Question

Suppose a company has the following adjustments A) Inventory Write-off $3.0M; B) Goodwill Write-off $5.0M; C) Store Closure $4.0M; D) Extraordinary Item - Uninsured

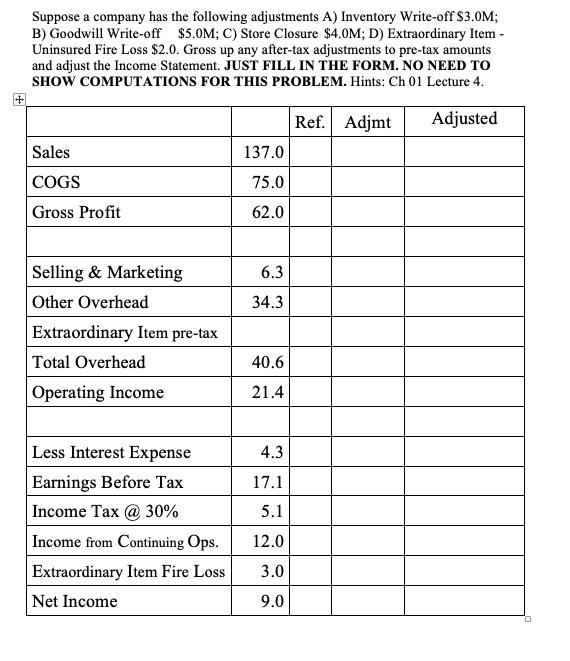

Suppose a company has the following adjustments A) Inventory Write-off $3.0M; B) Goodwill Write-off $5.0M; C) Store Closure $4.0M; D) Extraordinary Item - Uninsured Fire Loss $2.0. Gross up any after-tax adjustments to pre-tax amounts and adjust the Income Statement. JUST FILL IN THE FORM. NO NEED TO SHOW COMPUTATIONS FOR THIS PROBLEM. Hints: Ch 01 Lecture 4. Ref. Adjmt Adjusted Sales 137.0 COGS 75.0 Gross Profit 62.0 Selling & Marketing 6.3 Other Overhead 34.3 Extraordinary Item pre-tax Total Overhead 40.6 Operating Income 21.4 Less Interest Expense 4.3 Earnings Before Tax 17.1 Income Tax @ 30% 5.1 Income from Continuing Ops. 12.0 Extraordinary Item Fire Loss 3.0 Net Income 9.0

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Ref Adjmt Adjusted Sales 13700 13700 COGS 75...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Management Accounting

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta

16th edition

978-0133058819, 9780133059748, 133058816, 133058786, 013305974X , 978-0133058789

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App