Answered step by step

Verified Expert Solution

Question

1 Approved Answer

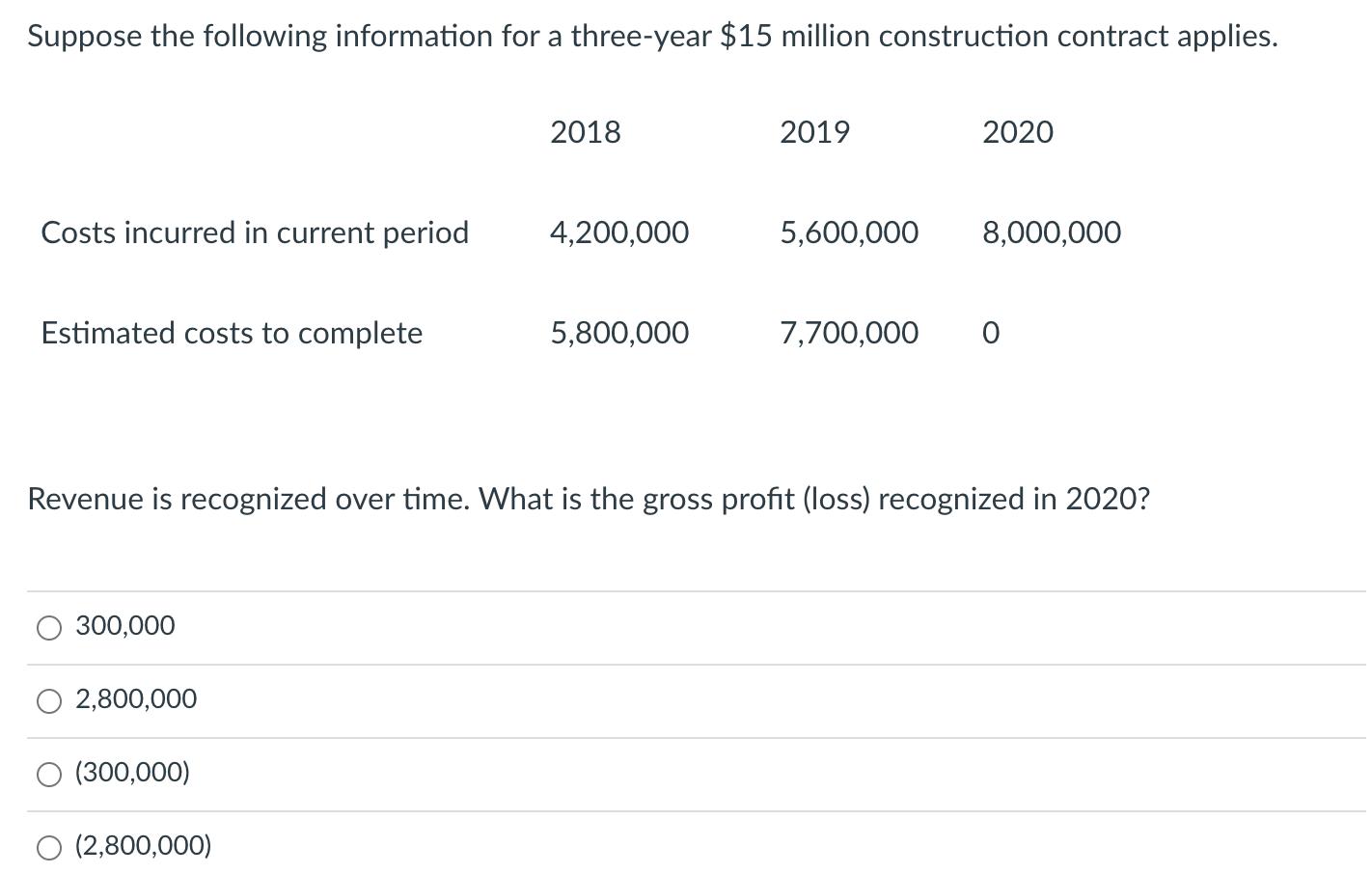

Suppose the following information for a three-year $15 million construction contract applies. 2018 2019 2020 Costs incurred in current period 4,200,000 5,600,000 8,000,000 Estimated

