Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Omaha Inc. reports $156,000 financial income for 2018, before adjusting the following differences for tax reporting purpose. 1. Pollution fine of $25,000 was paid

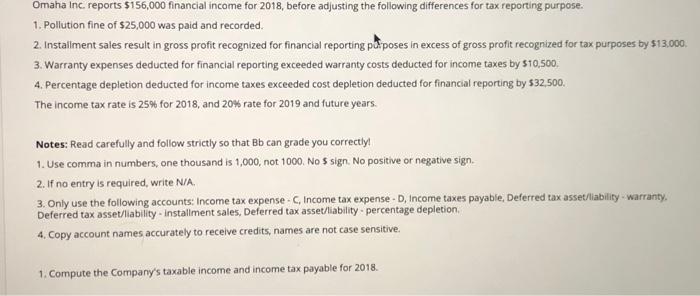

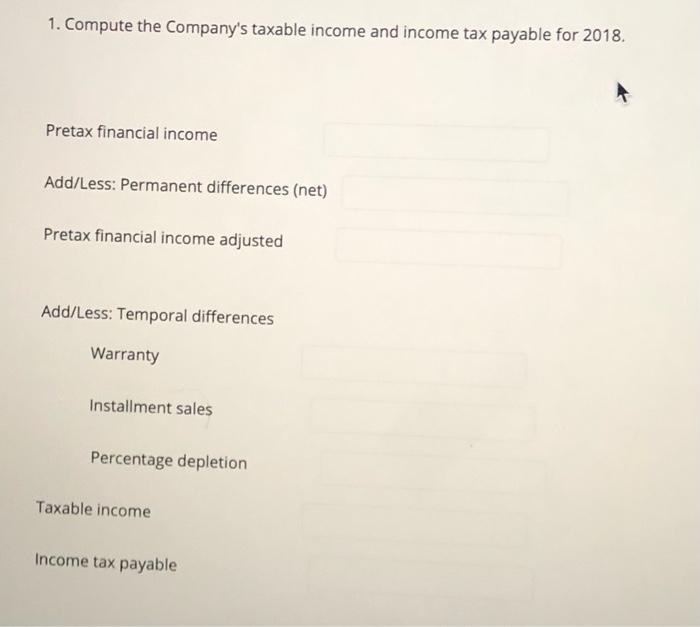

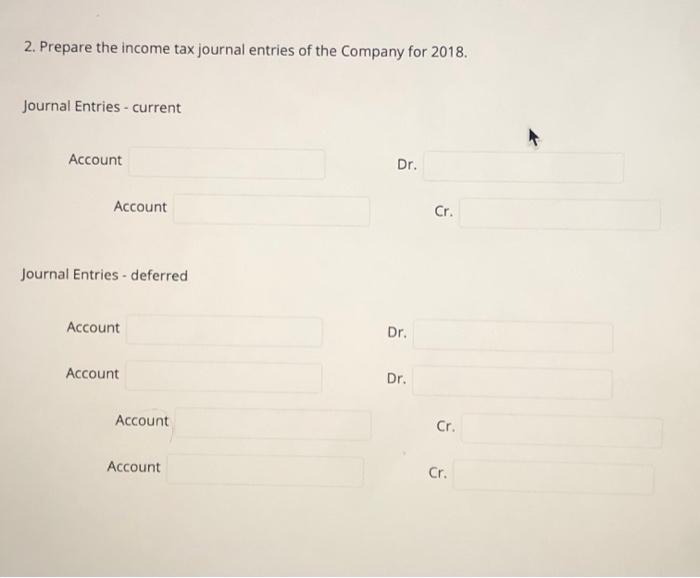

Omaha Inc. reports $156,000 financial income for 2018, before adjusting the following differences for tax reporting purpose. 1. Pollution fine of $25,000 was paid and recorded. 2. Instalment sales result in gross profit recognized for financial reporting parposes in excess of gross profit recognized for tax purposes by $13.000. 3. Warranty expenses deducted for financial reporting exceeded warranty costs deducted for income taxes by $10,500. 4. Percentage depletion deducted for income taxes exceeded cost depletion deducted for financial reporting by $32,500. The income tax rate is 25% for 2018, and 20% rate for 2019 and future years. Notes: Read carefully and follow strictly so that Bb can grade you correctly! 1. Use comma in numbers, one thousand is 1,000, not 1000. No $ sign. No positive or negative sign. 2. If no entry is required, write N/A. 3. Only use the following accounts: Income tax expense - C, Income tax expense - D, Income taxes payable, Deferred tax asset/liability warranty. Deferred tax asset/liability - installment sales, Deferred tax asset/liability - percentage depletion. 4. Copy account names accurately to receive credits, names are not case sensitive. 1. Compute the Company's taxable income and income tax payable for 2018. 1. Compute the Company's taxable income and income tax payable for 2018. Pretax financial income Add/Less: Permanent differences (net) Pretax financial income adjusted Add/Less: Temporal differences Warranty Installment sales Percentage depletion Taxable income Income tax payable 2. Prepare the income tax journal entries of the Company for 2018. Journal Entries - current Account Dr. Account Cr. Journal Entries - deferred Account Dr. Account Dr. Account Cr. Account Cr. Omaha Inc. reports $156,000 financial income for 2018, before adjusting the following differences for tax reporting purpose. 1. Pollution fine of $25,000 was paid and recorded. 2. Instalment sales result in gross profit recognized for financial reporting parposes in excess of gross profit recognized for tax purposes by $13.000. 3. Warranty expenses deducted for financial reporting exceeded warranty costs deducted for income taxes by $10,500. 4. Percentage depletion deducted for income taxes exceeded cost depletion deducted for financial reporting by $32,500. The income tax rate is 25% for 2018, and 20% rate for 2019 and future years. Notes: Read carefully and follow strictly so that Bb can grade you correctly! 