Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Linda is an employee of a Canadian controlled private corporation (CCPC). She lives with her common-law partner Julian. The following information pertains to her

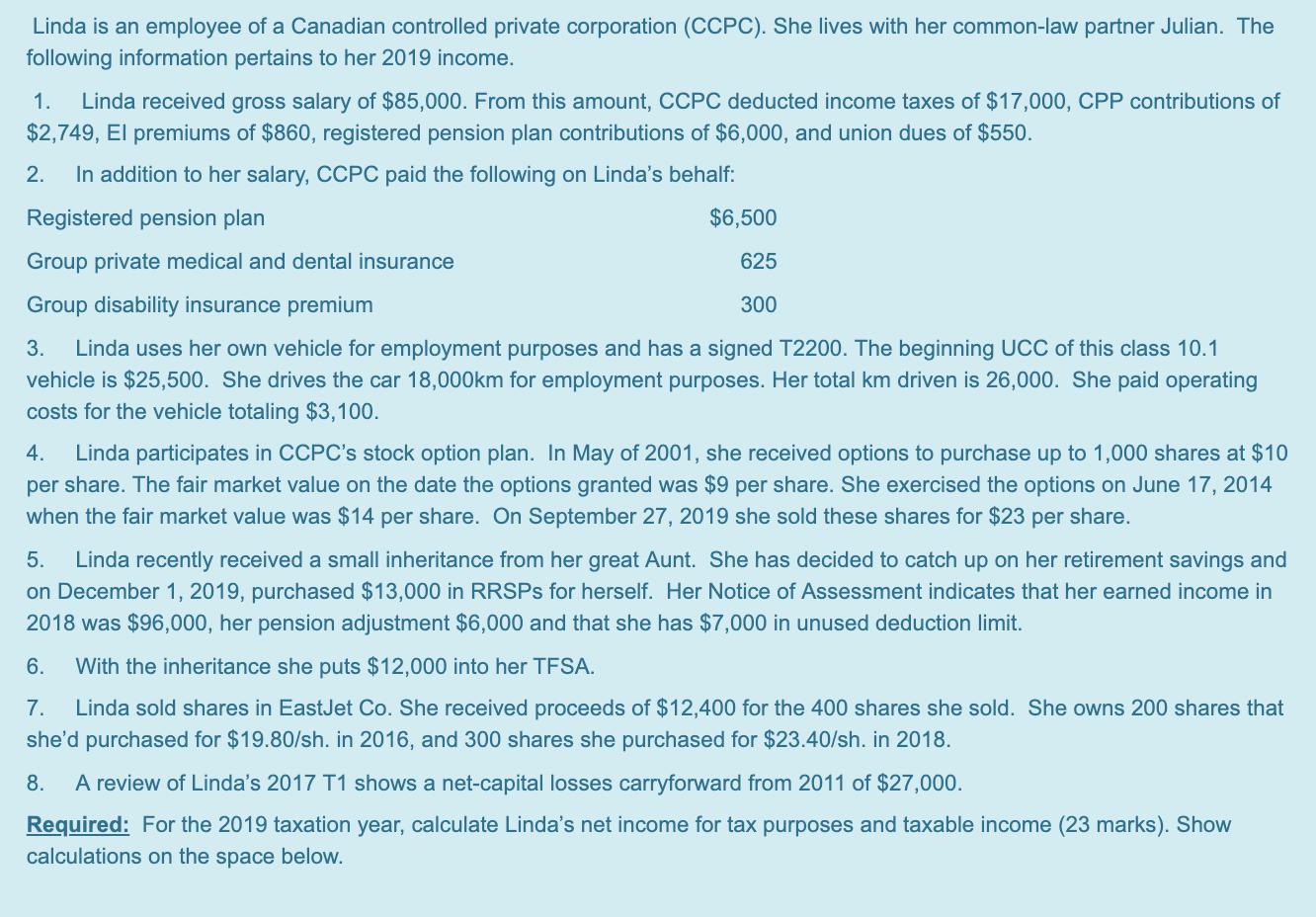

Linda is an employee of a Canadian controlled private corporation (CCPC). She lives with her common-law partner Julian. The following information pertains to her 2019 income. Linda received gross salary of $85,000. From this amount, CCPC deducted income taxes of $17,000, CPP contributions of $2,749, El premiums of $860, registered pension plan contributions of $6,000, and union dues of $550. 1. 2. In addition to her salary, CCPC paid the following on Linda's behalf: Registered pension plan $6,500 Group private medical and dental insurance 625 Group disability insurance premium 300 Linda uses her own vehicle for employment purposes and has a signed T2200. The beginning UCC of this class 10.1 vehicle is $25,500. She drives the car 18,000km for employment purposes. Her total km driven is 26,000. She paid operating costs for the vehicle totaling $3,100. 3. Linda participates in CCPC's stock option plan. In May of 2001, she received options to purchase up to 1,000 shares at $10 per share. The fair market value on the date the options granted was $9 per share. She exercised the options on June 17, 2014 when the fair market value was $14 per share. On September 27, 2019 she sold these shares for $23 per share. 4. Linda recently received a small inheritance from her great Aunt. She has decided to catch up on her retirement savings and on December 1, 2019, purchased $13,000 in RRSPS for herself. Her Notice of Assessment indicates that her earned income in 2018 was $96,000, her pension adjustment $6,000 and that she has $7,000 in unused deduction limit. 5. 6. With the inheritance she puts $12,000 into her TFSA. Linda sold shares in EastJet Co. She received proceeds of $12,400 for the 400 shares she sold. She owns 200 shares that she'd purchased for $19.80/sh. in 2016, and 300 shares she purchased for $23.40/sh. in 2018. 7. 8. A review of Linda's 2017 T1 shows a net-capital losses carryforward from 2011 of $27,000. Required: For the 2019 taxation year, calculate Linda's net income for tax purposes and taxable income (23 marks). Show calculations on the space below.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Linda Analysis of Her IncoMe Gross salary 85000 CO PC deducation it 00d contr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started