Kate, aged 42, is an Australian resident taxpayer with private patient hospital health insurance. Kate does have a HELP debt of $18,500 as at

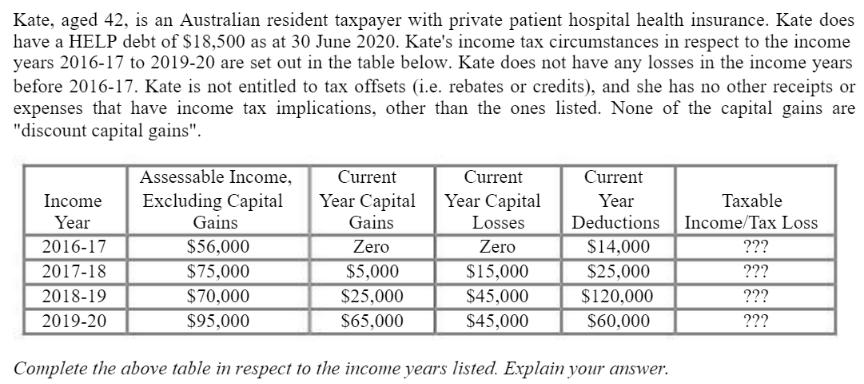

Kate, aged 42, is an Australian resident taxpayer with private patient hospital health insurance. Kate does have a HELP debt of $18,500 as at 30 June 2020. Kate's income tax circumstances in respect to the income years 2016-17 to 2019-20 are set out in the table below. Kate does not have any losses in the income years before 2016-17. Kate is not entitled to tax offsets (i.e. rebates or credits), and she has no other receipts or expenses that have income tax implications, other than the ones listed. None of the capital gains are "discount capital gains". Income Year 2016-17 2017-18 2018-19 2019-20 Assessable Income, Excluding Capital Gains $56,000 $75,000 $70,000 $95,000 Current Year Capital Gains Zero $5,000 $25,000 $65,000 Current Year Capital Losses Zero $15,000 $45,000 $45,000 Current Year Taxable Deductions Income Tax Loss $14,000 ??? $25,000 ??? $120,000 ??? $60,000 ??? Complete the above table in respect to the income years listed. Explain your answer.

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Year Assessable Income Capital Gains Capital Losses Deductions Taxable Income 201617 56000 0 0 14000 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started