1. Use comma in numbers, one thousand is 1,000, not 1000. No $ sign. No positive or negative sign. 2. If no entry is required, write N/A. 3. Only use the following accounts: Income tax expense - C, Income tax expense - D, Income taxes payable, Deferred tax asset/liability warranty. Deferred tax asset/liability - installment sales, Deferred tax asset/liability - percentage depletion. 4. Copy account names accurately to receive credits, names are not case sensitive. 1. Compute the Company's taxable income and income tax payable for 2018. 1. Compute the Company's taxable income and income tax payable for 2018. Pretax financial income Add/Less: Permanent differences (net) Pretax financial income adjusted Add/Less: Temporal differences Warranty Installment sales Percentage depletion Taxable income Income tax payable 2. Prepare the income tax journal entries of the Company for 2018. Journal Entries - current Account Dr. Account Cr. Journal Entries - deferred Account Dr. Account Dr. Account Cr. Account Cr. Omaha Inc. reports $156,000 financial income for 2018, before adjusting the following differences for tax reporting purpose. 1. Pollution fine of $25,000 was paid and recorded. 2. Instalment sales result in gross profit recognized for financial reporting parposes in excess of gross profit recognized for tax purposes by $13.000. 3. Warranty expenses deducted for financial reporting exceeded warranty costs deducted for income taxes by $10,500. 4. Percentage depletion deducted for income taxes exceeded cost depletion deducted for financial reporting by $32,500. The income tax rate is 25% for 2018, and 20% rate for 2019 and future years. Notes: Read carefully and follow strictly so that Bb can grade you correctly! 1. Use comma in numbers, one thousand is 1,000, not 1000. No $ sign. No positive or negative sign. 2. If no entry is required, write N/A. 3. Only use the following accounts: Income tax expense - C, Income tax expense - D, Income taxes payable, Deferred tax asset/liability warranty. Deferred tax asset/liability - installment sales, Deferred tax asset/liability - percentage depletion. 4. Copy account names accurately to receive credits, names are not case sensitive. 1. Compute the Company's taxable income and income tax payable for 2018. 1. Compute the Company's taxable income and income tax payable for 2018. Pretax financial income Add/Less: Permanent differences (net) Pretax financial income adjusted Add/Less: Temporal differences Warranty Installment sales Percentage depletion Taxable income Income tax payable 2. Prepare the income tax journal entries of the Company for 2018. Journal Entries - current Account Dr. Account Cr. Journal Entries - deferred Account Dr. Account Dr. Account Cr. Account Cr.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer1 Calculation of Companys Taxable Income and Income tax Payab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started