Answered step by step

Verified Expert Solution

Question

1 Approved Answer

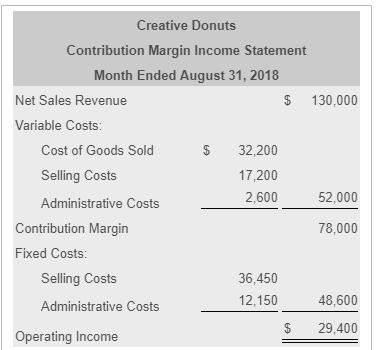

Creative Donuts Contribution Margin Income Statement Month Ended August 31, 2018 Net Sales Revenue 130,000 Variable Costs: Cost of Goods Sold 32,200 Selling Costs

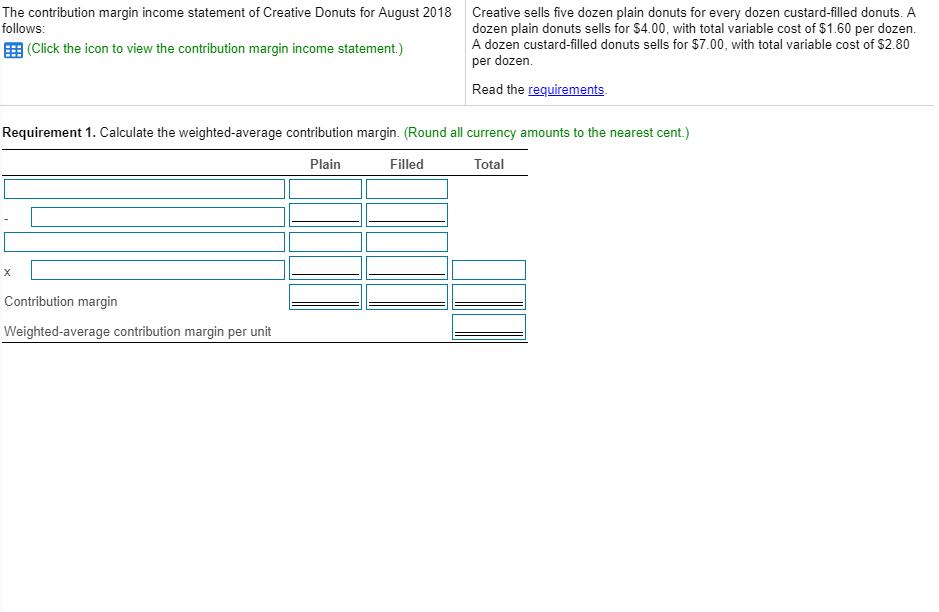

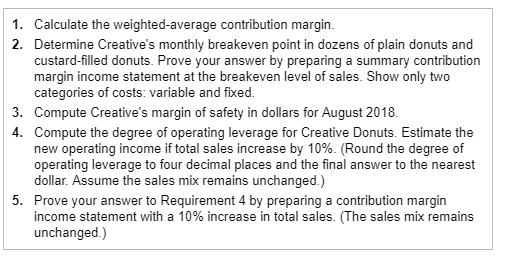

Creative Donuts Contribution Margin Income Statement Month Ended August 31, 2018 Net Sales Revenue 130,000 Variable Costs: Cost of Goods Sold 32,200 Selling Costs 17,200 Administrative Costs 2,600 52,000 Contribution Margin 78,000 Fixed Costs: Selling Costs 36,450 Administrative Costs 12,150 48,600 2$ 29,400 Operating Income %24 1. Calculate the weighted-average contribution margin. 2. Determine Creative's monthly breakeven point in dozens of plain donuts and custard-filled donuts. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of costs: variable and fixed. 3. Compute Creative's margin of safety in dollars for August 2018. 4. Compute the degree of operating leverage for Creative Donuts. Estimate the new operating income if total sales increase by 10%. (Round the degree of operating leverage to four decimal places and the final answer to the nearest dollar. Assume the sales mix remains unchanged.) 5. Prove your answer to Requirement 4 by preparing a contribution margin income statement with a 10% increase in total sales. (The sales mix remains unchanged.)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Plain Filled Total Sales price per unit 400 700 Variable cost per unit 160 280 Contribution margin ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started