Question

C2. Use the assumptions described in the table when modeling items that are not computed as totals or subtotals. Variable Modeling assumptions Revenue Annual revenue

C2. Use the assumptions described in the table when modeling items that are not computed as totals or subtotals.

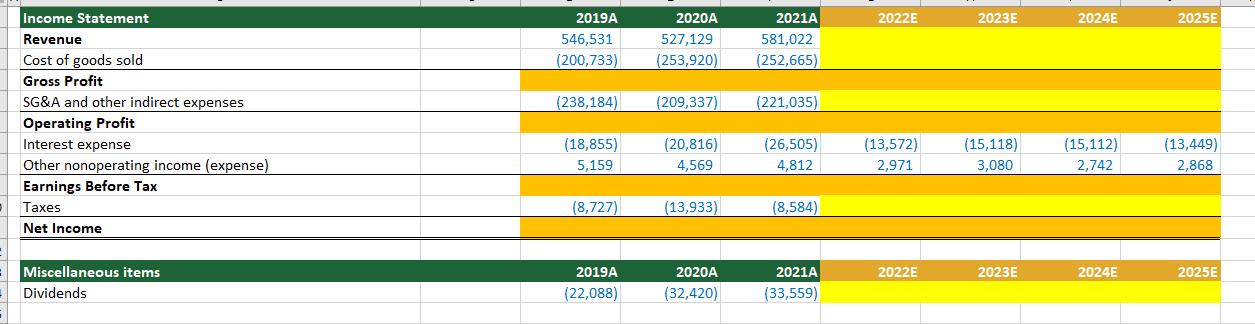

Variable | Modeling assumptions |

Revenue | Annual revenue growth in the first forecast year equals the average annual revenue growth rate from the historical period and the revenue growth rate in each subsequent year is 1.74 percentage points higher than the growth rate from the previous year |

Cost of goods sold | Cost of goods sold to revenue in each forecast year is 0.64 percentage points better than the average annual ratio from the last 2 years of the historical period |

SG&A and other indirect expenses | SG&A and other indirect expenses in each forecast year equals the average annual ratio from the historical period |

Taxes | The effective tax rate in each year of the forecast period equals the effective tax rate from the earliest year in the historical period |

Dividends | Annual dividend growth in each forecast year is 5.84 percentage points greater than the average annual dividend growth rate from the historical period |

Income Statement Revenue Cost of goods sold Gross Profit SG&A and other indirect expenses Operating Profit Interest expense Other nonoperating income (expense) Earnings Before Tax Taxes Net Income = Miscellaneous items Dividends 2019A 546,531 (200,733) (238,184) (18,855) 5,159 (8,727) 2019A (22,088) 2020A 527,129 581,022 (253,920) (252,665) (209,337) (20,816) 4,569 (13,933) 2021A 2020A (32,420) (221,035) (26,505) 4,812 (8,584) 2021A (33,559) 2022E (13,572) 2,971 2022E 2023E (15,118) 3,080 2023E 2024E (15,112) 2,742 2024E 2025E (13,449) 2,868 2025E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To forecast the income statement items for 2022E through 2025E well use the provided assumptions and historical data Heres how we can approach each it...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started