Answered step by step

Verified Expert Solution

Question

1 Approved Answer

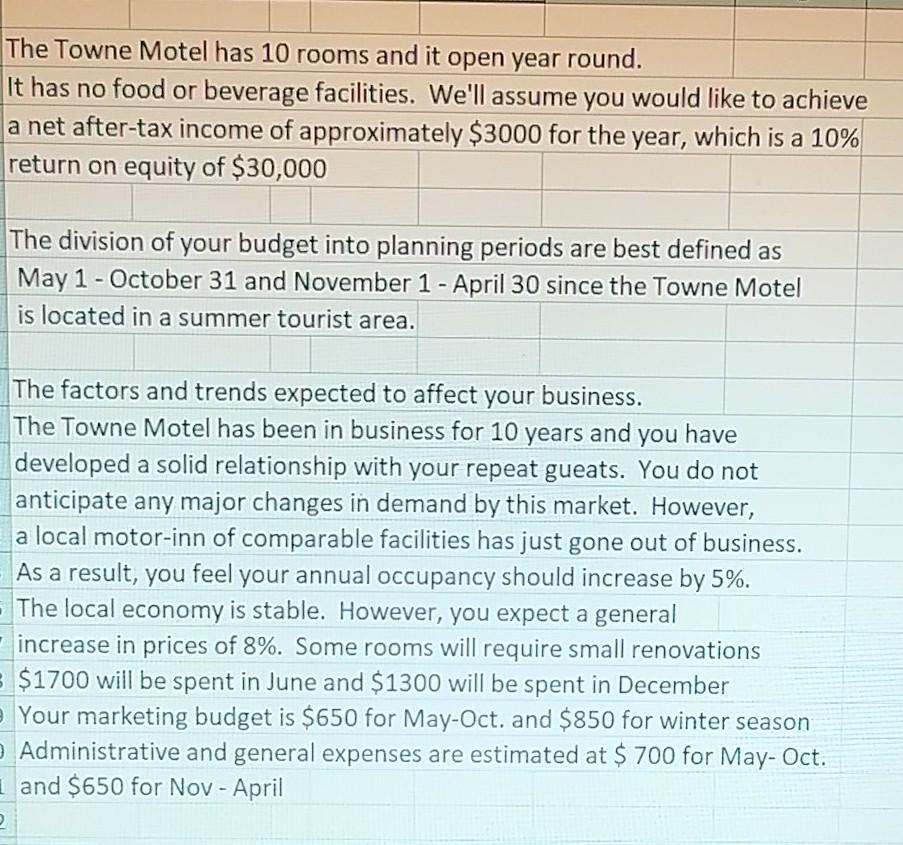

The Towne Motel has 10 rooms and it open year round. It has no food or beverage facilities. We'll assume you would like to