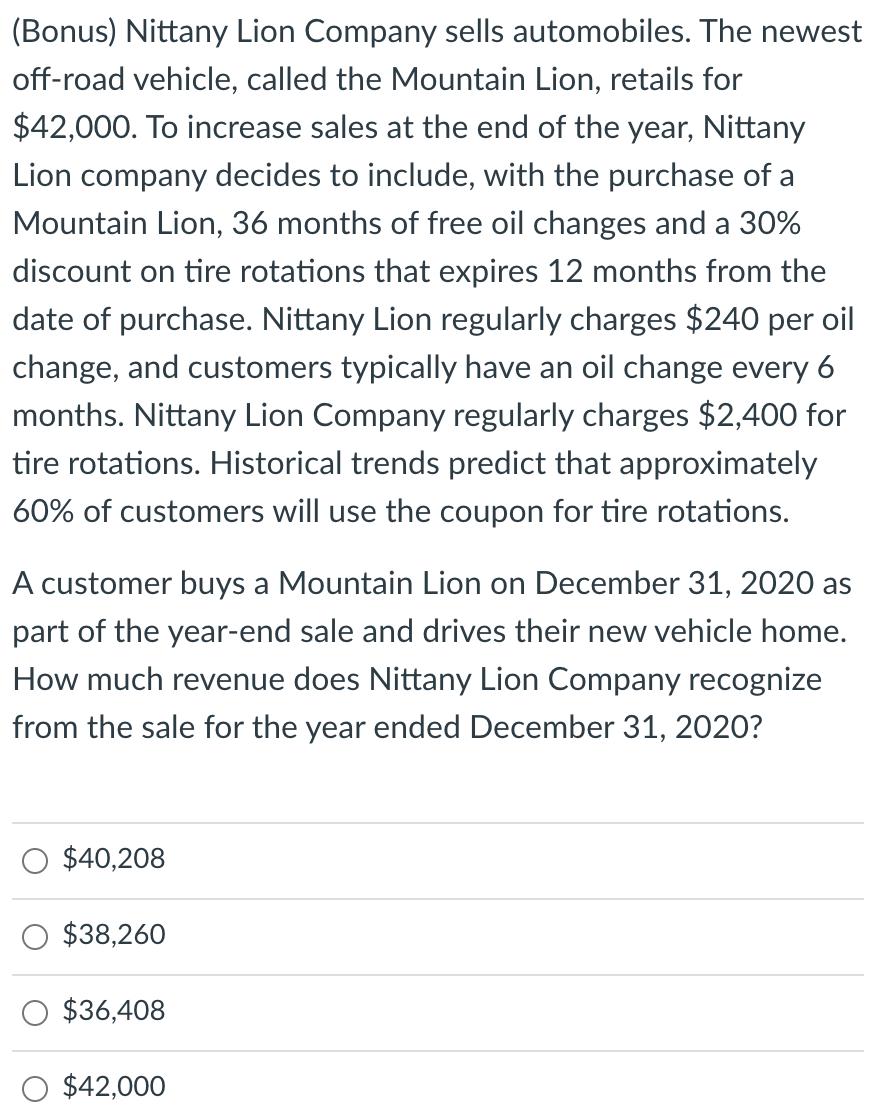

Suppose the following information for a three-year $15 million construction contract applies. 2018 2019 2020 Costs incurred in current period 4,200,000 5,600,000 8,000,000 Estimated costs to complete 5,800,000 7,700,000 Revenue is recognized over time. What is the gross profit (loss) recognized in 2020? 300,000 2,800,000 (300,000) O (2,800,000) (Bonus) Nittany Lion Company sells automobiles. The newest off-road vehicle, called the Mountain Lion, retails for $42,000. To increase sales at the end of the year, Nittany Lion company decides to include, with the purchase of a Mountain Lion, 36 months of free oil changes and a 30% discount on tire rotations that expires 12 months from the date of purchase. Nittany Lion regularly charges $240 per oil change, and customers typically have an oil change every 6 months. Nittany Lion Company regularly charges $2,400 for tire rotations. Historical trends predict that approximately 60% of customers will use the coupon for tire rotations. A customer buys a Mountain Lion on December 31, 2020 as part of the year-end sale and drives their new vehicle home. How much revenue does Nittany Lion Company recognize from the sale for the year ended December 31, 2020? $40,208 $38,260 $36,408 $42,000

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started