Answered step by step

Verified Expert Solution

Question

1 Approved Answer

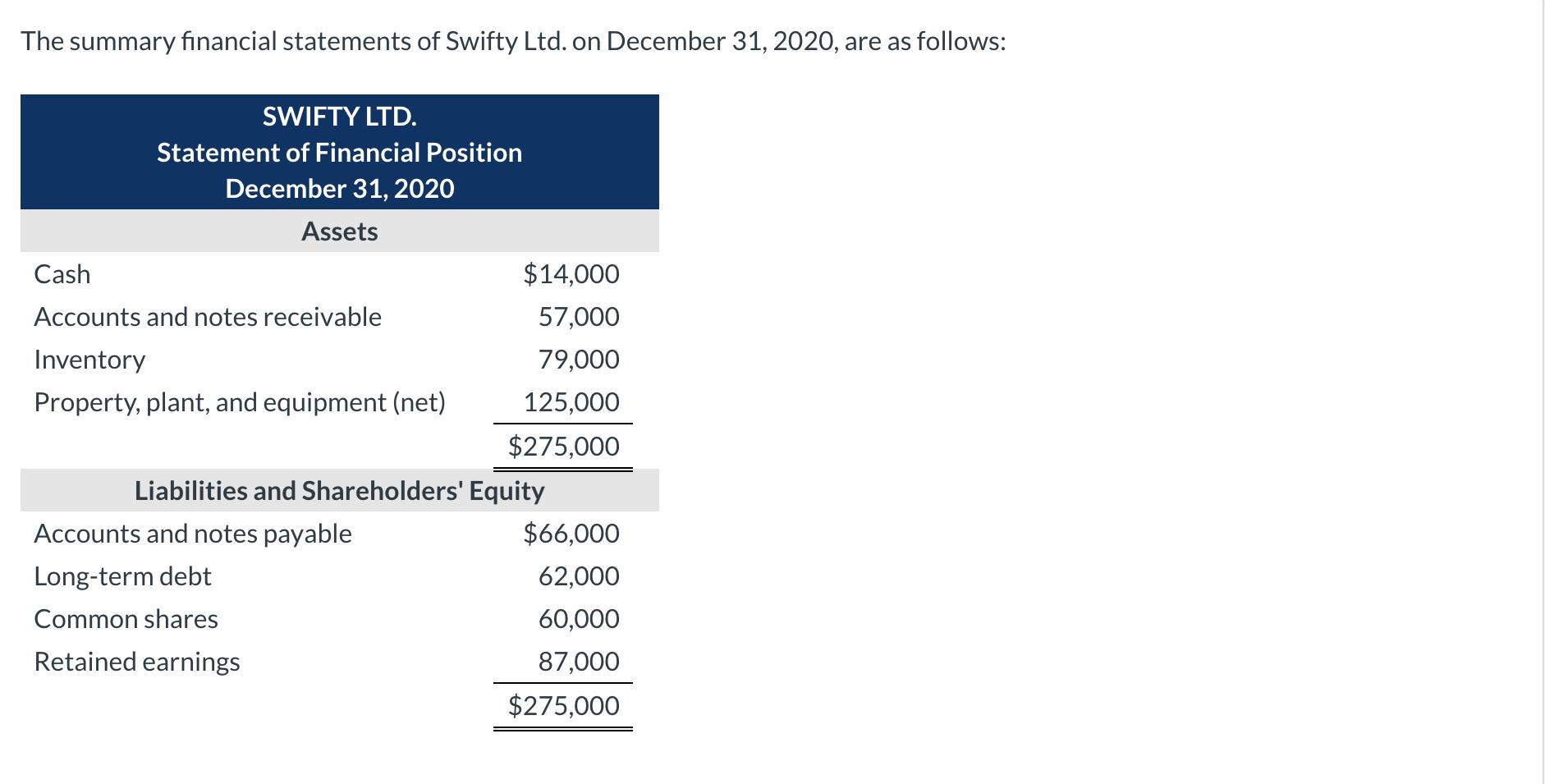

The summary financial statements of Swifty Ltd. on December 31, 2020, are as follows: SWIFTY LTD. Statement of Financial Position December 31, 2020 Assets

