Answered step by step

Verified Expert Solution

Question

1 Approved Answer

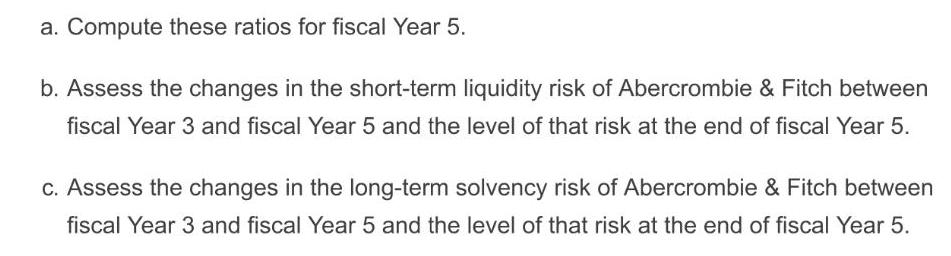

a. Compute these ratios for fiscal Year 5. b. Assess the changes in the short-term liquidity risk of Abercrombie & Fitch between fiscal Year

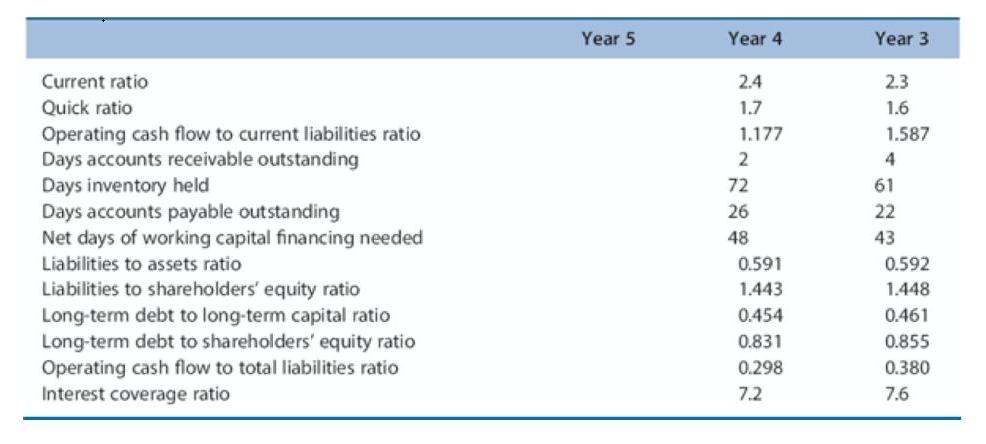

a. Compute these ratios for fiscal Year 5. b. Assess the changes in the short-term liquidity risk of Abercrombie & Fitch between fiscal Year 3 and fiscal Year 5 and the level of that risk at the end of fiscal Year 5. c. Assess the changes in the long-term solvency risk of Abercrombie & Fitch between fiscal Year 3 and fiscal Year 5 and the level of that risk at the end of fiscal Year 5. Year 5 Year 4 Year 3 Current ratio 2.4 2.3 Quick ratio 1.7 1.6 Operating cash flow to current liabilities ratio Days accounts receivable outstanding Days inventory held Days accounts payable outstanding Net days of working capital financing needed 1.177 1.587 2 72 61 26 22 48 43 Liabilities to assets ratio 0.591 0.592 Liabilities to shareholders' equity ratio Long-term debt to long-term capital ratio Long-term debt to shareholders' equity ratio Operating cash flow to total liabilities ratio Interest coverage ratio 1.443 1.448 0.454 0.461 0.831 0.855 0.298 0.380 7.2 7.6

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Current Ratio 652414 16 Quick Ratio 350 26414 09 Days Accounts Receivable 2021057 26 1225 3651225 3 days Days Inventory 104805201 248 47 36547 78 da...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started