Answered step by step

Verified Expert Solution

Question

1 Approved Answer

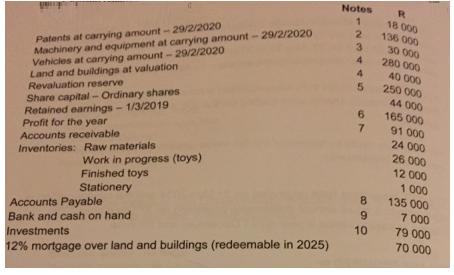

The following balances for 29 February 2020 were taken from the books of Harry ltd. company that manufactures toys: Additional information: 1. The patents were

Notes 18 000 2 136 000 3 Patents at carrying amount-29/2/2020 Machinery and equipment at carrying amount-29/2/2020 Vehicles at carrying amount-29/2/2020 Land and buildings at valuation Revaluation reserve 30 000 280 000 4. 4 40 000 250 000 44 000 165 000 91 000 24 000 26 000 12 000 1 000 135 000 7 000 5. Share capital-Ordinary shares Retained earnings - 1/3/2019 Profit for the year Accounts receivable Inventories: Raw materials 6. 7 Work in progress (toys) Finished toys Stationery 8 Accounts Payable Bank and cash on hand 10 79 000 Investments 70 000 12% mortgage over land and buildings (redeemable in 2025) Notes 18 000 2 136 000 3 Patents at carrying amount-29/2/2020 Machinery and equipment at carrying amount-29/2/2020 Vehicles at carrying amount-29/2/2020 Land and buildings at valuation Revaluation reserve 30 000 280 000 4. 4 40 000 250 000 44 000 165 000 91 000 24 000 26 000 12 000 1 000 135 000 7 000 5. Share capital-Ordinary shares Retained earnings - 1/3/2019 Profit for the year Accounts receivable Inventories: Raw materials 6. 7 Work in progress (toys) Finished toys Stationery 8 Accounts Payable Bank and cash on hand 10 79 000 Investments 70 000 12% mortgage over land and buildings (redeemable in 2025)

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

As it is visible write off for period March 2019 to Feb 2020 is pending and therefore we see value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started