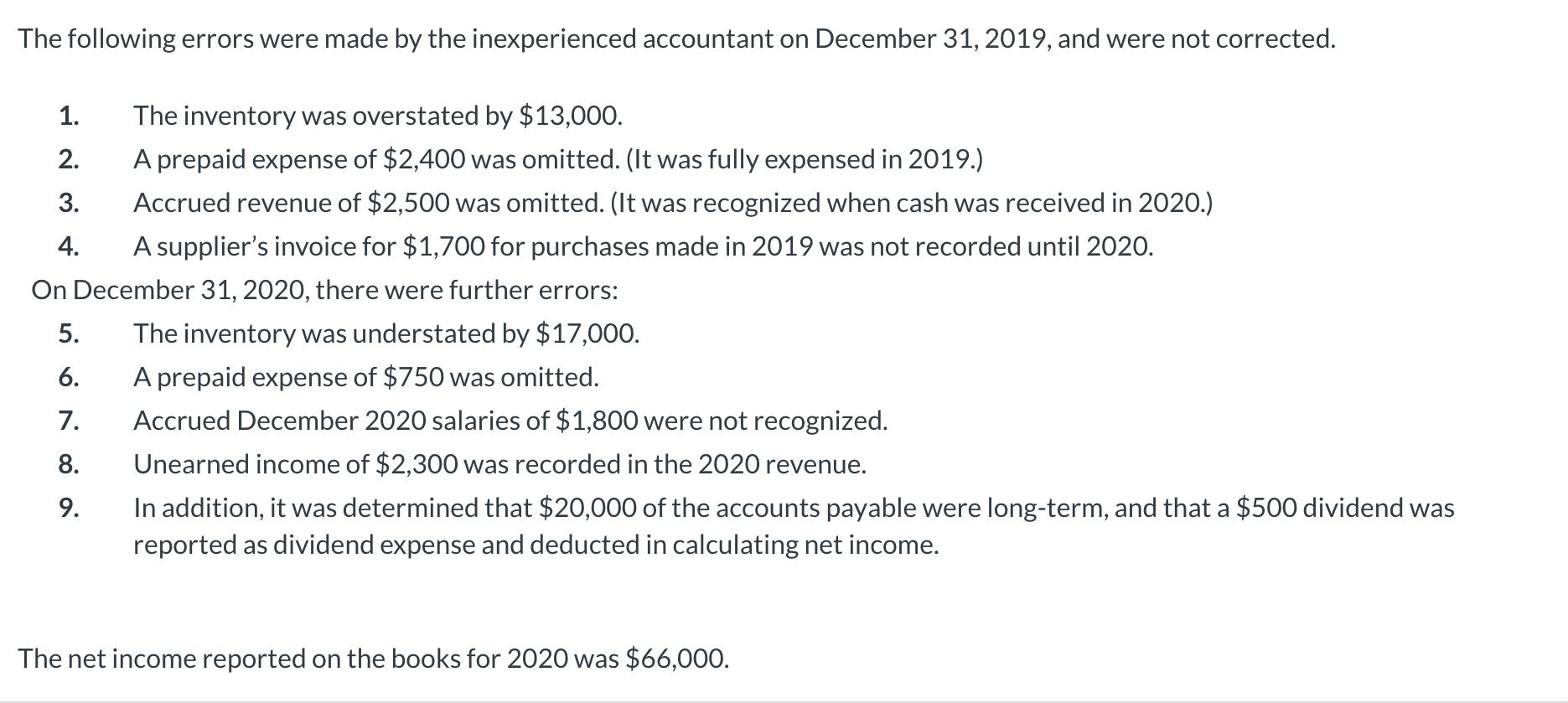

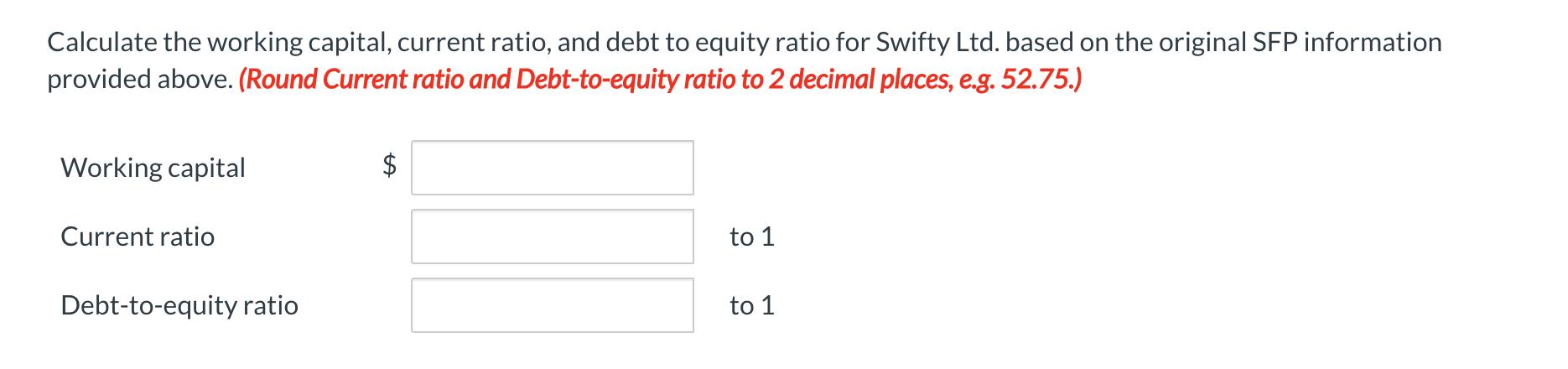

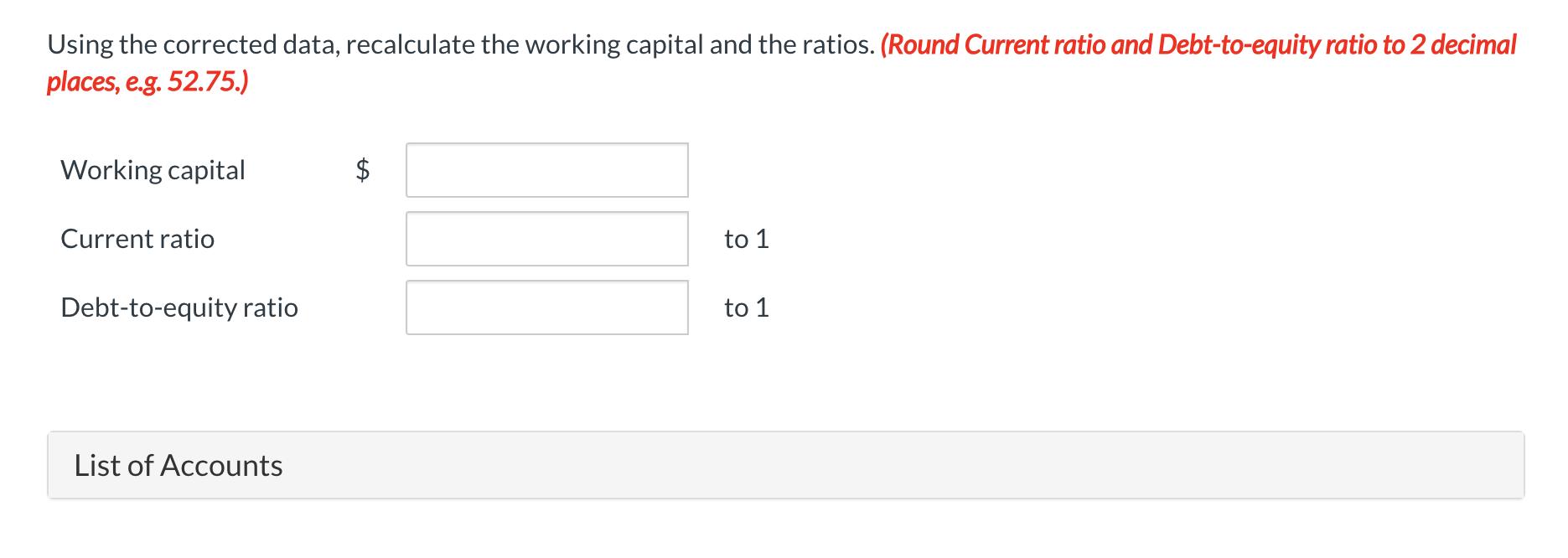

The summary financial statements of Swifty Ltd. on December 31, 2020, are as follows: SWIFTY LTD. Statement of Financial Position December 31, 2020 Assets Cash $14,000 Accounts and notes receivable 57,000 Inventory 79,000 Property, plant, and equipment (net) 125,000 $275,000 Liabilities and Shareholders' Equity Accounts and notes payable $66,000 Long-term debt 62,000 Common shares 60,000 Retained earnings 87,000 $275,000 The following errors were made by the inexperienced accountant on December 31, 2019, and were not corrected. 1. The inventory was overstated by $13,000. 2. A prepaid expense of $2,400 was omitted. (It was fully expensed in 2019.) 3. Accrued revenue of $2,500 was omitted. (It was recognized when cash was received in 2020.) 4. A supplier's invoice for $1,700 for purchases made in 2019 was not recorded until 2020. On December 31, 2020, there were further errors: 5. The inventory was understated by $17,000. 6. A prepaid expense of $750 was omitted. 7. Accrued December 2020 salaries of $1,800 were not recognized. 8. Unearned income of $2,300 was recorded in the 2020 revenue. In addition, it was determined that $20,000 of the accounts payable were long-term, and that a $500 dividend was reported as dividend expense and deducted in calculating net income. 9. The net income reported on the books for 2020 was $66,000. Calculate the working capital, current ratio, and debt to equity ratio for Swifty Ltd. based on the original SFP information provided above. (Round Current ratio and Debt-to-equity ratio to 2 decimal places, e.g. 52.75.) Working capital $ Current ratio to 1 Debt-to-equity ratio to 1 Prepare a corrected SFP at December 31, 2020. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Swifty Ltd. Statement of Financial Position Assets Unadj. Adj. Revised 2$ 2$ Total Assets 2$ $ Liabilities and Shareholders' Equity $ 2$ > > Using the corrected data, recalculate the working capital and the ratios. (Round Current ratio and Debt-to-equity ratio to 2 decimal places, e.g. 52.75.) Working capital Current ratio to 1 Debt-to-equity ratio to 1 