Answered step by step

Verified Expert Solution

Question

1 Approved Answer

accounting- taxation business pass thru entities please help Check my w AJ is a 30 percent partner in the Trane Partnership, a calendar year-end entity.

accounting- taxation business pass thru entities

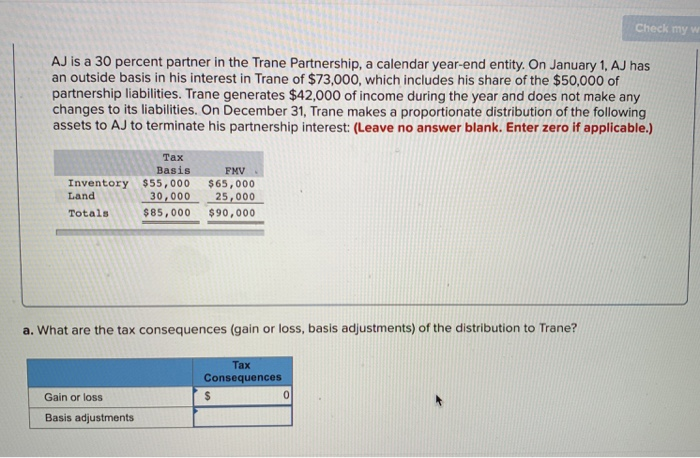

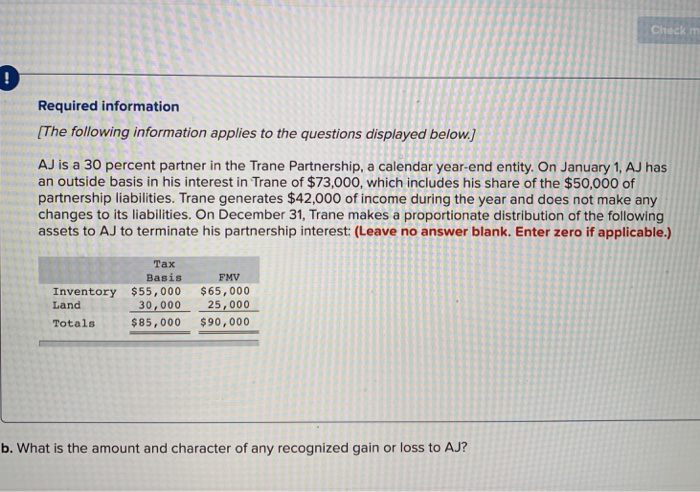

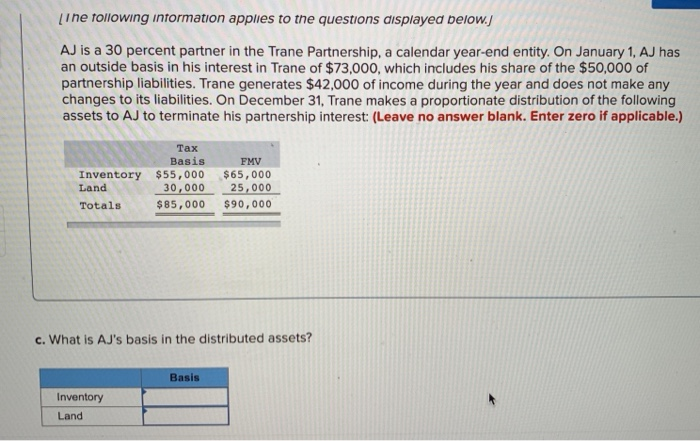

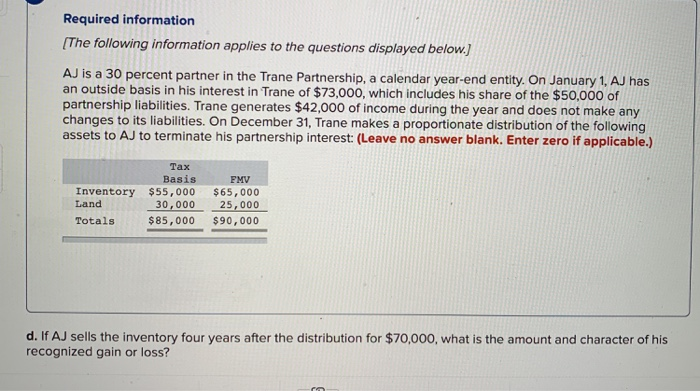

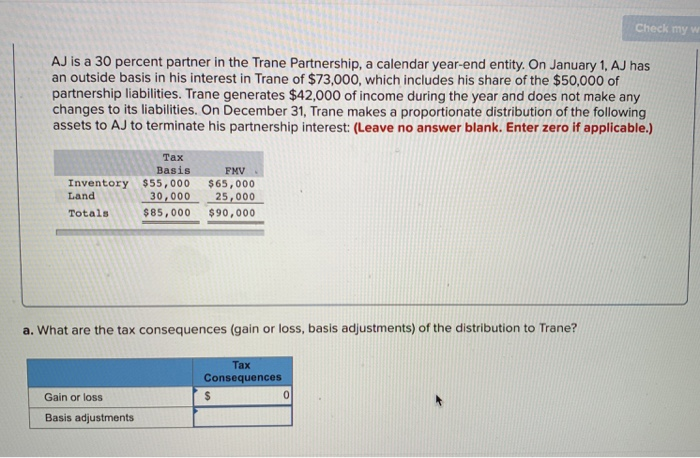

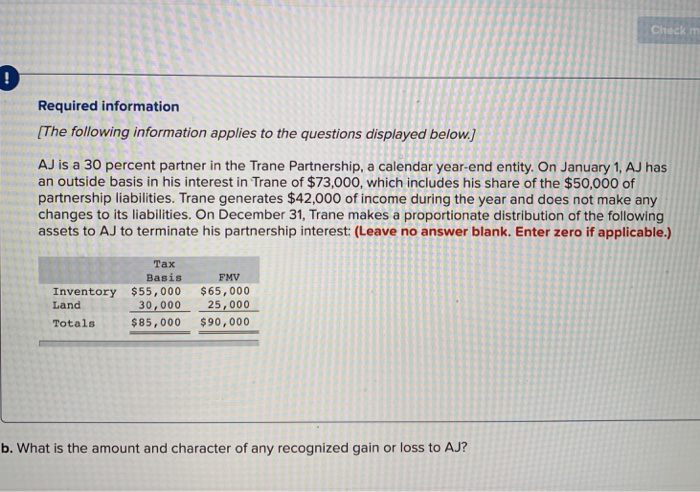

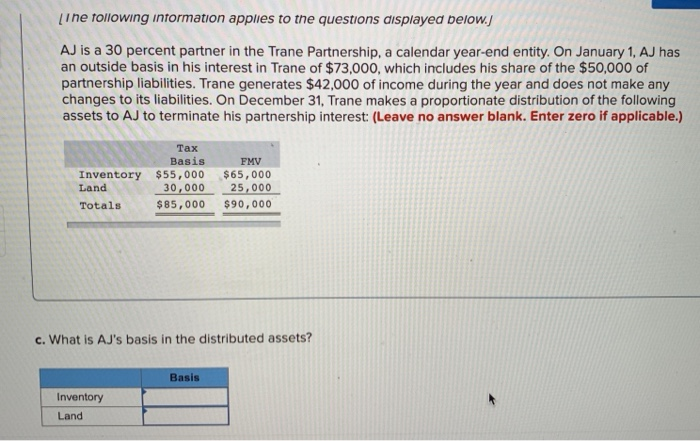

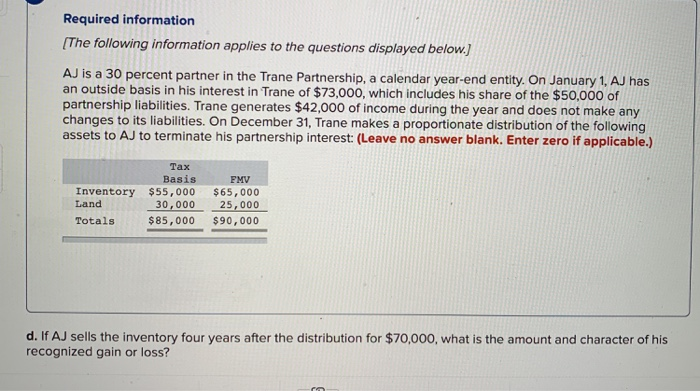

Check my w AJ is a 30 percent partner in the Trane Partnership, a calendar year-end entity. On January 1, AJ has an outside basis in his interest in Trane of $73,000, which includes his share of the $50,000 of partnership liabilities. Trane generates $42,000 of income during the year and does not make any changes to its liabilities. On December 31, Trane makes a proportionate distribution of the following assets to AJ to terminate his partnership interest: (Leave no answer blank. Enter zero if applicable.) Tax Basis FNV Inventory $55,000 65,000 30,000 25,000 Totals $85,000 $90,000 Land a. What are the tax consequences (gain or loss, basis adjustments) of the distribution to Trane? Tax Consequences Gain or loss Basis adjustments Check nm 0 Required information The following information applies to the questions displayed below.] AJ is a 30 percent partner in the Trane Partnership, a calendar year-end entity. On January 1, AJ has an outside basis in his interest in Trane of $73,000, which includes his share of the $50,000 of partnership liabilities. Trane generates $42,000 of income during the year and does not make any changes to its liabilities. On December 31, Trane makes a proportionate distribution of the following