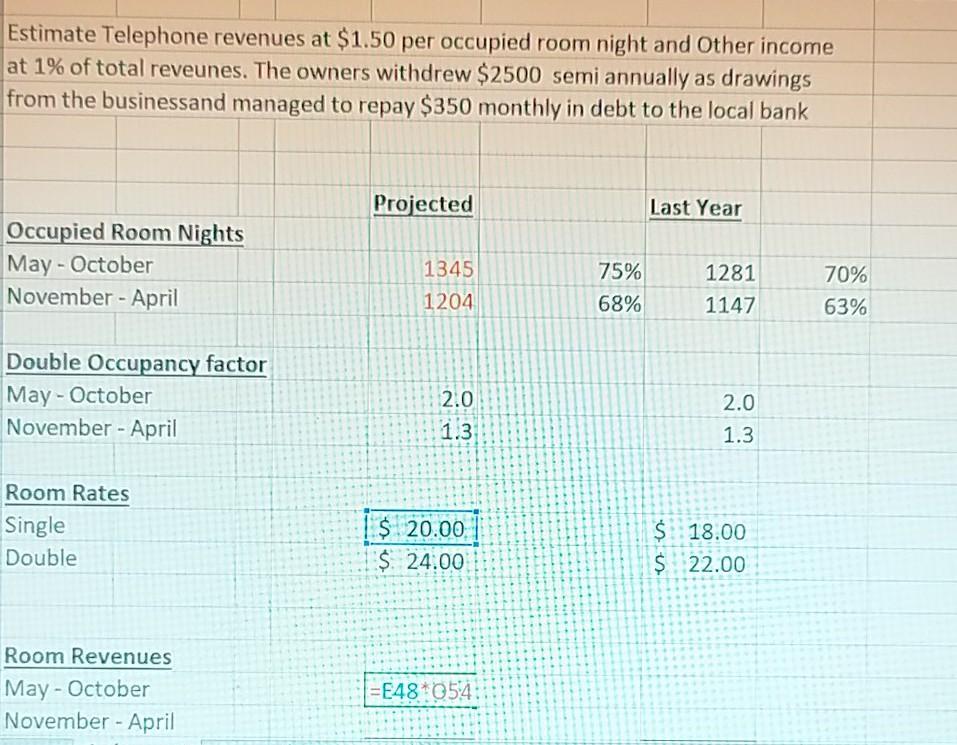

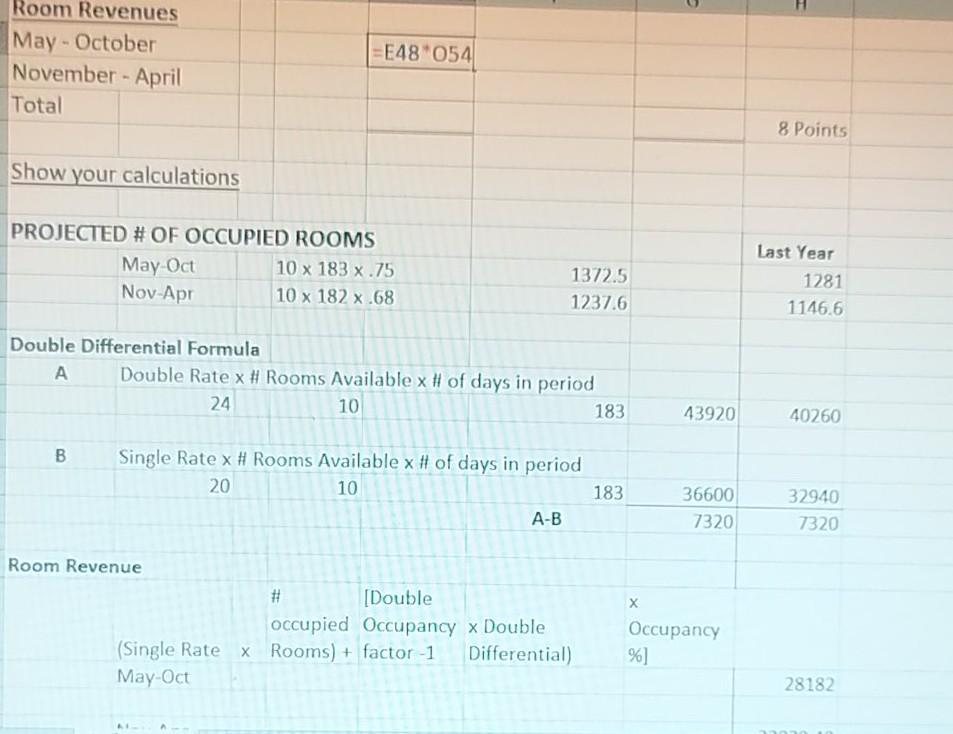

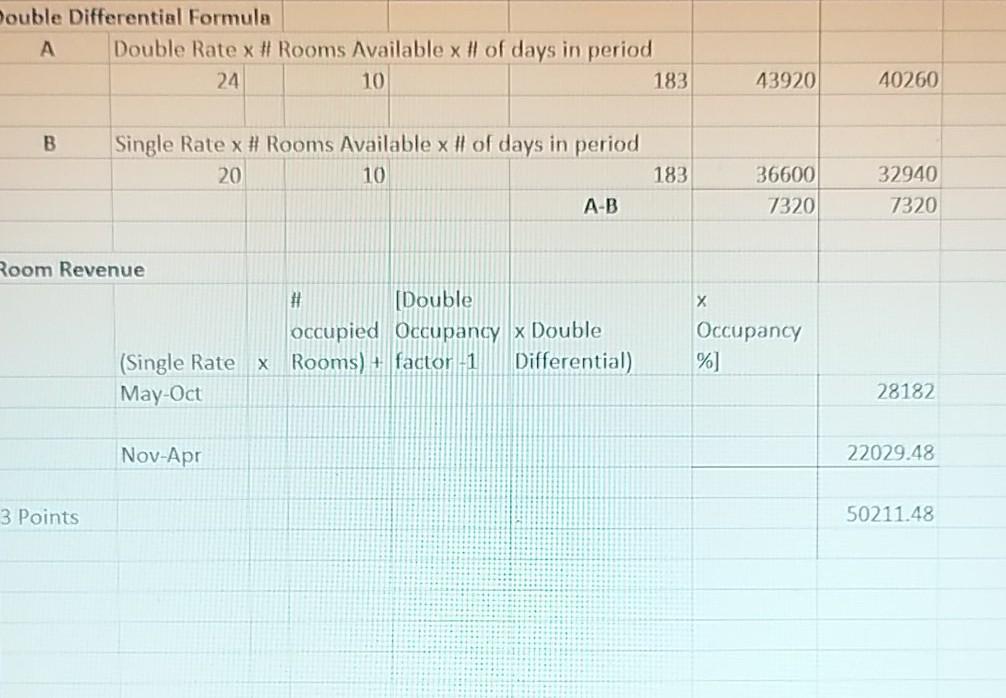

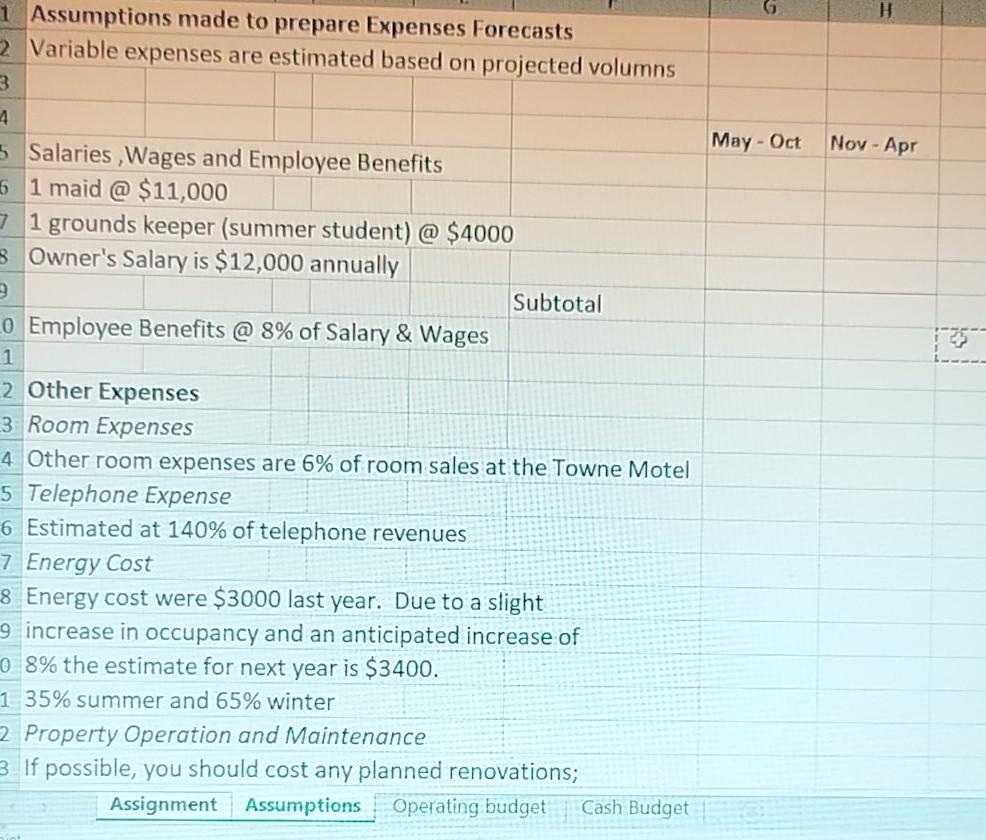

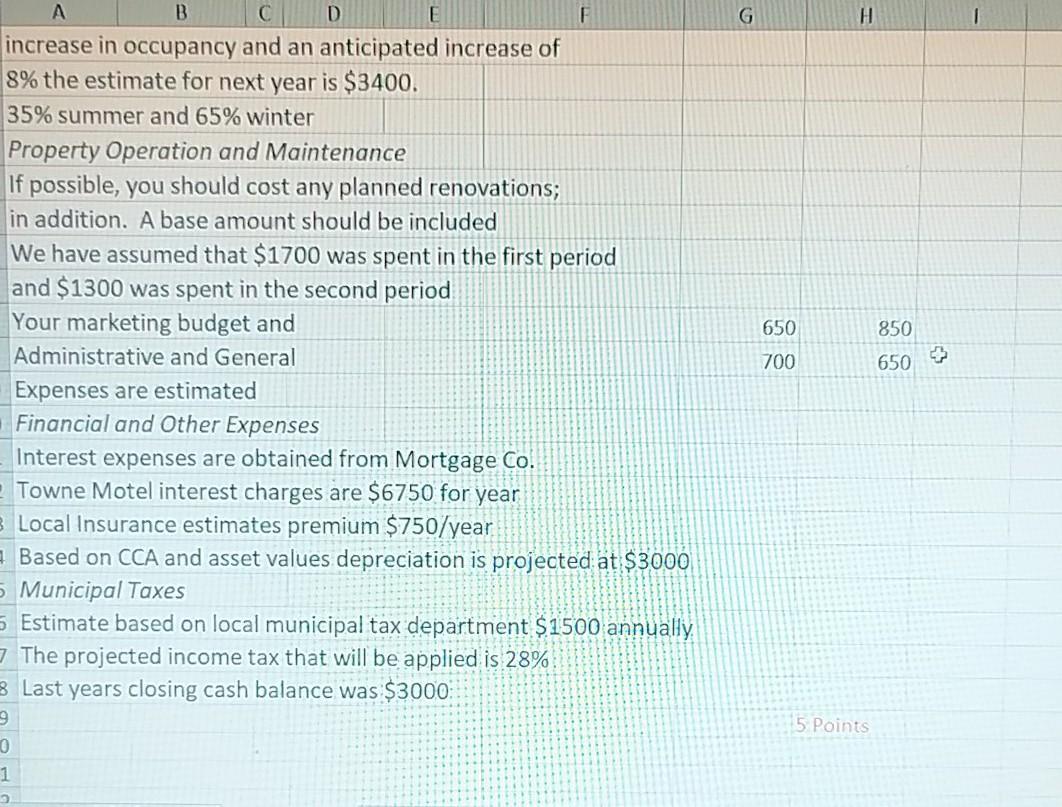

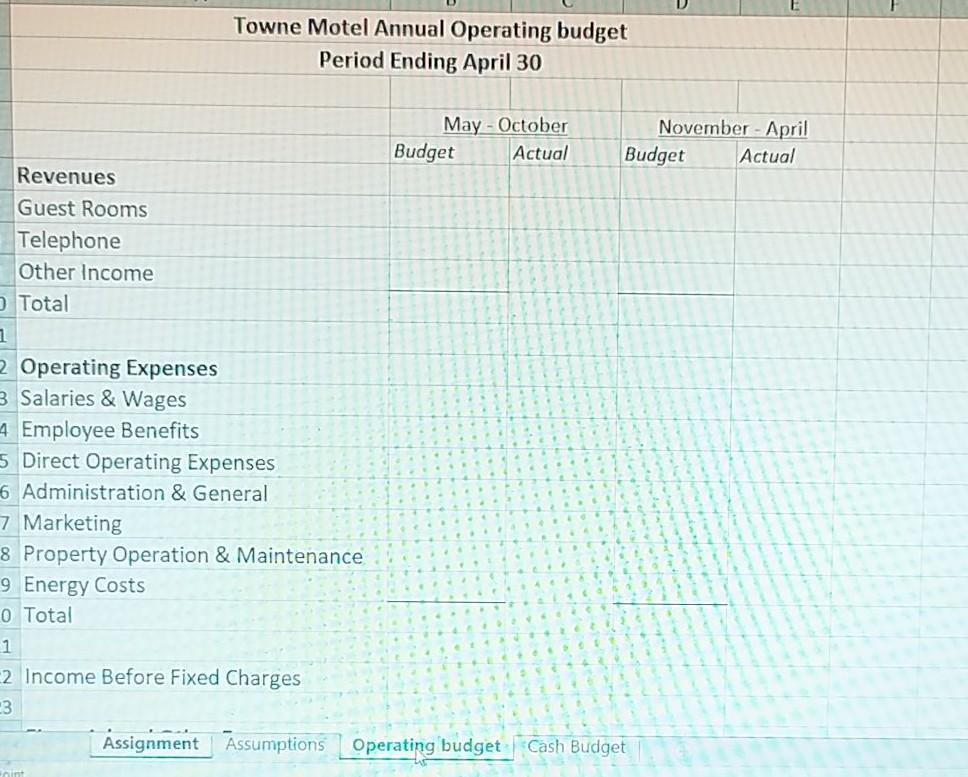

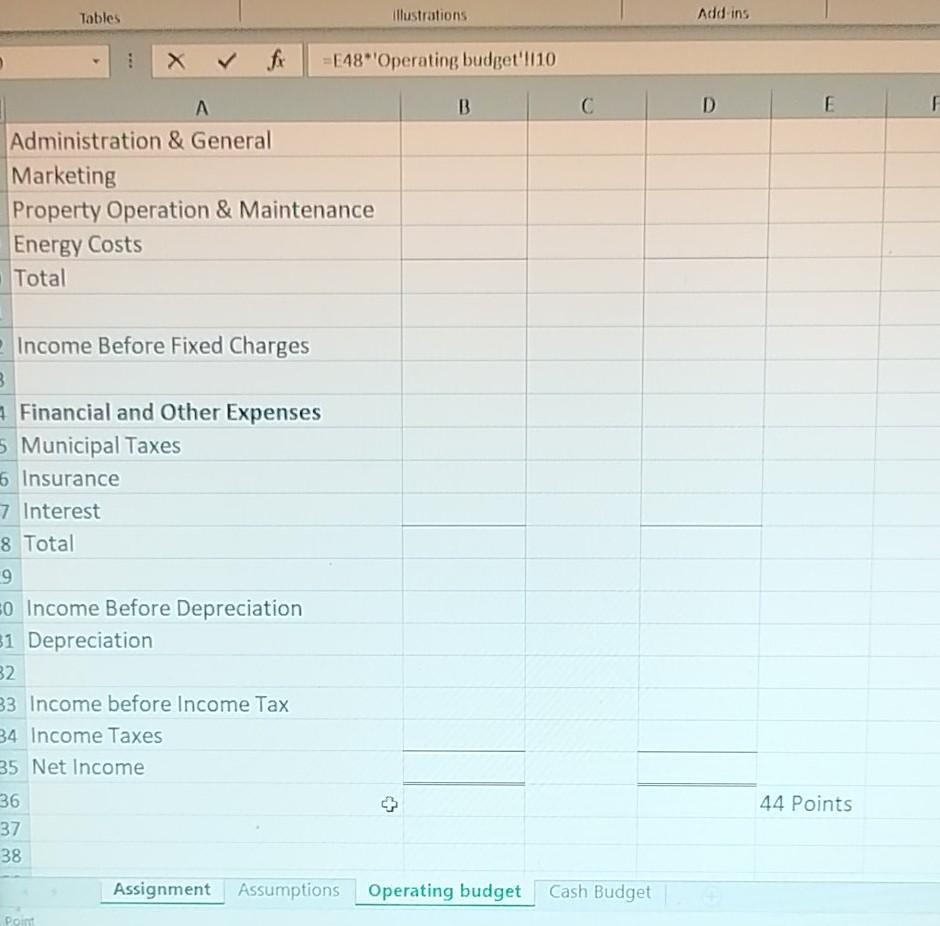

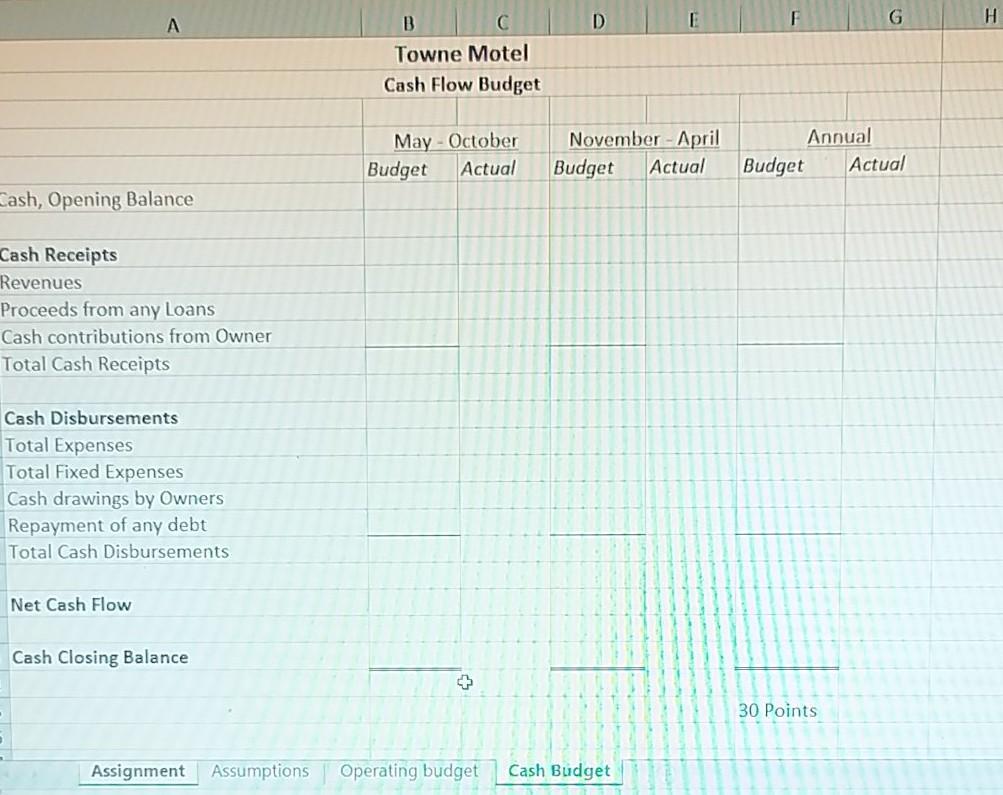

The Towne Motel has 10 rooms and it open year round. It has no food or beverage facilities. We'll assume you would like to achieve a net after-tax income of approximately $3000 for the year, which is a 10% return on equity of $30,000 The division of your budget into planning periods are best defined as May 1 - October 31 and November 1 - April 30 since the Towne Motel is located in a summer tourist area. The factors and trends expected to affect your business. The Towne Motel has