Question

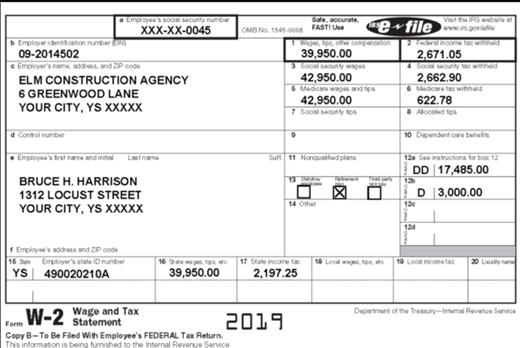

Taxpayer Information Taxpayer name: Bruce H. Harrison Taxpayer SSN: 201-00-0045 Taxpayer DOB: April 1, 1977 Taxpayer occupation: Contractor Spouse name: Lois A. Harrison Spouse SSN:

Taxpayer Information

Taxpayer name: | Bruce H. Harrison |

Taxpayer SSN: | 201-00-0045 |

Taxpayer DOB: | April 1, 1977 |

Taxpayer occupation: | Contractor |

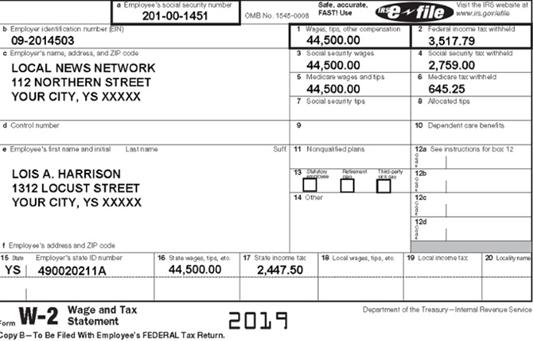

Spouse name: | Lois A. Harrison |

Spouse SSN: | 201-00-1451 |

Spouse DOB: | March 28, 1982 |

Spouse occupation: | Newscaster |

Address: | 1312 Locust Street |

Your City, YS XXXXX | |

Cell phone (T): | (XXX) 555-6336; Preferred: Anytime; |

Cell phone (S): | (XXX) 555-6363; Anytime; FCC: Yes; OK to call |

Taxpayer email: | bhharrison@net.net |

Spouse email: | lharrison@net.net |

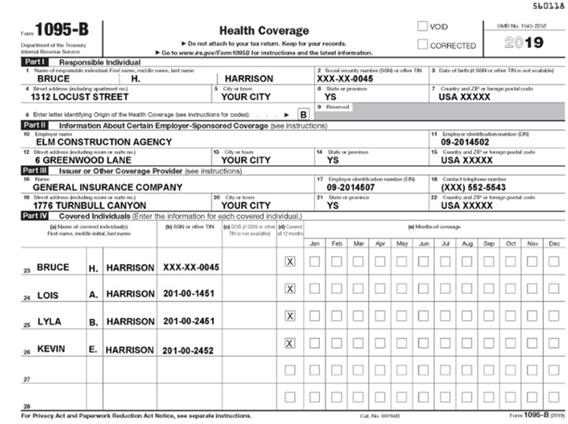

Health Insurance Information | |

Did everyone in the household have health insurance in 2019? | Yes |

Total months covered through a state exchange or federal marketplace: | 0 |

Total months covered through an employer-sponsored plan: | 12 |

Was a Form 1095-A issued? | No |

Bruce and Lois Harrison are new clients. Last year, they prepared their own return using online software, but this year, they would like professional assistance. They are married and wish to file a joint tax return. Both of their SSNs are valid for work in the U.S. and were received before the original filing due date of their return (including extensions). Both are U.S. citizens. No one may claim them as dependents. Neither is a student. They both wish to designate $3 to the Presidential Election Campaign Fund. Neither is blind or disabled.

Bruce and Lois did not suffer any casualty losses during the current tax year. They did not receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency. Neither Bruce nor Lois have a financial interest in or signature authority over a foreign account. They did not receive a distribution from, nor were they the grantors of or transferor to, a foreign trust. The IRS has not issued any Identity Protection ID Numbers for their return.

They did not receive a notice from the IRS or any state or local taxing authority within the last year. Neither Bruce nor Lois provide a driver’s license or state identification.

Household Information

Bruce and Lois own their home. They have two children.

Dependent name: | Lyla B. Harrison |

Dependent SSN: | 201-00-2451 |

Dependent DOB: | July 12, 2014 |

Dependent relationship: | Daughter |

Time in household: | 12 months |

Gross income: | $0 |

Support: | Does not provide over half of her own support |

Dependent name: | Kevin E. Harrison |

Dependent SSN: | 201-00-2452 |

Dependent DOB: | October 15, 2016 |

Dependent relationship: | Son |

Time in household: | 12 months |

Gross income: | $0 |

Support: | Does not provide over half of his own support |

Lyla and Kevin lived with Bruce and Lois all year, and they did not have any income. Neither is married or disabled. They are both U.S. citizens. Lyla and Kevin have SSNs that are valid for work in the United States and were received before the due date for the return (including extensions). Bruce and Lois brought in copies of medical records for both children.

Adjustments

Lois contributed $2,500 to a traditional IRA during the year. She only has one IRA account, and the value of this account on December 31, 2019, was $13,097.85. All of her previous contributions were deductible. Lois has never taken a distribution from this or any other retirement account. Bruce is covered by an employer-sponsored retirement plan, but Lois is not.

Credits

Bruce and Lois paid Little Ones Learning Center $7,200 ($3,600 for each child) to care for Kevin and Lyla while they worked. The center's EIN is 09-2014501. It is located at 1521 West Plain Road, Your City, YS XXXXX. The phone number for the Center is (XXX) 555-0034. Bruce and Lois have documentation substantiating this expense.

