Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sofie Lang, who was 55 years of age in January 2018, is a Canadian citizen who has lived in Toronto, Canada all her life

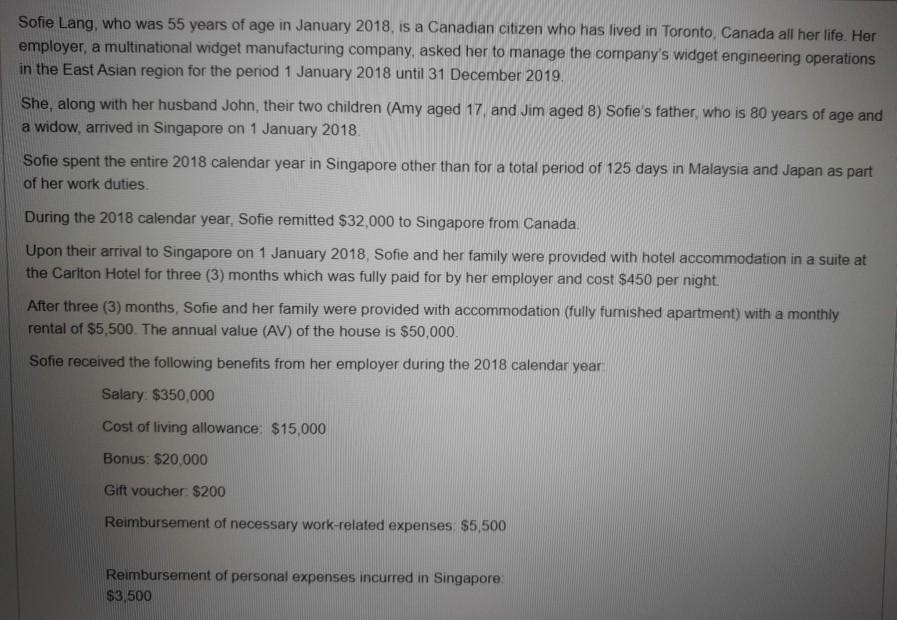

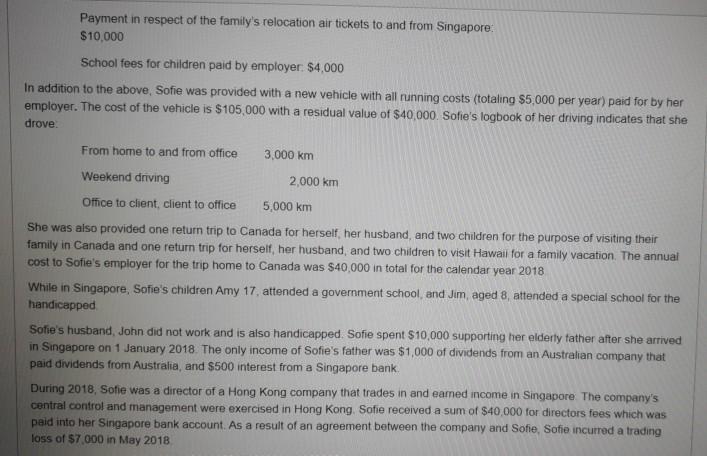

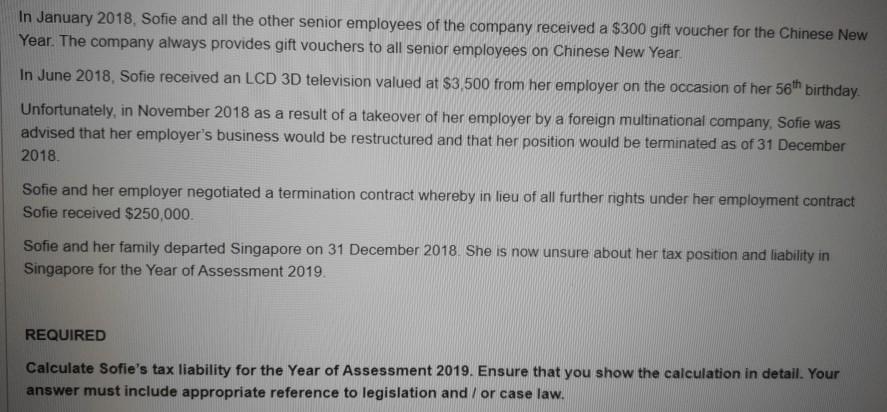

Sofie Lang, who was 55 years of age in January 2018, is a Canadian citizen who has lived in Toronto, Canada all her life Her employer, a multinational widget manufacturing company, asked her to manage the company's widget engineering operations in the East Asian region for the period 1 January 2018 until 31 December 2019. She, along with her husband John, their two children (Amy aged 17, and Jim aged 8) Sofie's father, who is 80 years of age and a widow, arrived in Singapore on 1 January 2018. Sofie spent the entire 2018 calendar year in Singapore other than for a total period of 125 days in Malaysia and Japan as part of her work duties. During the 2018 calendar year, Sofie remitted $32,000 to Singapore from Canada. Upon their arrival to Singapore on 1 January 2018, Sofie and her family were provided with hotel accommodation in a suite at the Carlton Hotel for three (3) months which was fully paid for by her employer and cost $450 per night. After three (3) months, Sofie and her family were provided with accommodation (fully fumished apartment) with a monthly rental of $5,500. The annual value (AV) of the house is $50,000. Sofie received the following benefits from her employer during the 2018 calendar year Salary: $350,000 Cost of living allowance: $15,000 Bonus: $20,000 Gift voucher: $200 Reimbursement of necessary work-related expenses: $5,500 Reimbursement of personal expenses incurred in Singapore: $3,500 Payment in respect of the family's relocation air tickets to and from Singapore: $10,000 School fees for children paid by employer: $4,000 In addition to the above, Sofie was provided with a new vehicle with all running costs (totaling $5,000 per year) paid for by her employer. The cost of the vehicle is $105,000 with a residual value of $40,000. Sofie's logbook of her driving indicates that she drove From home to and from office 3,000 km Weekend driving 2,000 km Office to client, client to office 5,000 km She was also provided one return trip to Canada for herself, her husband, and two children for the purpose of visiting their family in Canada and one return