Answered step by step

Verified Expert Solution

Question

1 Approved Answer

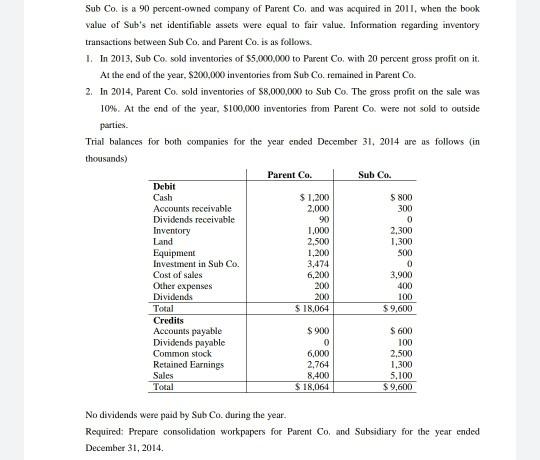

Sub Co. is a 90 percent-owned company of Parent Co, and was acquired in 2011, when the book value of Sub's net identifiable assets

Sub Co. is a 90 percent-owned company of Parent Co, and was acquired in 2011, when the book value of Sub's net identifiable assets were equal to fair value. Information regarding inventory transactions between Sub Co, and Parent Co. is as follows. 1. In 2013, Sub Co. sold inventories of $5,000,000 to Parent Co. with 20 percent gross profit on it. At the end of the year, $200,000 inventories from Sub Co. remained in Parent Co. 2. In 2014, Parent Co. sold inventories of S8,000,000 to Sub Co. The gross profit on the sale was 10%. At the end of the year, $100,000 inventories from Parent Co. were not sold to outside parties. Trial balances for both companies for the year ended December 31, 2014 are as follows (in thousands) Parent Co. Sub Co. Debit Cash $1,200 2,000 S 800 300 Accounts receivable Dividends receivable 90 2,300 1,300 500 Invento 1,000 2,500 1,200 3,474 6,200 200 Land Equipment Investment in Sub Co. Cost of sales Other expenses Dividends 3,900 400 200 100 Total Credits Accounts payable Dividends payable S 18,064 $9.600 $900 $ 600 100 6,000 2,764 Common stock 2,500 1,300 Retained Earnings Sales 8,400 $ 18,064 5,100 Total $9,600 No dividends were paid by Sub Co. during the year. Required: Prepare consolidation workpapers for Parent Co, and Subsidiary for the year ended December 31, 2014.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

WORKINGS 1 net assets of sub co2011 347490100 3860 net assets 2014 4600 740 INCREASE IN NET ASSETS 7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started