Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting solve need ==================================== =============== 1. The primary objective of cost accounting is A. Ascertain the cost of goods and services B. Ascertain the profit

Accounting solve need

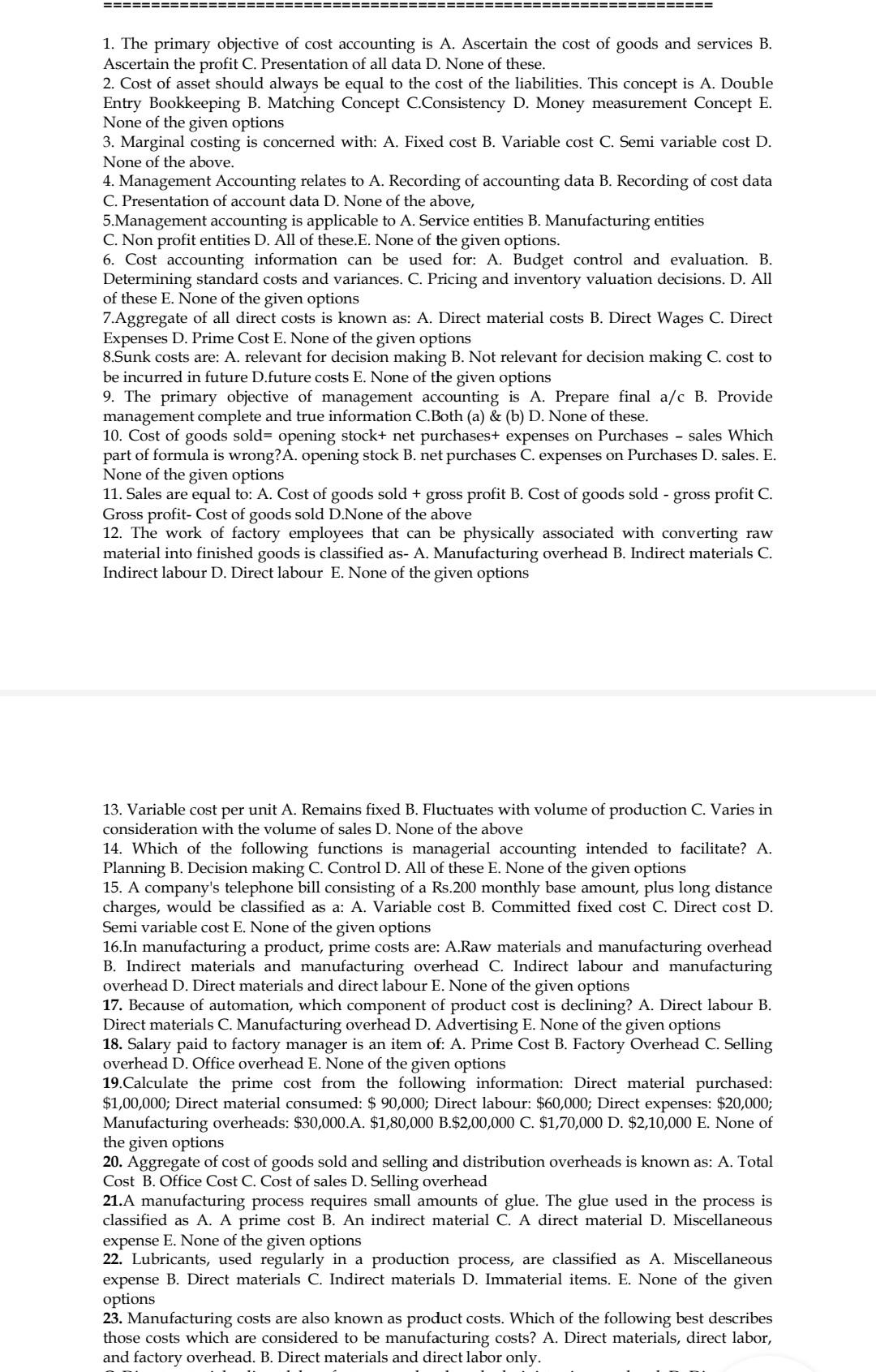

==================================== =============== 1. The primary objective of cost accounting is A. Ascertain the cost of goods and services B. Ascertain the profit C. Presentation of all data D. None of these. 2. Cost of asset should always be equal to the cost of the liabilities. This concept is A. Double Entry Bookkeeping B. Matching Concept C.Consistency D. Money measurement Concept E. None of the given options 3. Marginal costing is concerned with: A. Fixed cost B. Variable cost C. Semi variable cost D. None of the above. 4. Management Accounting relates to A. Recording of accounting data B. Recording of cost data C. Presentation of account data D. None of the above, 5.Management accounting is applicable to A. Service entities B. Manufacturing entities C. Non profit entities D. All of these.E. None of the given options. 6. Cost accounting information can be used for: A. Budget control and evaluation. B. Determining standard costs and variances. C. Pricing and inventory valuation decisions. D. All of these E. None of the given options 7.Aggregate of all direct costs is known as: A. Direct material costs B. Direct Wages C. Direct Expenses D. Prime Cost E. None of the given options 8.Sunk costs are: A. relevant for decision making B. Not relevant for decision making C. cost to be incurred in future D.future costs E. None of the given options 9. The primary objective of management accounting is A. Prepare final a/c B. Provide management complete and true information C.Both (a) & (b) D. None of these. 10. Cost of goods sold= opening stock+ net purchasest expenses on Purchases - sales Which part of formula is wrong? A. opening stock B. net purchases C. expenses on Purchases D. sales. E. None of the given options 11. Sales are equal to: A. Cost of goods sold + gross profit B. Cost of goods sold - gross profit C. Gross profit- Cost of goods sold D. None of the above 12. The work of factory employees that can be physically associated with converting raw material into finished goods is classified as- A. Manufacturing overhead B. Indirect materials