been in business for 10 years and you have developed a solid relationship with your repeat gueats. You do not anticipate any major changes in demand by this market. However, a local motor-inn of comparable facilities has just gone out of business. As a result, you feel your annual occupancy should increase by 5%. The local economy is stable. However, you expect a general increase in prices of 8%. Some rooms will require small renovations $1700 will be spent in June and $1300 will be spent in December Your marketing budget is $650 for May-Oct. and $850 for winter season O Administrative and general expenses are estimated at $ 700 for May- Oct. and $650 for Nov - April 2 Estimate Telephone revenues at $1.50 per occupied room night and Other income at 1% of total reveunes. The owners withdrew $2500 semi annually as drawings from the businessand managed to repay $350 monthly in debt to the local bank Occupied Room Nights May - October November - April Double Occupancy factor May-October November - April Room Rates Single Double Room Revenues May - October November - April Projected 1345 1204 2.0 1.3 $20.00 $. 24.00 =E48 054 75% 68% Last Year 1281 1147 2.0 1.3 $18.00 $ 22.00 70% 63% Room Revenues May-October November - April Total Show your calculations PROJECTED # OF OCCUPIED ROOMS 10 x 183 x.75 10 x 182 x .68 May-Oct Nov-Apr B E48 054 Double Differential Formula A Double Rate x # Rooms Available x # of days in period 24 10 Room Revenue Single Rate x # Rooms Available x # of days in period 20 10 # 1372.5 1237.6 A-B [Double occupied Occupancy x Double (Single Rate x Rooms) + factor-1 Differential) May-Oct 183 183 X 