accounting review help

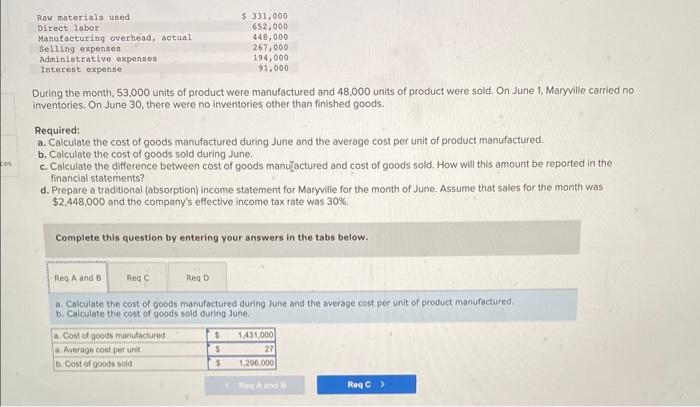

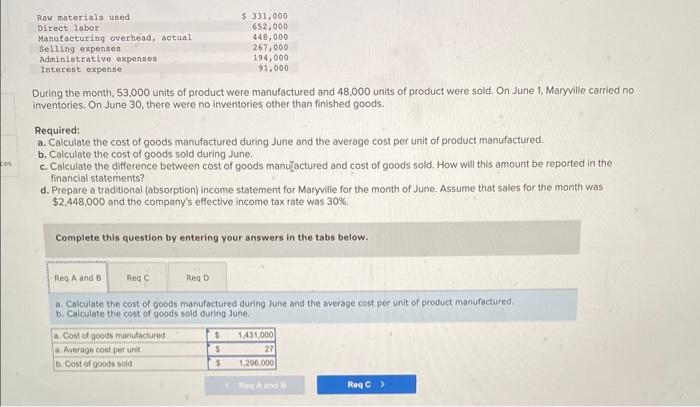

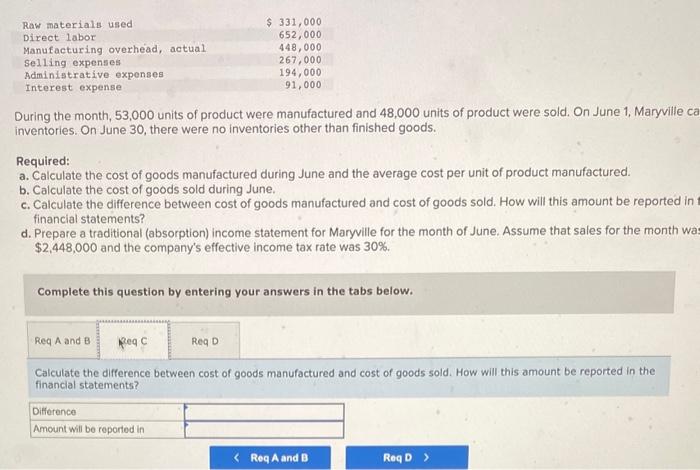

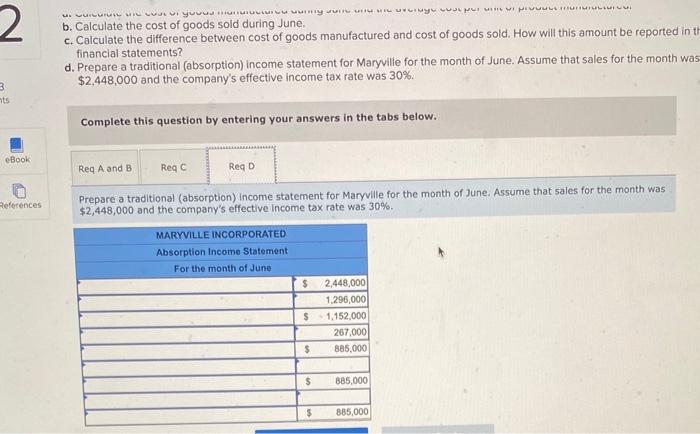

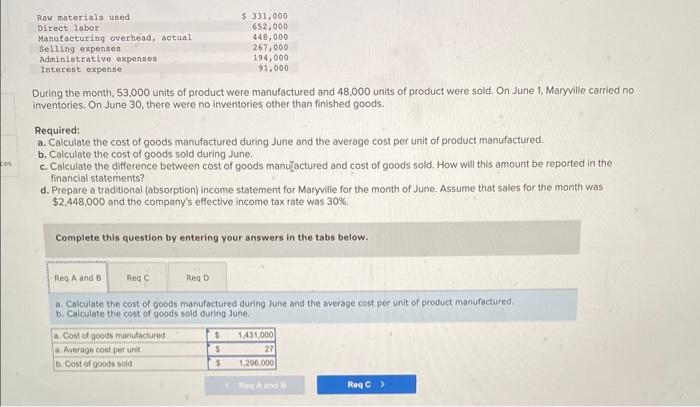

During the month, 53,000 units of product were manufactured and 48,000 units of product were sold. On June 1 , Maryville carried no inventories. On June 30 , there were no inventories other than finished goods. Required: a. Calculate the cost of goods manufactured during June and the average cost per unit of product manufactured. b. Calculate the cost of goods sold during June. c. Calculate the difference between cost of goods manulactured and cost of goods sold. How will this amount be reported in the financial statements? d. Prepare a traditional (absorption) income statement for Maryville for the month of June. Assume that sales for the month was $2,448,000 and the company's effective income tax rate was 30%. Complete this question by entering your answers in the tabs below. a. Cakculate the cost of goods manufactured during June and the average cost per unit of product manufactured. b. Calculate the cost of goods soid during June. During the month, 53,000 units of product were manufactured and 48,000 units of product were sold. On June 1, Maryville ce inventories. On June 30 , there were no inventories other than finished goods. Required: a. Calculate the cost of goods manufactured during June and the average cost per unit of product manufactured. b. Calculate the cost of goods sold during June. c. Calculate the difference between cost of goods manufactured and cost of goods sold. How will this amount be reported in financial statements? d. Prepare a traditional (absorption) income statement for Maryville for the month of June. Assume that sales for the month wa $2,448,000 and the company's effective income tax rate was 30%. Complete this question by entering your answers in the tabs below. Calculate the difference between cost of goods manufactured and cost of goods sold. How will this amount be reported in the financial statements? . Calculate the cost of goods sold during June. . Calculate the difference between cost of goods manufactured and cost of goods sold. How will this amount be reported in financial statements? d. Prepare a traditional (absorption) income statement for Maryville for the month of June. Assume that sales for the month wa $2,448,000 and the company's effective income tax rate was 30%. Complete this question by entering your answers in the tabs below. Prepare a traditional (absorption) income statement for Maryville for the month of June. Assume that sales for the month was $2,448,000 and the company's effective income tax rate was 30%