Question

Accounting Research Problem: General Mills, Inc. The fiscal year 2017 annual report of Gen- eral Mills, Inc. is available on this books web site. Required

Accounting Research Problem: General Mills, Inc. The fiscal year 2017 annual report of Gen-

eral Mills, Inc. is available on this books web site.

Required

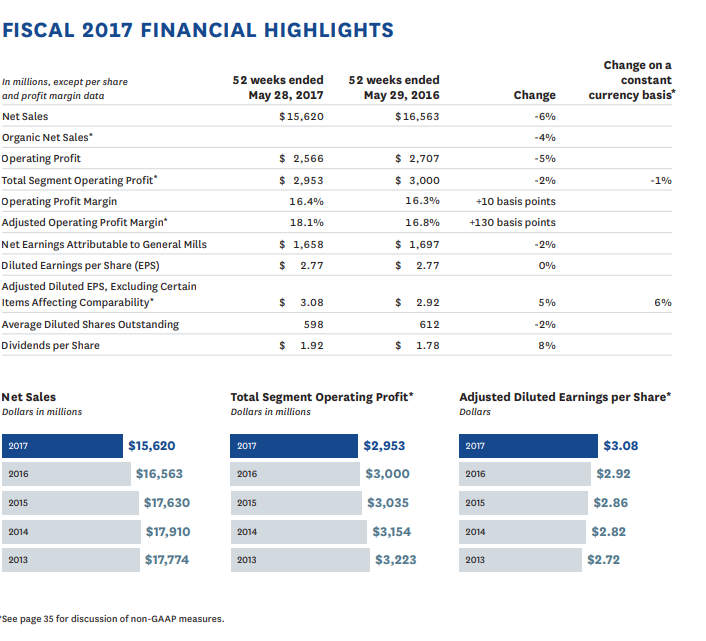

a. Calculate (or identify) the following financial ratios for 2016 and 2017:

1. Gross profit percentage

2. Return on sales

3. Asset turnover (2015, total assets 5 $21,832.0 million)

4. Return on assets (2015, total assets 5 $21,832.0 million)

5. Return on common stockholders equity (2015, total stockholders equity 5

$4,996.7 million)

6. Current ratio

7. Quick ratio

8. Operating-cash-flow-to-current-liabilities ratio (2015, current liabilities 5 $4,890.1

million)

9. Accounts receivable turnover (2015, accounts receivable 5 $1,386.7 million)

10. Average collection period

11. Inventory turnover (2015, inventory 5 $1,540.9 million)

12. Days sales in inventory

13. Debt-to-equity ratio

14. Times-interest-earned ratio

15. Operating-cash-flow-to-capital-expenditures ratio

16. Earnings per share

17. Price-earnings ratio (Use year-end adjusted closing stock price of $57.32 for 2017 and

$63.69 for 2016.)

18. Dividend yield

19. Dividend payout ratio

b. Comment briefly on the changes from fiscal 2016 to fiscal 2017 in the ratios computed above.

Fiscal Year Report:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started