Answered step by step

Verified Expert Solution

Question

1 Approved Answer

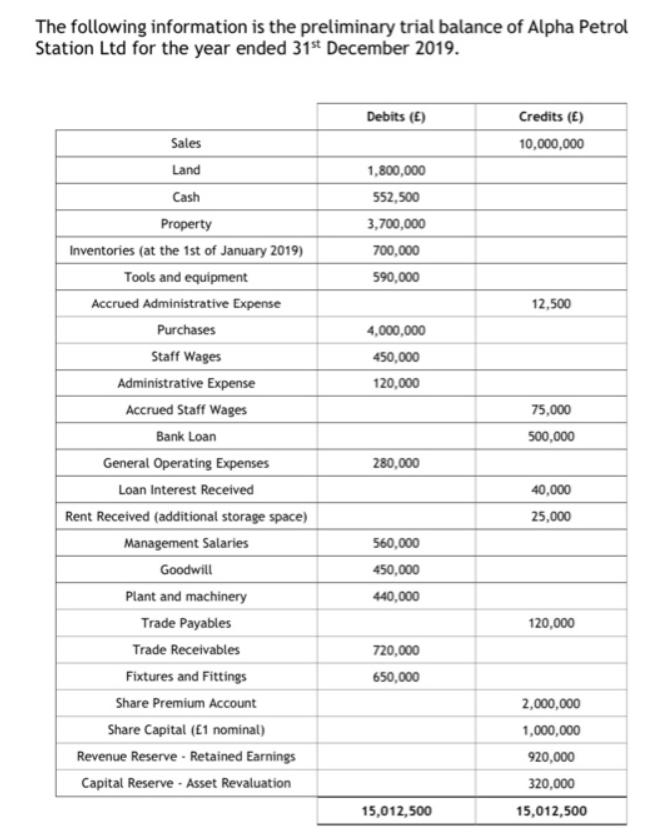

The following information is the preliminary trial balance of Alpha Petrol Station Ltd for the year ended 31* December 2019. Debits (E) Credits ()

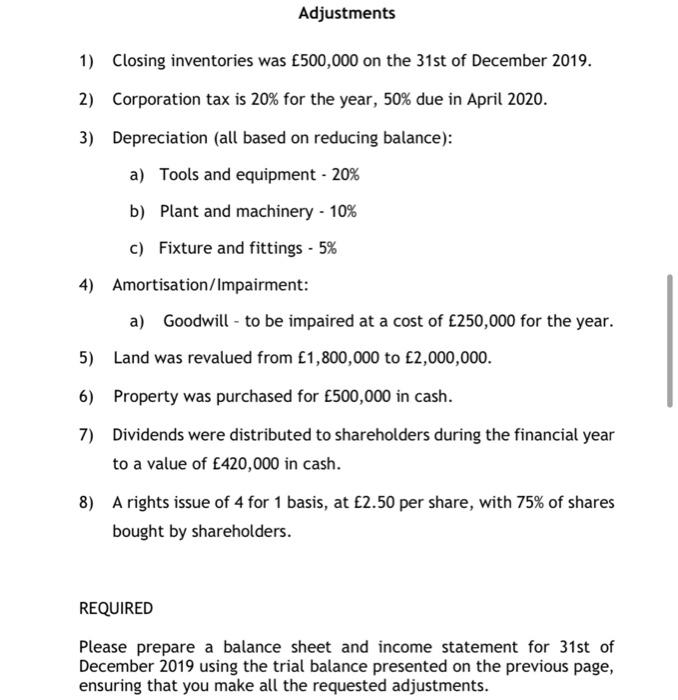

The following information is the preliminary trial balance of Alpha Petrol Station Ltd for the year ended 31* December 2019. Debits (E) Credits () Sales 10,000,000 Land 1,800,000 Cash 552,500 Property 3,700,000 Inventories (at the 1st of January 2019) 700,000 Tools and equipment 590,000 Accrued Administrative Expense 12,500 Purchases 4,000,000 Staff Wages 450,000 Administrative Expense 120,000 Accrued Staff Wages 75,000 Bank Loan 500,000 General Operating Expenses 280,000 Loan Interest Received 40,000 Rent Received (additional storage space) 25,000 Management Salaries 560,000 Goodwill 450,000 Plant and machinery 440,000 Trade Payables 120,000 Trade Receivables 720,000 Fixtures and Fittings 650,000 Share Premium Account 2,000,000 Share Capital (E1 nominal) 1,000,000 Revenue Reserve - Retained Earnings 920,000 Capital Reserve - Asset Revaluation 320,000 15,012,500 15,012,500 Adjustments 1) Closing inventories was 500,000 on the 31st of December 2019. 2) Corporation tax is 20% for the year, 50% due in April 2020. 3) Depreciation (all based on reducing balance): a) Tools and equipment - 20% b) Plant and machinery - 10% c) Fixture and fittings - 5% 4) Amortisation/Impairment: a) Goodwill - to be impaired at a cost of 250,000 for the year. 5) Land was revalued from 1,800,000 to 2,000,000. 6) Property was purchased for 500,000 in cash. 7) Dividends were distributed to shareholders during the financial year to a value of 420,000 in cash. 8) A rights issue of 4 for 1 basis, at 2.50 per share, with 75% of shares bought by shareholders. REQUIRED Please prepare a balance sheet and income statement for 31st of December 2019 using the trial balance presented on the previous page, ensuring that you make all the requested adjustments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Income Statement of Alpha Petrol station Ltdfor the year ended on 31st Dec 2019 Income Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started