Part A: You are the audit manager in charge of the financial statements audit for Dew Carre Pte Ltd (the Company) for the financial

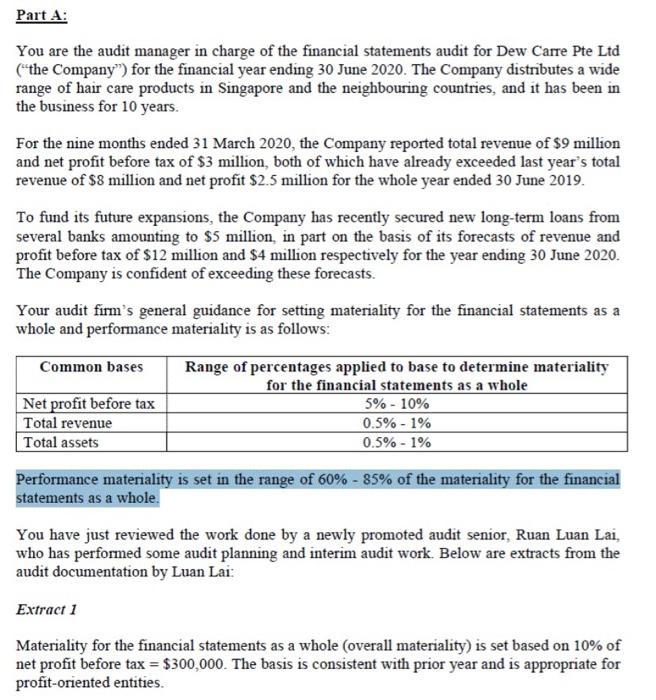

Part A: You are the audit manager in charge of the financial statements audit for Dew Carre Pte Ltd ("the Company") for the financial year ending 30 June 2020. The Company distributes a wide range of hair care products in Singapore and the neighbouring countries, and it has been in the business for 10 years. For the nine months ended 31 March 2020, the Company reported total revenue of $9 million and net profit before tax of $3 million, both of which have already exceeded last year's total revenue of $8 million and net profit $2.5 million for the whole year ended 30 June 2019. To fund its future expansions, the Company has recently secured new long-term loans from several banks amounting to $5 million, in part on the basis of its forecasts of revenue and profit before tax of $12 million and $4 million respectively for the year ending 30 June 2020. The Company is confident of exceeding these forecasts. Your audit firm's general guidance for setting materiality for the financial statements as a whole and performance materiality is as follows: Common bases Net profit before tax Total revenue Total assets Range of percentages applied to base to determine materiality for the financial statements as a whole 5% - 10% 0.5% -1% 0.5% -1% Performance materiality is set in the range of 60% - 85% of the materiality for the financial statements as a whole. You have just reviewed the work done by a newly promoted audit senior, Ruan Luan Lai, who has performed some audit planning and interim audit work. Below are extracts from the audit documentation by Luan Lai: Extract 1 Materiality for the financial statements as a whole (overall materiality) is set based on 10% of net profit before tax = $300,000. The basis is consistent with prior year and is appropriate for profit-oriented entities. Performance materiality is set at 80% of overall materiality = $240,000. The basis is consistent with prior year and is appropriate since we did not detect any material misstatement during last year's audit. Consistent with prior year, there is no need to set any specific materiality for this audit. Extract 2 Per discussion with the IT Manager, Soh Ai Tee, since January 2020, the company has replaced the credit manager with a new automated credit-approval system, "Al-approved!". AI-Approved! is developed in-house and uses artificial intelligence to analyse the creditworthiness of customers and approve credit sales based on guidelines set by the company and information provided by the company and from other sources. Sales orders are input online by the sales department and approvals are typically received within seconds. According to Ai Tee, the implementation of Al-Approved! has significantly improved the efficiency and effectiveness of sales processing, which is demonstrated by the healthy growth in revenue and a 50% increase in new customers this year. Given that the controls over credit approval remain strong, we will follow last year's audit strategy and rely on the controls to reduce substantive testing for sales. Required: (1) How does the use of an IT system alter the audit assertions that are required to be achieved by the auditor? Explain how the type of audit evidence would change. (11) For EACH of the Extracts of the audit documentation, critically evaluate Luan Lai's professional judgments and suggest any additional factors and/or actions that Luan Lai should have considered.

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 The use of an IT system alters the audit assertions that are required to be achieved by the auditor in that it increases the need for the auditor to ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started