Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Scenario 1 Clara Tate an employee of Harrow's Accounting Firm, worked 44 hours during the week of June 8 through 12. Her rate

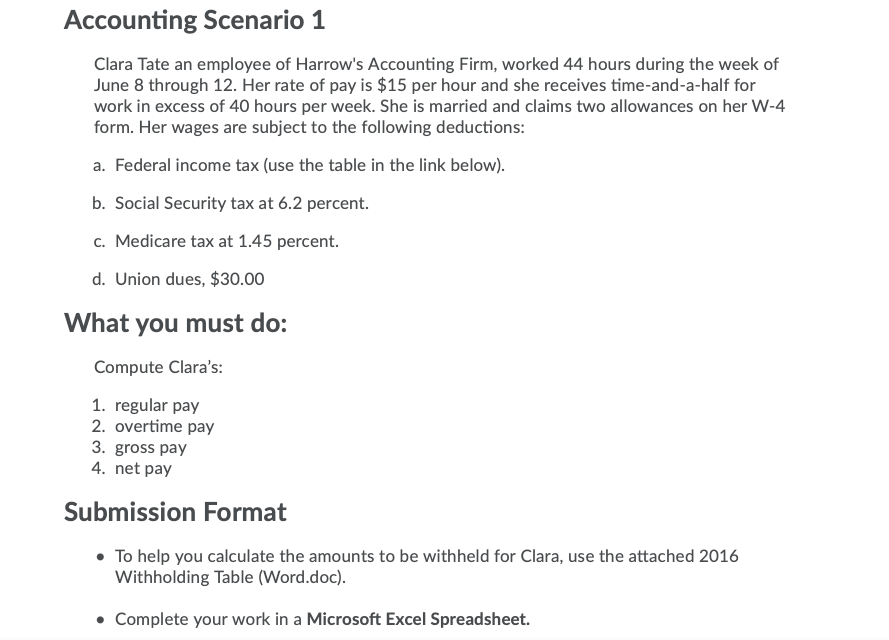

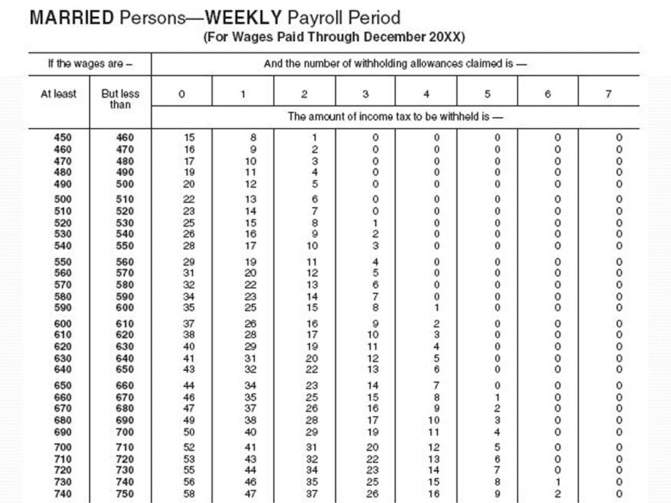

Accounting Scenario 1 Clara Tate an employee of Harrow's Accounting Firm, worked 44 hours during the week of June 8 through 12. Her rate of pay is $15 per hour and she receives time-and-a-half for work in excess of 40 hours per week. She is married and claims two allowances on her W-4 form. Her wages are subject to the following deductions: a. Federal income tax (use the table in the link below). b. Social Security tax at 6.2 percent. c. Medicare tax at 1.45 percent. d. Union dues, $30.00 What you must do: Compute Clara's: 1. regular pay 2. overtime pay 3. gross pay 4. net pay Submission Format To help you calculate the amounts to be withheld for Clara, use the attached 2016 Withholding Table (Word.doc). Complete your work in a Microsoft Excel Spreadsheet. MARRIED Persons-WEEKLY Payroll Period (For Wages Paid Through December 20XX) If the wages are- And the number of withholding allowances claimed is - At least But less than 2 3 5 7 The amount of income tax to be withheld is - 0. 00000 00000 000 0000o 00000 o 0000 o0000 o 12 100 .000 0000000123 45678 9 888 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 Regular pay regular hours worked x hourly rate of pay 40 15 600 P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started