assets to AJ to terminate his partnership interest (Leave no answer blank. Enter zero if applicable.) Tax Basis FMV Inventory $5,000 ,000 30,000 25,000 Land $85,000 $90,000 b. What is the amount and character of any recognized gain or loss to AJ? line tollowing intormation applies to the questions aisplayed below. AJ is a 30 percent partner in the Trane Partnership, a calendar year-end entity. On January 1, AJ has an outside basis in his interest in Trane of $73,000, which includes his share of the $50,000 of partnership liabilities. Trane generates $42,000 of income during the year and does not make any changes to its liabilities. On December 31, Trane makes a proportionate distribution of the following assets to AJ to terminate his partnership interest: (Leave no answer blank. Enter zero if applicable.) Tax Basis FMV Inventory $55,000 $65,000 Land 30,00025,000 $85,000 $90,000 Totals c. What is AJ's basis in the distributed assets? Basis Inventory Land Required information [The following information applies to the questions displayed below] AJ is a 30 percent partner in the Trane Partnership, a calendar year-end entity. On January 1. AJ has an outside basis in his interest in Trane of $73,000, which includes his share of the $50,000 of partnership liabilities. Trane generates $42,000 of income during the year and does not make any changes to its liabilities. On December 31, Trane makes a proportionate distribution of the following assets to AJ to terminate his partnership interest: (Leave no answer blank. Enter zero if applicable.) Tax Basis FMV Inventory $55,000 $65,000 30,000 25,000 Totals $85,000 $90,000 Land d. If AJ sells the inventory four years after the distribution for $70,000, what is the amount and character of his recognized gain or loss please help

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started