List of Accounts %24 The summary financial statements of Swifty Ltd. on December 31, 2020, are as follows: SWIFTY LTD. Statement of Financial Position December 31, 2020 Assets Cash $14,000 Accounts and notes receivable 57,000 Inventory 79,000 Property, plant, and equipment (net) 125,000 $275,000 Liabilities and Shareholders' Equity Accounts and notes payable $66,000 Long-term debt 62,000 Common shares 60,000 Retained earnings 87,000 $275,000 The following errors were made by the inexperienced accountant on December 31, 2019, and were not corrected. 1. The inventory was overstated by $13,000. 2. A prepaid expense of $2,400 was omitted. (It was fully expensed in 2019.) 3. Accrued revenue of $2,500 was omitted. (It was recognized when cash was received in 2020.) 4. A supplier's invoice for $1,700 for purchases made in 2019 was not recorded until 2020. On December 31, 2020, there were further errors: 5. The inventory was understated by $17,000. 6. A prepaid expense of $750 was omitted. 7. Accrued December 2020 salaries of $1,800 were not recognized. 8. Unearned income of $2,300 was recorded in the 2020 revenue. In addition, it was determined that $20,000 of the accounts payable were long-term, and that a $500 dividend was reported as dividend expense and deducted in calculating net income. 9. The net income reported on the books for 2020 was $66,000. Calculate the working capital, current ratio, and debt to equity ratio for Swifty Ltd. based on the original SFP information provided above. (Round Current ratio and Debt-to-equity ratio to 2 decimal places, e.g. 52.75.) Working capital $ Current ratio to 1 Debt-to-equity ratio to 1 Prepare a corrected SFP at December 31, 2020. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Swifty Ltd. Statement of Financial Position Assets Unadj. Adj. Revised 2$ 2$ Total Assets 2$ $ Liabilities and Shareholders' Equity $ 2$ > > Using the corrected data, recalculate the working capital and the ratios. (Round Current ratio and Debt-to-equity ratio to 2 decimal places, e.g. 52.75.) Working capital Current ratio to 1 Debt-to-equity ratio to 1 List of Accounts %24 The summary financial statements of Swifty Ltd. on December 31, 2020, are as follows: