Answered step by step

Verified Expert Solution

Question

1 Approved Answer

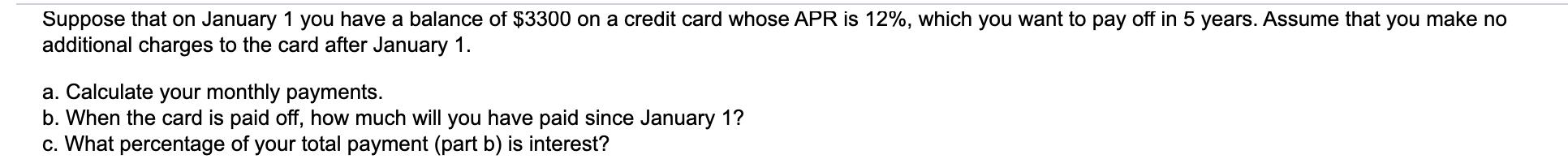

Suppose that on January 1 you have a balance of $3300 on a credit card whose APR is 12%, which you want to pay

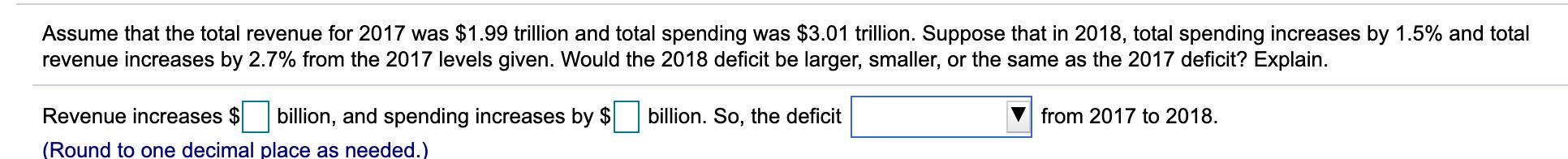

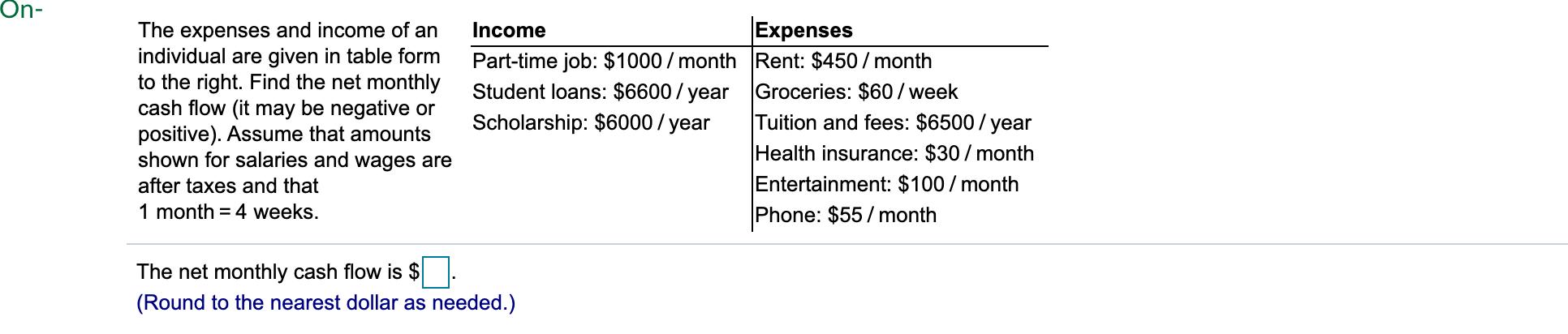

Suppose that on January 1 you have a balance of $3300 on a credit card whose APR is 12%, which you want to pay off in 5 years. Assume that you make no additional charges to the card after January 1. a. Calculate your monthly payments. b. When the card is paid off, how much will you have paid since January 1? c. What percentage of your total payment (part b) is interest? Assume that the total revenue for 2017 was $1.99 trillion and total spending was $3.01 trillion. Suppose that in 2018, total spending increases revenue increases by 2.7% from the 2017 levels given. Would the 2018 deficit be larger, smaller, or the same as the 2017 deficit? Explain. 1.5% and total Revenue increases $ billion, and spending increases by $ billion. So, the deficit from 2017 to 2018. (Round to one decimal place as needed.) On- Expenses The expenses and income of an individual are given in table form to the right. Find the net monthly cash flow (it may be negative or positive). Assume that amounts shown for salaries and wages are Income Part-time job: $1000/ month Rent: $450 / month Student loans: $6600/ year Groceries: $60/week Scholarship: $6000 / year Tuition and fees: $6500 / year Health insurance: $30/ month Entertainment: $100/ month after taxes and that 1 month = 4 weeks. Phone: $55/ month The net monthly cash flow is $ (Round to the nearest dollar as needed.)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Monthly payments PMT Prn 1 1 rnnt 330001212...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started