Answered step by step

Verified Expert Solution

Question

1 Approved Answer

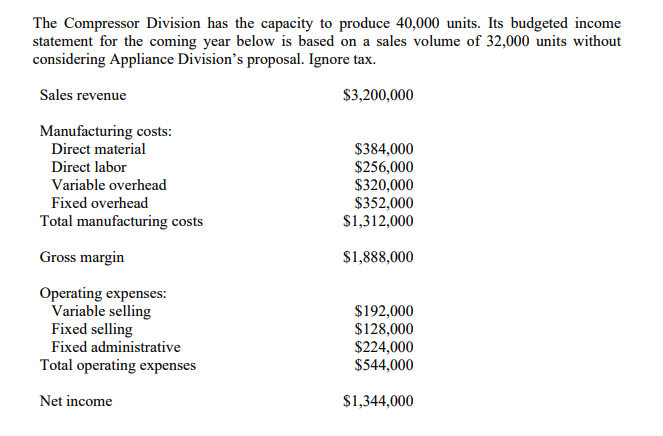

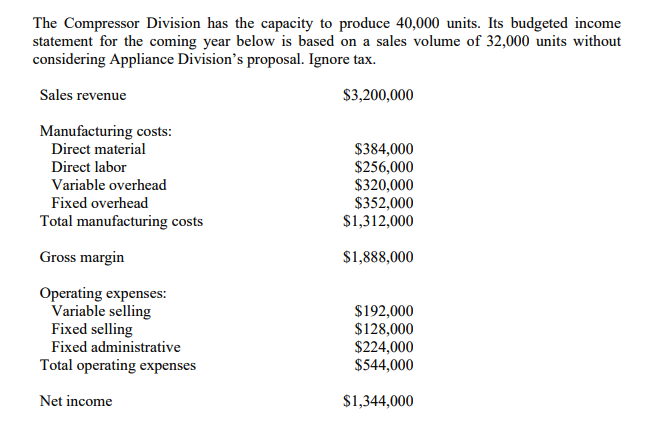

The Compressor Division has the capacity to produce 40,000 units. Its budgeted income statement for the coming year below is based on a sales

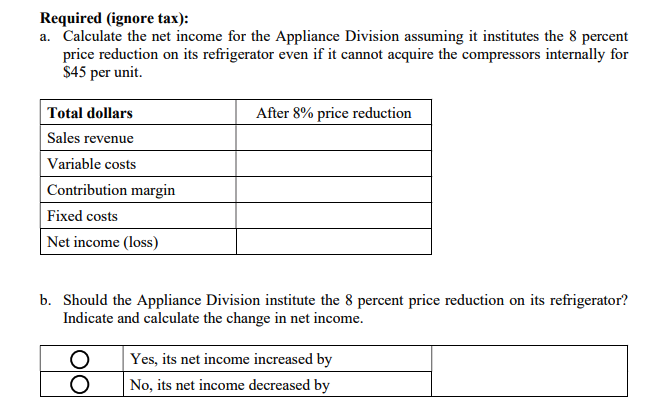

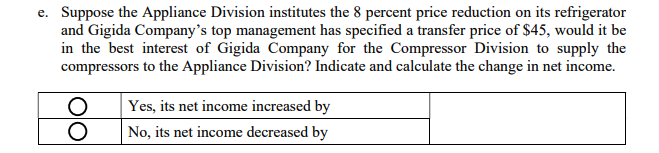

The Compressor Division has the capacity to produce 40,000 units. Its budgeted income statement for the coming year below is based on a sales volume of 32,000 units without considering Appliance Division's proposal. Ignore tax. Sales revenue $3,200,000 Manufacturing costs: Direct material Direct labor Variable overhead Fixed overhead Total manufacturing costs Gross margin Operating expenses: Variable selling Fixed selling Fixed administrative Total operating expenses Net income $384,000 $256,000 $320,000 $352,000 $1,312,000 $1,888,000 $192,000 $128,000 $224,000 $544,000 $1,344,000 The Compressor Division has the capacity to produce 40,000 units. Its budgeted income statement for the coming year below is based on a sales volume of 32,000 units without considering Appliance Division's proposal. Ignore tax. Sales revenue $3,200,000 Manufacturing costs: Direct material Direct labor Variable overhead Fixed overhead Total manufacturing costs Gross margin Operating expenses: Variable selling Fixed selling Fixed administrative Total operating expenses Net income $384,000 $256,000 $320,000 $352,000 $1,312,000 $1,888,000 $192,000 $128,000 $224,000 $544,000 $1,344,000 Required (ignore tax): a. Calculate the net income for the Appliance Division assuming it institutes the 8 percent price reduction on its refrigerator even if it cannot acquire the compressors internally for $45 per unit. Total dollars Sales revenue Variable costs Contribution margin Fixed costs Net income (loss) After 8% price reduction b. Should the Appliance Division institute the 8 percent price reduction on its refrigerator? Indicate and calculate the change in net income. O O Yes, its net income increased by No, its net income decreased by e. Suppose the Appliance Division institutes the 8 percent price reduction on its refrigerator and Gigida Company's top management has specified a transfer price of $45, would it be in the best interest of Gigida Company for the Compressor Division to supply the compressors to the Appliance Division? Indicate and calculate the change in net income. O Yes, its net income increased by No, its net income decreased by

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a Total dollars After 8 price reduction Sales revenue 3200000 8 of 32000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started