Answered step by step

Verified Expert Solution

Question

1 Approved Answer

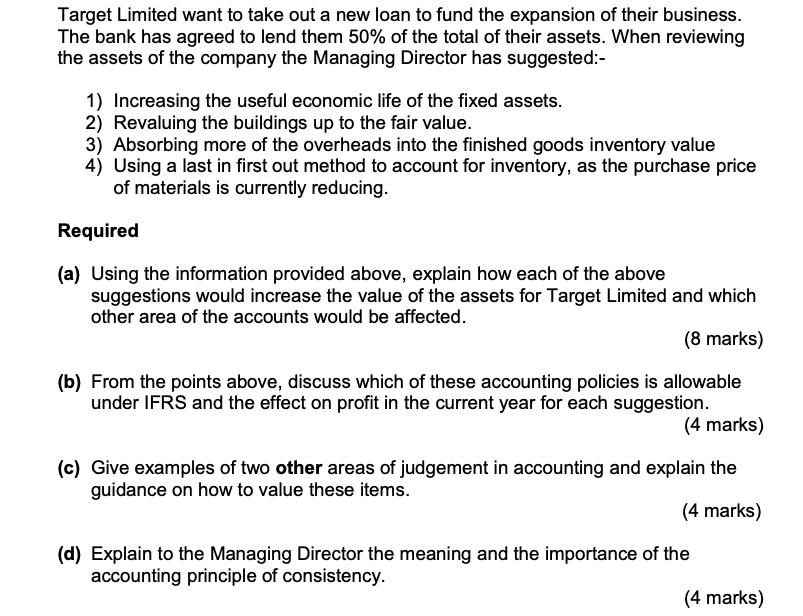

Target Limited want to take out a new loan to fund the expansion of their business. The bank has agreed to lend them 50%

Target Limited want to take out a new loan to fund the expansion of their business. The bank has agreed to lend them 50% of the total of their assets. When reviewing the assets of the company the Managing Director has suggested:- 1) Increasing the useful economic life of the fixed assets. 2) Revaluing the buildings up to the fair value. 3) Absorbing more of the overheads into the finished goods inventory value 4) Using a last in first out method to account for inventory, as the purchase price of materials is currently reducing. Required (a) Using the information provided above, explain how each of the above suggestions would increase the value of the assets for Target Limited and which other area of the accounts would be affected. (8 marks) (b) From the points above, discuss which of these accounting policies is allowable under IFRS and the effect on profit in the current year for each suggestion. (4 marks) (c) Give examples of two other areas of judgement in accounting and explain the guidance on how to value these items. (4 marks) (d) Explain to the Managing Director the meaning and the importance of the accounting principle of consistency. (4 marks)

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Events Its Effects on Value of asset Explaination Increaing the useful ife Asset value increases Depreciation amount to be amortised decreases as the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started