Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have collected the following information in order to prepare your tax return for 2019. a. You are married to your honey. Insert your

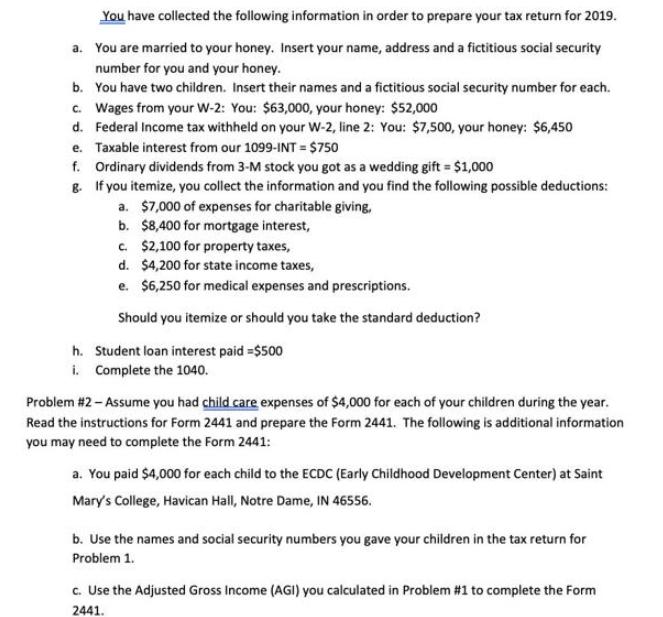

You have collected the following information in order to prepare your tax return for 2019. a. You are married to your honey. Insert your name, address and a fictitious social security number for you and your honey. b. You have two children. Insert their names and a fictitious social security number for each. c. Wages from your W-2: You: $63,000, your honey: $52,000 d. Federal Income tax withheld on your W-2, line 2: You: $7,500, your honey: $6,450 e. Taxable interest from our 1099-INT = $750 f. Ordinary dividends from 3-M stock you got as a wedding gift = $1,000 g. If you itemize, you collect the information and you find the following possible deductions: a. $7,000 of expenses for charitable giving. b. $8,400 for mortgage interest, c. $2,100 for property taxes, d. $4,200 for state income taxes, e. $6,250 for medical expenses and prescriptions. Should you itemize or should you take the standard deduction? Student loan interest paid =$500 h. i. Complete the 1040. Problem #2 - Assume you had child care expenses of $4,000 for each of your children during the year. Read the instructions for Form 2441 and prepare the Form 2441. The following is additional information you may need to complete the Form 2441: a. You paid $4,000 for each child to the ECDC (Early Childhood Development Center) at Saint Mary's College, Havican Hall, Notre Dame, IN 46556. b. Use the names and social security numbers you gave your children in the tax return for Problem 1. c. Use the Adjusted Gross Income (AGI) you calculated in Problem #1 to complete the Form 2441.

Step by Step Solution

★★★★★

3.49 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 To determine whether you should itemize deductions or take the standard deduction you need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started