Answered step by step

Verified Expert Solution

Question

1 Approved Answer

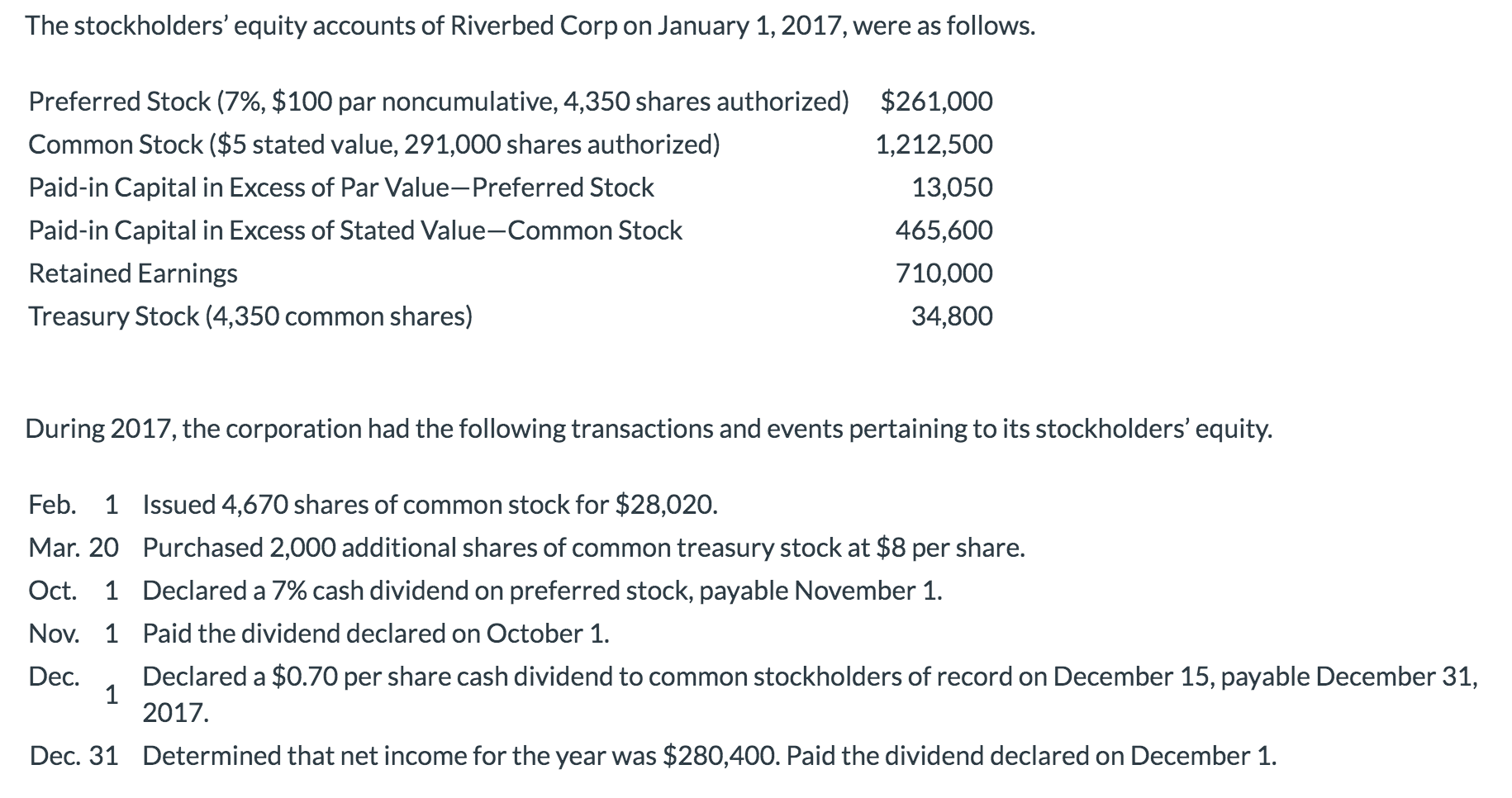

?? The stockholders' equity accounts of Riverbed Corp on January 1, 2017, were as follows. Preferred Stock (7%, $100 par noncumulative, 4,350 shares authorized) Common

??

??