trip for herself, her husband, and two children to visit Hawaii for a family vacation. The annual cost to Sofie's employer for the trip home to Canada was $40,000 in total for the calendar year 2018 While in Singapore, Sofie's children Amy 17, attended a government school, and Jim, aged 8, attended a special school for the handicapped Sofie's husband, John did not work and is also handicapped. Sofie spent $10,000 supporting her elderly father after she arrived in Singapore on 1 January 2018. The only income of Sofie's father was $1,000 of dividends from an Australian company that paid dividends from Australia, and $500 interest from a Singapore bank. During 2018, Sofie was a director of a Hong Kong company that trades in and earned income in Singapore The company's central control and management were exercised in Hong Kong. Sofie received a sum of $40,000 for directors fees which was paid into her Singapore bank account. As a result of an agreement between the company and Sofie, Sofie incurred a trading loss of $7.000 in May 2018 In January 2018, Sofie and all the other senior employees of the company received a $300 gift voucher for the Chinese New Year. The company always provides gift vouchers to all senior employees on Chinese New Year. In June 2018, Sofie received an LCD 3D television valued at $3,500 from her employer on the occasion of her 56h birthday. Unfortunately, in November 2018 as a result of a takeover of her employer by a foreign multinational company, Sofie was advised that her employer's business would be restructured and that her position would be terminated as of 31 December 2018. Sofie and her employer negotiated a termination contract whereby in lieu of all further rights under her employment contract Sofie received $250,000. Sofie and her family departed Singapore on 31 December 2018. She is now unsure about her tax position and liability in Singapore for the Year of Assessment 2019. REQUIRED Calculate Sofie's tax liability for the Year of Assessment 2019. Ensure that you show the calculation in detail. Your answer must include appropriate reference to legislation and / or case law.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Sofies tax liability for the Year of Assessment 2019 is as follows Income from employment 350000 Cost of living allowance 15000 Bonus 20000 Gift vouch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started