SWIFTY LTD. Statement of Financial Position December 31, 2020 Assets Cash $14,000 Accounts and notes receivable 57,000 Inventory 79,000 Property, plant, and equipment (net) 125,000 $275,000 Liabilities and Shareholders' Equity Accounts and notes payable $66,000 Long-term debt 62,000 Common shares 60,000 Retained earnings 87,000 $275,000 The following errors were made by the inexperienced accountant on December 31, 2019, and were not corrected. 1. The inventory was overstated by $13,000. 2. A prepaid expense of $2,400 was omitted. (It was fully expensed in 2019.) 3. Accrued revenue of $2,500 was omitted. (It was recognized when cash was received in 2020.) 4. A supplier's invoice for $1,700 for purchases made in 2019 was not recorded until 2020. On December 31, 2020, there were further errors: 5. The inventory was understated by $17,000. 6. A prepaid expense of $750 was omitted. 7. Accrued December 2020 salaries of $1,800 were not recognized. 8. Unearned income of $2,300 was recorded in the 2020 revenue. In addition, it was determined that $20,000 of the accounts payable were long-term, and that a $500 dividend was reported as dividend expense and deducted in calculating net income. 9. The net income reported on the books for 2020 was $66,000. Calculate the working capital, current ratio, and debt to equity ratio for Swifty Ltd. based on the original SFP information provided above. (Round Current ratio and Debt-to-equity ratio to 2 decimal places, e.g. 52.75.) Working capital $ Current ratio to 1 Debt-to-equity ratio to 1 Prepare a corrected SFP at December 31, 2020. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Swifty Ltd. Statement of Financial Position Assets Unadj. Adj. Revised 2$ 2$ Total Assets 2$ $ Liabilities and Shareholders' Equity $ 2$ > > Using the corrected data, recalculate the working capital and the ratios. (Round Current ratio and Debt-to-equity ratio to 2 decimal places, e.g. 52.75.) Working capital Current ratio to 1 Debt-to-equity ratio to 1 List of Accounts %24

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Based on Original Data Working Capital Current assestCurrent Liabilities 84...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started