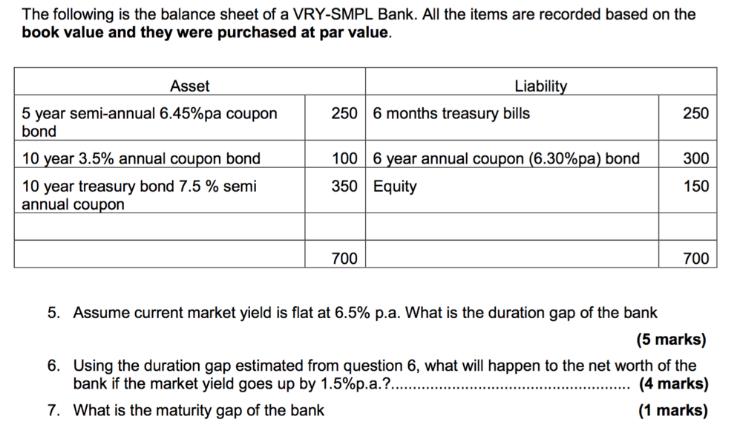

. The following is the balance sheet of a VRY-SMPL Bank. All the items are recorded based on the book value and they were purchased

.

.

The following is the balance sheet of a VRY-SMPL Bank. All the items are recorded based on the book value and they were purchased at par value. Asset Liability 5 year semi-annual 6.45%pa coupon bond 250 6 months treasury bills 250 10 year 3.5% annual coupon bond 100 6 year annual coupon (6.30%pa) bond 300 10 year treasury bond 7.5 % semi annual coupon 350 Equity 150 700 700 5. Assume current market yield is flat at 6.5% p.a. What is the duration gap of the bank (5 marks) 6. Using the duration gap estimated from question 6, what will happen to the net worth of the bank if the market yield goes up by 1.5%p.a.? . 7. What is the maturity gap of the bank (4 marks) (1 marks)

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

All figures below are in USD unless mentioned otherwise Asset 1 Duration of 5 year semiannual 645 per annum coupon with par value of USD 250 Half Year No A Scheduled Debt Obligations Cash Flows B Year ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started