C. Indirect labour D. Direct labour E. None of the given options 13. Variable cost per unit A. Remains fixed B. Fluctuates with volume of production C. Varies in consideration with the volume of sales D. None of the above 14. Which of the following functions is managerial accounting intended to facilitate? A. Planning B. Decision making C. Control D. All of these E. None of the given options 15. A company's telephone bill consisting of a Rs.200 monthly base amount, plus long distance charges, would be classified as a: A. Variable cost B. Committed fixed cost C. Direct cost D. Semi variable cost E. None of the given options 16.In manufacturing a product, prime costs are: A.Raw materials and manufacturing overhead B. Indirect materials and manufacturing overhead C. Indirect labour and manufacturing overhead D. Direct materials and direct labour E. None of the given options 17. Because of automation, which component of product cost is declining? A. Direct labour B. Direct materials C. Manufacturing overhead D. Advertising E. None of the given options 18. Salary paid to factory manager is an item of: Prim Cost B. Factory Overhead C. Selling overhead D. Office overhead E. None the given options 19. Calculate the prime cost from the following information: Direct material purchased: $1,00,000; Direct material consumed: $ 90,000; Direct labour: $60,000; Direct expenses: $20,000; Manufacturing overheads: $30,000.A. $1,80,000 B.$2,00,000 C. $1,70,000 D. $2,10,000 E. None of the given options 20. Aggregate of cost of goods sold and selling and distribution overheads is known as: A. Total Cost B. Office Cost C. Cost of sales D. Selling overhead 21.A manufacturing process requires small amounts of glue. The glue used in the process is classified as A. A prime cost B. An indirect material C. A direct material D. Miscellaneous expense E. None of the given options 22. Lubricants, used regularly in a production process, are classified as A. Miscellaneous expense B. Direct materials C. Indirect materials D. Immaterial items. E. None of the given options 23. Manufacturing costs are also known as product costs. Which of the following best describes those costs which are considered to be manufacturing costs? A. Direct materials, direct labor, and factory overhead. B. Direct materials and direct labor onlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started