Question

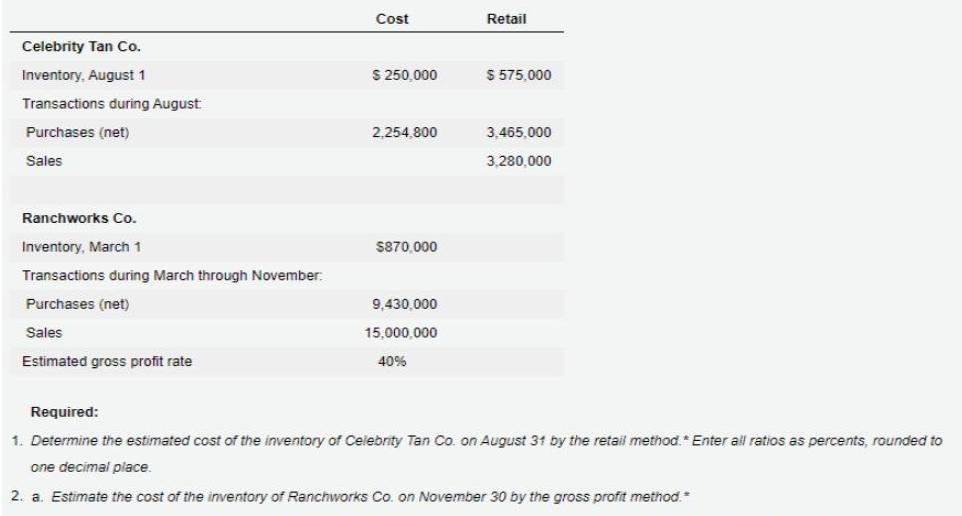

Selected data on inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks Co. are as follows: Cost Retail Celebrity Tan Co. Inventory, August 1

Selected data on inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks Co. are as follows:

Cost Retail Celebrity Tan Co. Inventory, August 1 S 250.000 $ 575,000 Transactions during August Purchases (net) 2,254,800 3,465,000 Sales 3.280.000 Ranchworks Co. Inventory, March 1 S870,000 Transactions during March through November: Purchases (net) 9,430,000 Sales 15,000,000 Estimated gross profit rate 40% Required: 1. Determine the estimated cost of the inventory of Celebrity Tan Co. on August 31 by the retail method.* Enter all ratios as percents, rounded to one decimal place. 2. a. Estimate the cost of the inventory of Ranchworks Co. on November 30 by the gross profit method.*

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Cost Retail Beginning inventory 300000 57500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Financial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan E. Duchac

12th edition

1305041399, 1285078586, 978-1-133-9524, 9781133952428, 978-1305041394, 9781285078588, 1-133-95241-0, 978-1133952411

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App