Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Sameer plc, a listed industrial Company, is considering a major investment. The Company needs an appropriate rate at which to discount the estimated after-tax

.

.

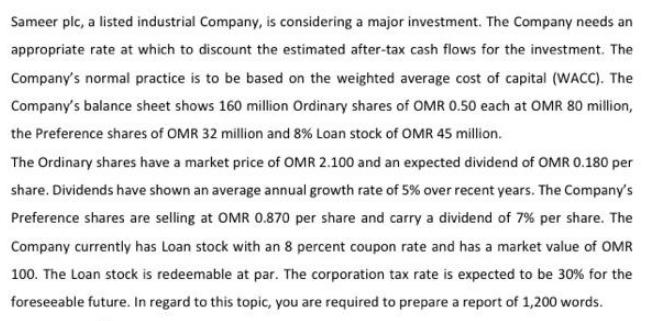

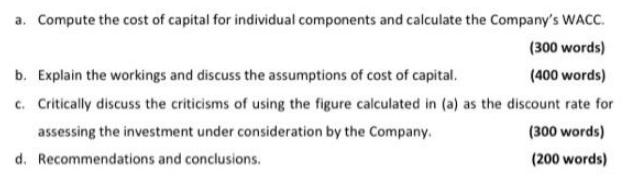

Sameer plc, a listed industrial Company, is considering a major investment. The Company needs an appropriate rate at which to discount the estimated after-tax cash flows for the investment. The Company's normal practice is to be based on the weighted average cost of capital (WACC). The Company's balance sheet shows 160 million Ordinary shares of OMR 0.50 each at OMR 80 million, the Preference shares of OMR 32 million and 8% Loan stock of OMR 45 million. The Ordinary shares have a market price of OMR 2.100 and an expected dividend of OMR 0.180 per share. Dividends have shown an average annual growth rate of 5% over recent years. The Company's Preference shares are selling at OMR 0.870 per share and carry a dividend of 7% per share. The Company currently has Loan stock with an 8 percent coupon rate and has a market value of OMR 100. The Loan stock is redeemable at par. The corporation tax rate is expected to be 30% for the foreseeable future. In regard to this topic, you are required to prepare a report of 1,200 words.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Cost of equity Ke expected dividend market price 100 g in 01821100 5 1357 Cost of preference shares Kp dividend rate market price 100 007 087 100 8046 Cost of debt Coupon rate 1tax rate 8 103 56 WACC Cost of funds Book value in OMR million Cost of funds value Equity 1357 80 10856 Preference 8046 32 257472 debt 56 45 252 Total 157 1595072 WACC cost of funds value book value 1016 b workings of cost of capital are given above face value per preference share ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started