realistically expected that the work would be completed in ten months but after the ten-month period Dorothy is asked to continue for seven more months and if an additional $9,000 of travel expenses are incurred during the extended period? O A. Only the expenses associated with the first twelve months would be deductible if the position of the IRS is upheld by the courts in 2019. The apartment rent, airfare and meal expenses for the last five months are not deductible because the move lasts more than one year. The entertainment is still not deductible. B. None of the expenses are deductible because the move lasts more than one year and is considered indefinite for the extended period. O C. Only the arifare to and from Atlanta would be deductible as a moving expense because the move lasts more than one year and is considered indefinite. O D. Only the expenses associated with the first ten months would be deductible if the position of the IRS is upheld by the courts in 2019. The apartment rent, airfare and meal expenses for the last seven months are not deductible because the move lasts more than one year and is considered indefinite for the extended period. The entertainment is still not deductible.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The amount of deduction for the expenditures before any nondeductible floor limitation are applied ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started