Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1 a Calculate the issuance proceeds of the bond. 1 b Calculate the issuance proceeds of the accrued interest. 2. Record all entries associated

Required:

1 a Calculate the issuance proceeds of the bond.

1 b Calculate the issuance proceeds of the accrued interest.

2. Record all entries associated with the bond for 20x1 and 20x2

3. calculate interest expense for 20x1 and determine the net balance of bonds payable as of 31 December 20x1.

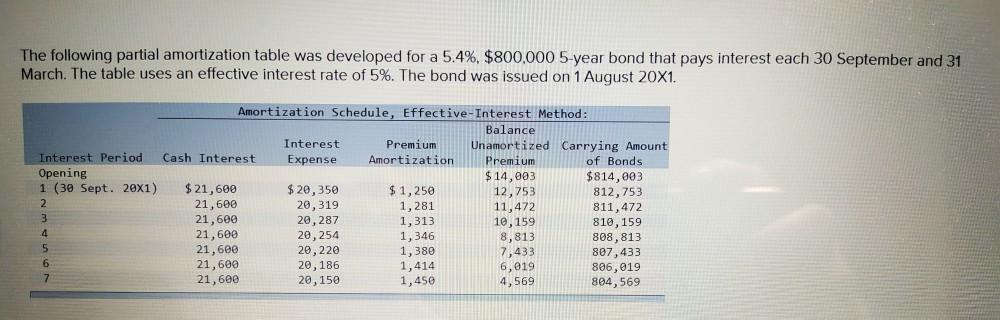

The following partial amortization table was developed for a 5.4%, $800,000 5-year bond that pays interest each 30 September and 31 March. The table uses an effective interest rate of 5%. The bond was issued on 1 August 20X1. Amortization Schedule, Effective-Interest Method: Balance Interest Premium Amortization Unamortized Carrying Amount Interest Period Opening 1 (30 Sept. 20X1) Cash Interest Expense Premium of Bonds $ 20,350 20,319 20, 287 20, 254 $14,003 12,753 11,472 10,159 8,813 7,433 6,019 4,569 $814,003 812,753 811,472 810,159 808,813 807,433 806,019 804, 569 $21,600 21,600 21,600 21,600 21,600 21,600 21,600 $1,250 1,281 1,313 1,346 1,380 1,414 1,450 3 4 20,220 20,186 20,150 6.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started