Self-Employment Income

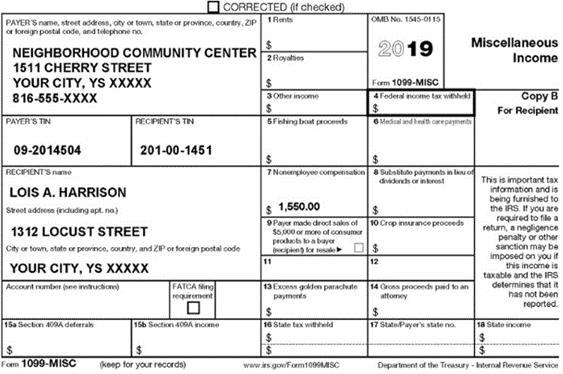

Lois has always been an avid reader, and during the year, she had an opportunity to lead a book club at a nearby community center. The community center paid Lois for this work. At the end of the year, they sent Lois a Form 1099-MISC reporting an amount for nonemployee compensation in box 7 of the form. This form is shown in the Information Documents section. The community center is within walking distance of the couple's home, so Lois did not have any vehicle or travel expenses. Her only business-related expense was for $225 in supplies.

For purposes of the qualified business income deduction (QBID), this is not a specified service trade or business (SSTB). Lois did not pay any qualified wages, nor does she have any qualified business property, or any losses or short-term gains from asset disposition.

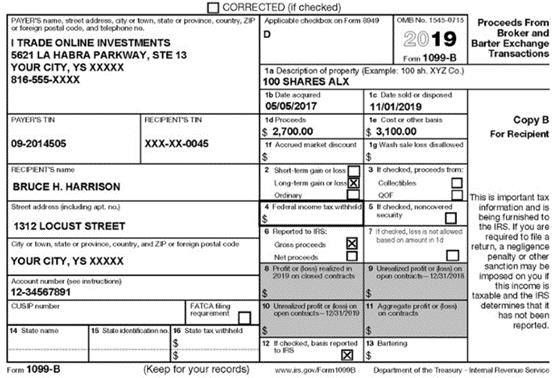

Capital Assets

Bruce was unhappy with the performance of an investment he had made in 2017. He sold the shares of stock on November 7, 2019, for fear the stock would continue its downward trend. Information relating to this sale was reported on a Form 1099-B. This form is shown in the Information Documents section.

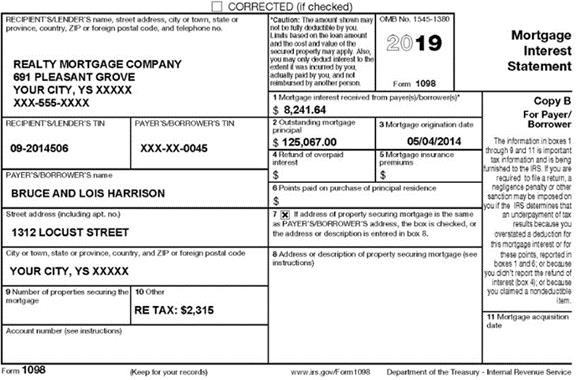

Itemized Deductions

Bruce and Lois want to itemize deductions if it will be more beneficial than taking the standard deduction. They bring a Form 1098 reporting mortgage interest and real estate taxes paid on their personal residence. This is shown in the Information Documents section. Bruce and Lois would prefer to take the state income tax deduction rather than the sales tax deduction. They also had the following potentially deductible items for 2019:

Item | Amount | Notes |

2018 State balance due | $582 | Made this payment on April 10, 2019 |

Cash donation to Cancer Research Foundation | $475 | Paid March 4, 2019 |

- What is Bruce’s and Lois’s total income?

- What is their AGI?

- What is their taxable income?

- What is their tax for taxable income?

- What is their child tax credit for other dependents?

- What is the self-employment tax?

- What is their total tax?

- What is the federal income tax withheld?

- Are there any other payments and refundable credits? If so, what are they and how much are they each worth? What is the total for all of these?

- What are their total payments?

- Are they getting a refund or do they owe money? If there is a refund, how much will they receive? If they owe, how much do they owe?

b Employer identification number Employes's social security number XXX-XX-0045 09-2014502 e Employer's name, address, and 2P code ELM CONSTRUCTION AGENCY 6 GREENWOOD LANE YOUR CITY, YS XXXXX d Control number Employee's frat naandal Last name BRUCE H. HARRISON 1312 LOCUST STREET YOUR CITY, YS XXXXX Employee's address and ZIP code 15 Employer's state ID number YS 490020210A Form W-2 Wage and Tax Statement 16 ap 39,950.00 OMB No 1545-0008 Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service 2019 0 Safe, accurate. FASTU 3 Sool sounty wages 42,950.00 5 Medicars wages and tips 42,950.00 7 500 secunty to Wage, lips, other compensation 39,950.00 Suff 11 Nonquified plans 13 TURAN 17 State income tax 2,197.25 14 Other Tabwat X efileg 2 Federalnom fait withheld 2,671.05 4 Social secunty tax withheld 2,662.90 Visit the 6 Medicare tax withd 622.78 Aloosted Sp 10 Dipendent care benefits 12a Ses instructions for bax 12 DD 17,485.00 126 120 1 124 D 3,000.00 19 Looal income tax 20 Latyn Department of the Treasury-Internal Revenue Sente

Step by Step Solution

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Taxpayer Information Taxpayer name Bruce H Harrison Taxpayer SSN 201000045 Taxpayer DOB April 1 1977 Taxpayer occupation Contractor Spouse name Lois A Harrison Spouse SSN 201001451 Spouse DOB March 28 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started