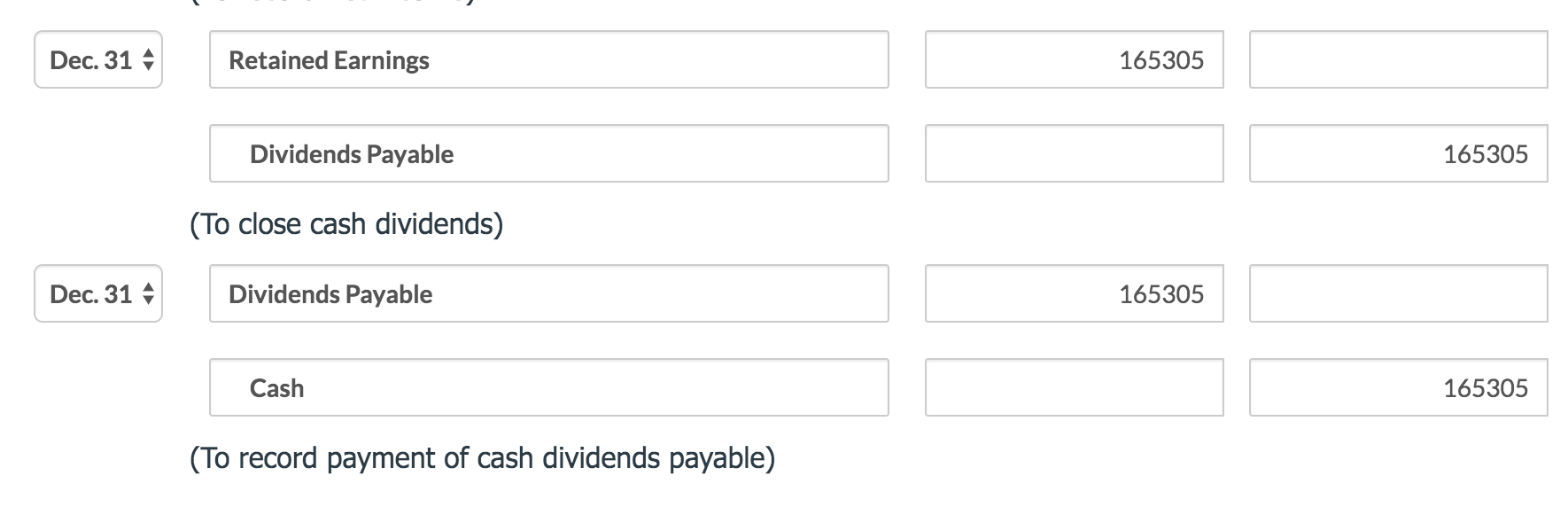

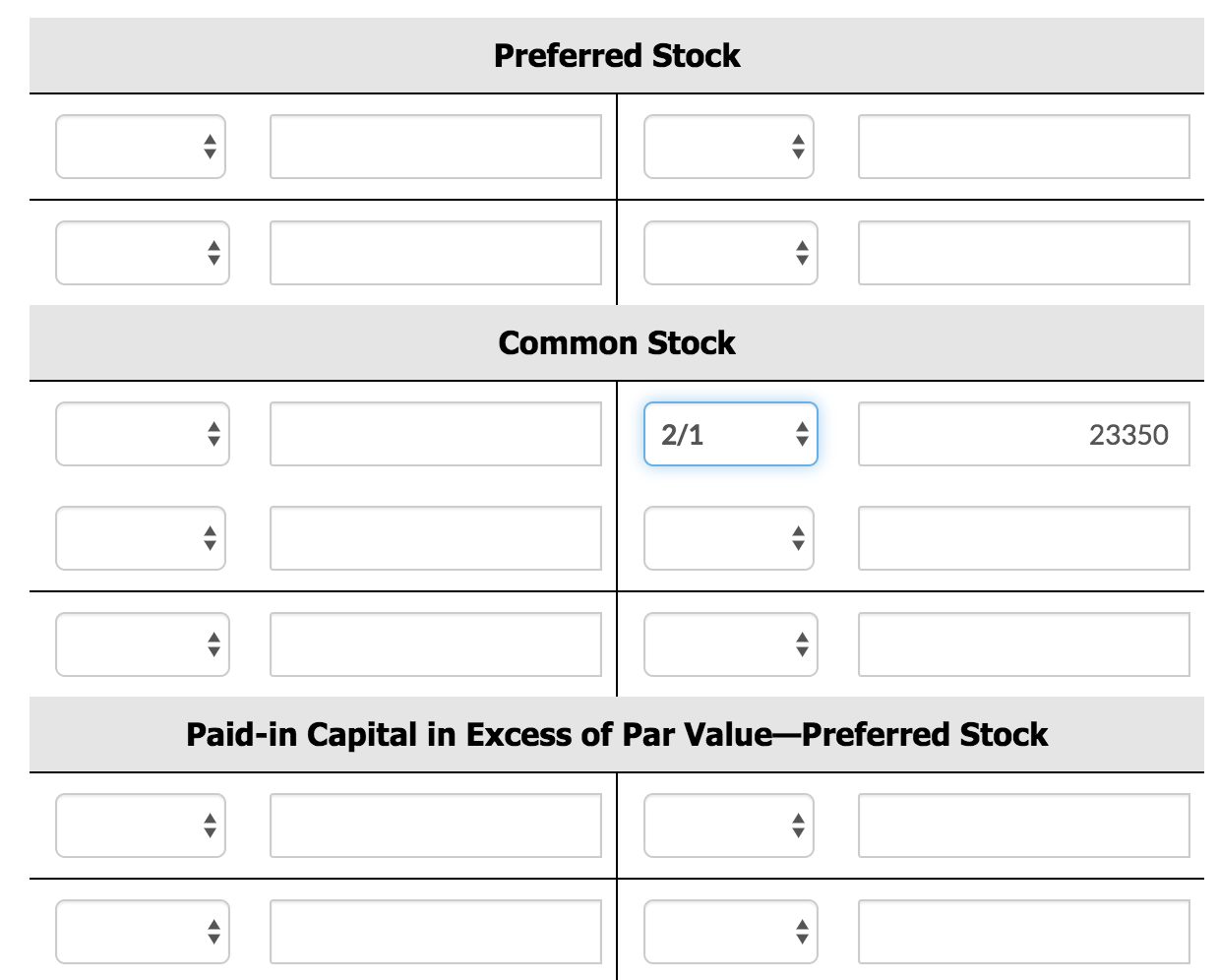

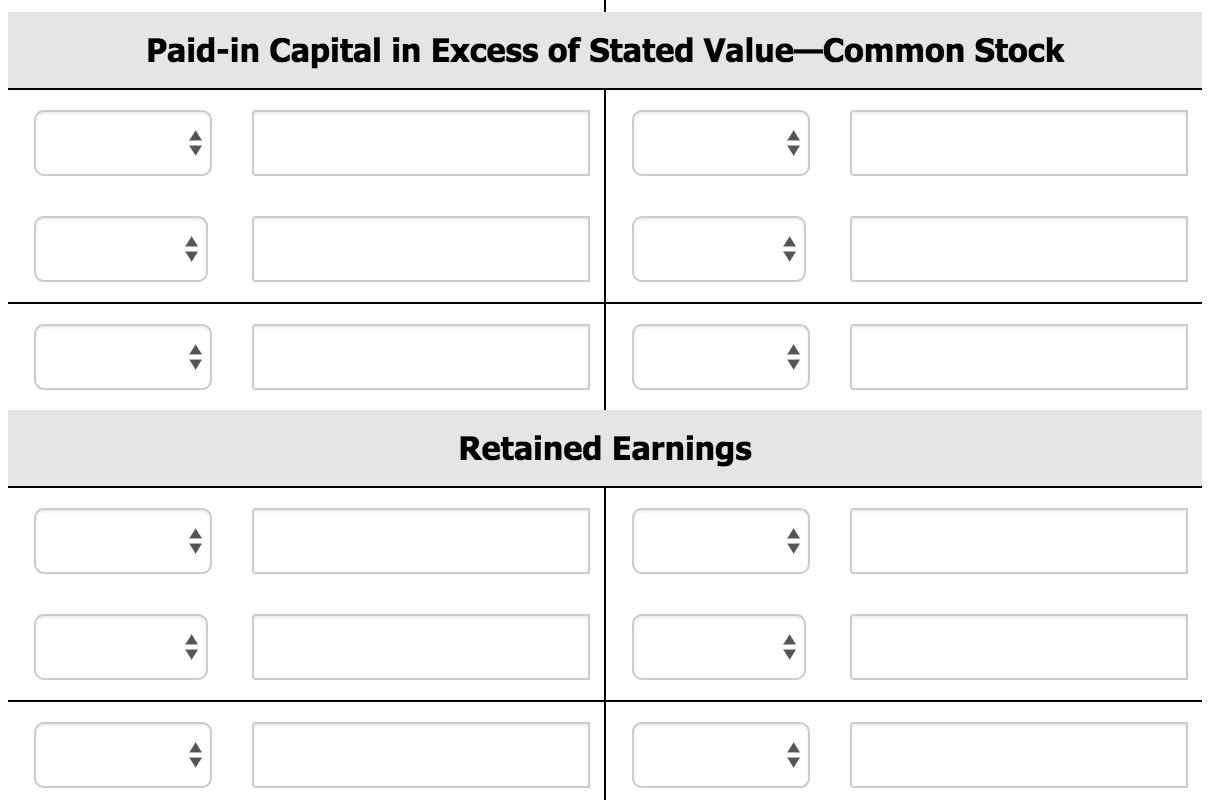

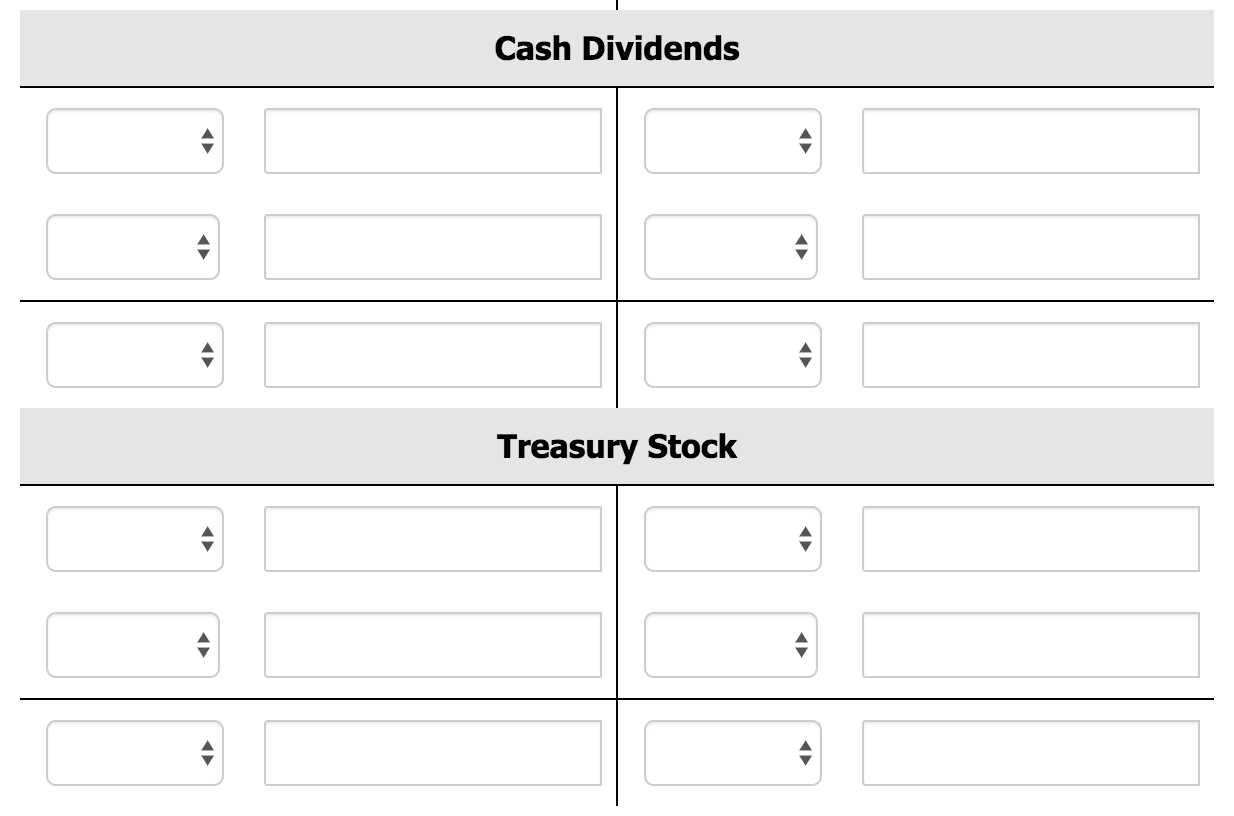

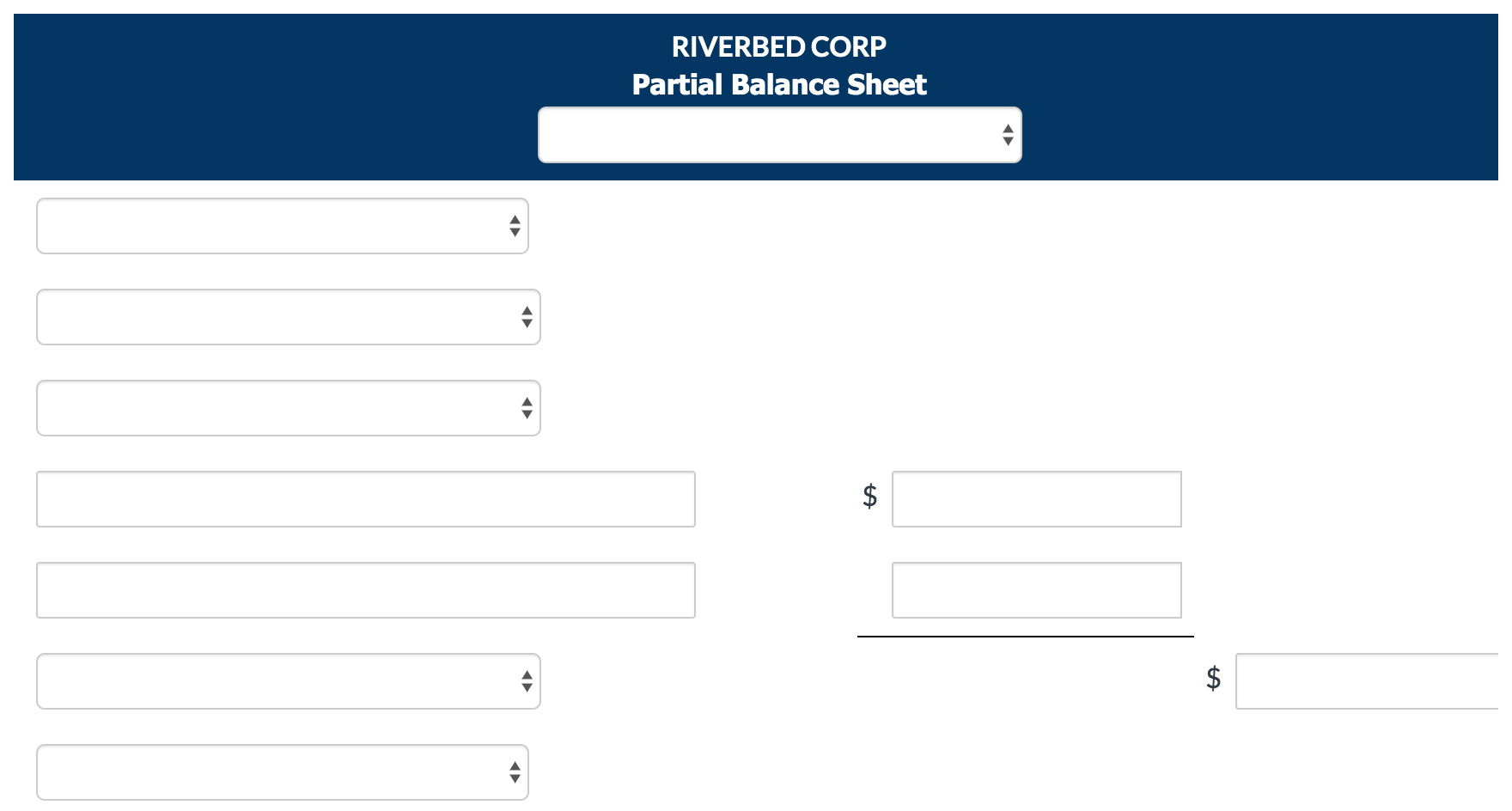

The stockholders' equity accounts of Riverbed Corp on January 1, 2017, were as follows. Preferred Stock (7%, $100 par noncumulative, 4,350 shares authorized) Common Stock ($5 stated value, 291,000 shares authorized) Paid-in Capital in Excess of Par