Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kart Tucker and Truman Barron began a w consulting buninosn on January 1, 2018. They organired the business as a C corporation, KT, Inc.

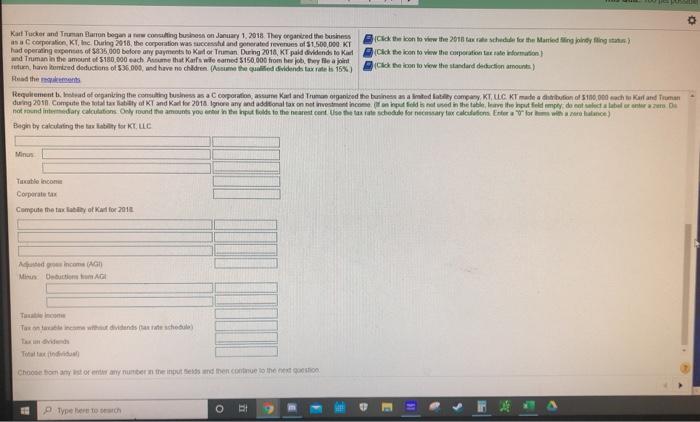

Kart Tucker and Truman Barron began a w consulting buninosn on January 1, 2018. They organired the business as a C corporation, KT, Inc. During 2018, the corporation was uccesstul and generated revenues of $1,500.000 KT had operating expenses of $836,000 before any payments to Kut or Truman. During 2010, KT paid dividends to Kart and Truman in the amount of $180,000 each Asnume that Karfs wile earmed $150.000 from her job, they fle a joint utuen, have homized deductions of $36.000, und have no children (Assme the qualiled dividends tax rates 15%) Ckk the kon to view the 2010 tax rate schedude for the Manied ing joindy fing stat) (Cikk te con to vinw the orporation tar sate informution Cick the kon to vieow the standard decuction amounts) Read the mkemerts Requitement b. otad of organiing the comting tusiness as a C coporation, assume Kart and Truman organired the bunines an a tod katty company. KT. LLC KT made a dibufion of S100, 000 ach Kart and Truman during 2010 Compute the total tax abilty of KT and Kal for 2018. Ignore any and additional tak on net investent income on input feld is not usedin the table, lenve Ihe input feld empry de not select a labal or entr a ze D not round intemedary calculations Only round he amounts you enter in th input folds to the nearest cont Use the tax rate schodde for necessary tar calculutions Enter a lor withare halance) Begin by calculating the ta abity tor KT. LLC Minus TEuble lncoe Corperate tax Compute the tax labity of Kat for 201 Aduted groe income (AG Minun Deductiom om AG Taate incone Tax on taa income withut dividends a te schedule) Tax un dvidends Total ta indvidual) Choose bom any st or entr any nunben the input teids nd then contnue lo the nest guestion Type here to search

Step by Step Solution

★★★★★

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Angwee qiven below 1 calculation of Tax Linhility OF a 1 calculation of Fax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started