Question

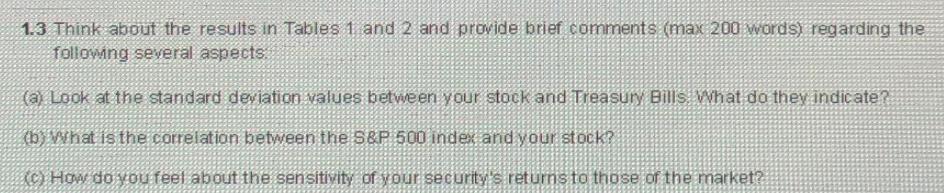

1.3 Think about the results in Tables 1 and 2 and provide brief conments (max 200 words) regarding the following several aspects. (a) Look

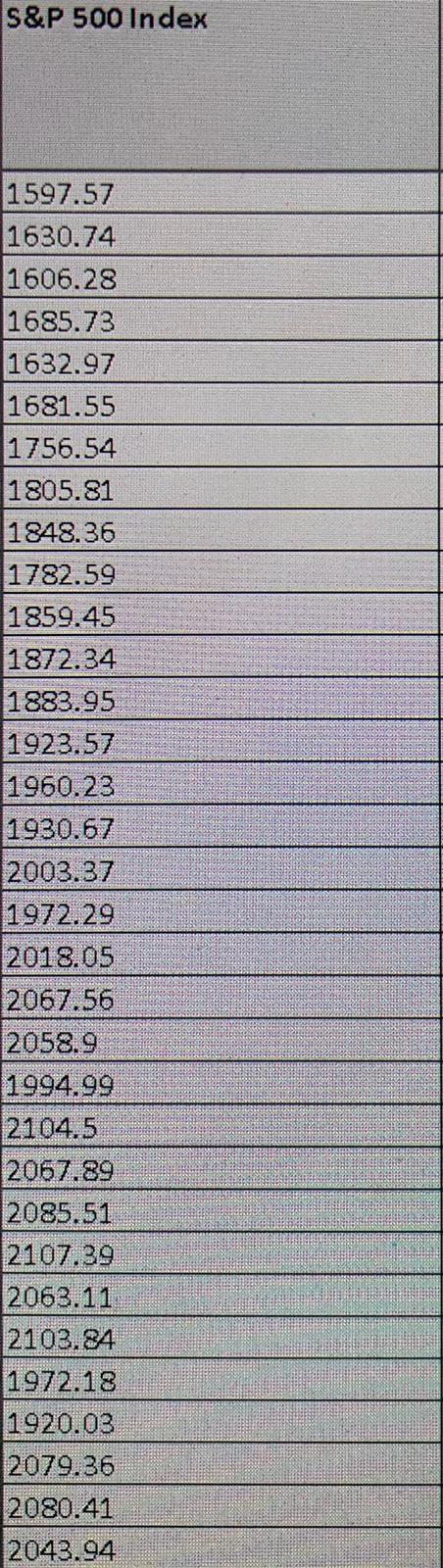

1.3 Think about the results in Tables 1 and 2 and provide brief conments (max 200 words) regarding the following several aspects. (a) Look at the standard devjation values between your stock and Treasury Bills. What do they indic ate? (b) What is the correlation between the SEP 500 index and your stock? (C) How do you feel about the sensitivity of your security's returnsto those of the market? S&P 500 Index 1597.57 1630.74 1606.28 1685.73 1632.97 1681.55 1756.54 1805.81 1848.36 1782.59 1859.45 1872.34 1883.95 1923.57 1960.23 1930.67 2003.37 1972.29 2018.05 2067.56 2058.9 1994.99 2104.5 2067.89 2085.51 2107.39 2063.11 2103.84 1972.18 1920.03 2079.36 2080.41 2043.94

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

13 a The standard deviation of your stock is much higher than th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical Business Statistics

Authors: Andrew Siegel

6th Edition

0123852080, 978-0123852083

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App