Value-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Retained Earnings Treasury Stock (4,350 common shares) $261,000 1,212,500 13,050 465,600 710,000 34,800 During 2017, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 4,670 shares of common stock for $28,020. Mar. 20 Purchased 2,000 additional shares of common treasury stock at $8 per share. Oct. 1 Declared a 7% cash dividend on preferred stock, payable November 1. Nov. 1 Paid the dividend declared on October 1. Dec. 1 Declared a $0.70 per share cash dividend to common stockholders of record on December 15, payable December 31, 2017. Dec. 31 Determined that net income for the year was $280,400. Paid the dividend declared on December 1. Dec. 31+ Dec. 31 Retained Earnings Dividends Payable (To close cash dividends) Dividends Payable Cash (To record payment of cash dividends payable) 165305 165305 165305 165305 - Preferred Stock Common Stock 2/1 Paid-in Capital in Excess of Par Value-Preferred Stock 23350 Paid-in Capital in Excess of Stated Value-Common Stock Retained Earnings - Cash Dividends Treasury Stock - RIVERBED CORP Partial Balance Sheet $ LA Calculate the payout ratio, earnings per share, and return on common stockholders' equity. (Round earning per share to 2 decimal places, e.g. $2.66 and all other answers to 1 decimal place. 17.5%.) Payout ratio Earnings per share Return on common stockholders' equity % %

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started