Question: In his senior year at Notre Dame, Chris Moore had been the third runner-up for the fabled Heisman Trophy. The trophy goes to the

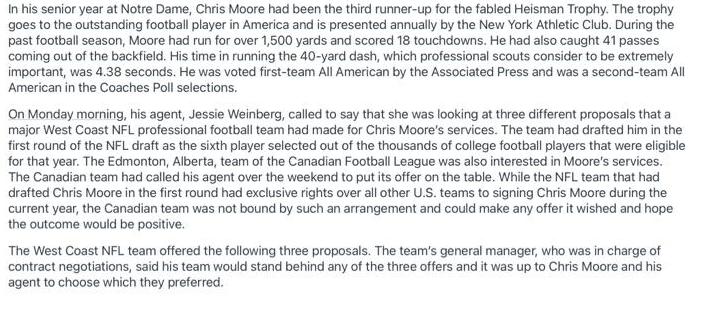

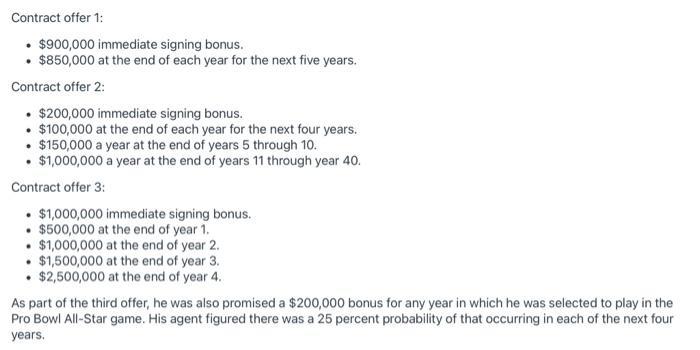

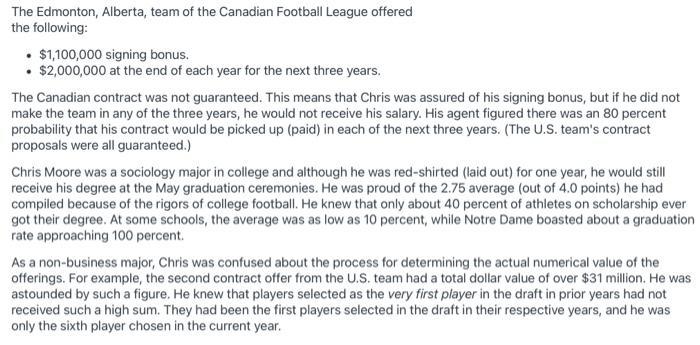

In his senior year at Notre Dame, Chris Moore had been the third runner-up for the fabled Heisman Trophy. The trophy goes to the outstanding football player in America and is presented annually by the New York Athletic Club. During the past football season, Moore had run for over 1,500 yards and scored 18 touchdowns. He had also caught 41 passes coming out of the backfield. His time in running the 40-yard dash, which professional scouts consider to be extremely important, was 4.38 seconds. He was voted first-team All American by the Associated Press and was a second-team All American in the Coaches Poll selections, On Monday morning, his agent, Jessie Weinberg, called to say that she was looking at three different proposals that a major West Coast NFL professional football team had made for Chris Moore's services. The team had drafted him in the first round of the NFL draft as the sixth player selected out of the thousands of college football players that were eligible for that year. The Edmonton, Alberta, team of the Canadian Football League was also interested in Moore's services. The Canadian team had called his agent over the weekend to put its offer on the table. While the NFL team that had drafted Chris Moore in the first round had exclusive rights over all other U.S. teams to signing Chris Moore during the current year, the Canadian team was not bound by such an arrangement and could make any offer it wished and hope the outcome would be positive. The West Coast NFL team offered the following three proposals. The team's general manager, who was in charge of contract negotiations, said his team would stand behind any of the three offers and it was up to Chris Moore and his agent to choose which they preferred. Contract offer 1: $900,000 immediate signing bonus. $850,000 at the end of each year for the next five years. Contract offer 2: $200,000 immediate signing bonus. $100,000 at the end of each year for the next four years. $150,000 a year at the end of years 5 through 10. $1,000,000 a year at the end of years 11 through year 40. Contract offer 3: $1,000,000 immediate signing bonus. $500,000 at the end of year 1. $1,000,000 at the end of year 2. $1,500,000 at the end of year 3. $2,500,000 at the end of year 4. As part of the third offer, he was also promised a $200,000 bonus for any year in which he was selected to play in the Pro Bowl All-Star game. His agent figured there was a 25 percent probability of that occurring in each of the next four years. The Edmonton, Alberta, team of the Canadian Football League offered the following: $1,100,000 signing bonus. $2,000,000 at the end of each year for the next three years. The Canadian contract was not guaranteed. This means that Chris was assured of his signing bonus, but if he did not make the team in any of the three years, he would not receive his salary. His agent figured there was an 80 percent probability that his contract would be picked up (paid) in each of the next three years. (The U.S. team's contract proposals were all guaranteed.) Chris Moore was a sociology major in college and although he was red-shirted (laid out) for one year, he would still receive his degree at the May graduation ceremonies. He was proud of the 2.75 average (out of 4.0 points) he had compiled because of the rigors of college football. He knew that only about 40 percent of athletes on scholarship ever got their degree. At some schools, the average was as low as 10 percent, while Notre Dame boasted about a graduation rate approaching 100 percent. As a non-business major, Chris was confused about the process for determining the actual numerical value of the offerings. For example, the second contract offer from the U.S. team had a total dollar value of over $31 million. He was astounded by such a figure. He knew that players selected as the very first player in the draft in prior years had not received such a high sum. They had been the first players selected in the draft in their respective years, and he was only the sixth player chosen in the current year. His agent, Jessie Weinberg, began to explain to Chris the importance of the time value of money. She said inflows in the future were not worth nearly as much as current inflows and that, therefore, they should be discounted back to the present at a 10 percent interest rate. While Chris did not fully understand how the calculations were done, he knew he could rely on his agent to do the proper analysis. Chris's agent, Jessie Weinberg, has hired you to compare and contrast these four offers. Please use your Time Value of Money skills to break-down each offer into today's dollars. Then, rank the offers in the order that you think is most (1) to least (4) favorable to Chris. Justify your rankings and be sure to include any factors you considered in addition to the present value of each offer.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Time value of money is the key deciding factor to evaluate all this contract We will determine prese... View full answer

Get step-by-step solutions from verified subject matter experts