43920 36600 7320 Occupancy %] 8 Points Last Year 1281 1146.6 40260 32940 7320 28182 13070 10 Double Differential Formula A Double Rate x # Rooms Available x # of days in period 24 10 B Single Rate x # Rooms Available x # of days in period 20 10 Room Revenue 3 Points # Nov-Apr A-B [Double occupied Occupancy x Double (Single Rate X Rooms) + factor -1 Differential) May-Oct 183 183 X 43920 36600 7320 Occupancy %] 40260 32940 7320 28182 22029.48 50211.48 1 Assumptions made to prepare Expenses Forecasts 2 Variable expenses are estimated based on projected volumns 3 4 5 Salaries, Wages and Employee Benefits 51 maid @ $11,000 71 grounds keeper (summer student) @ $4000 Owner's Salary is $12,000 annually 9 0 Employee Benefits @ 8% of Salary & Wages 1 2 Other Expenses 3 Room Expenses 4 Other room expenses are 6% of room sales at the Towne Motel 5 Telephone Expense 6 Estimated at 140% of telephone revenues Subtotal 7 Energy Cost 8 Energy cost were $3000 last year. Due to a slight 9 increase in occupancy and an anticipated increase of 0 8% the estimate for next year is $3400. 1 35% summer and 65% winter 2 Property Operation and Maintenance 3 If possible, you should cost any planned renovations; Assignment Assumptions Operating budget Cash Budget G May-Oct Nov - Apr A B F increase in occupancy and an anticipated increase of 8% the estimate for next year is $3400. 35% summer and 65% winter D Property Operation and Maintenance If possible, you should cost any planned renovations; in addition. A base amount should be included We have assumed that $1700 was spent in the first period and $1300 was spent in the second period Your marketing budget and Administrative and General Expenses are estimated Financial and Other Expenses Interest expenses are obtained from Mortgage Co. Towne Motel interest charges are $6750 for year 3 Local Insurance estimates premium $750/year Based on CCA and asset values depreciation is projected at $3000 5 Municipal Taxes 5 Estimate based on local municipal tax department $1500 annually The projected income tax that will be applied is 28% 8 Last years closing cash balance was $3000 9 0 1 2 650 700 H 5 Points 850 650 Revenues Guest Rooms Telephone Other Income Total 1 2 Operating Expenses 3 Salaries & Wages Towne Motel Annual Operating budget Period Ending April 30 4 Employee Benefits 5 Direct Operating Expenses 6 Administration & General 7 Marketing 8 Property Operation & Maintenance 9 Energy Costs 0 Total 1 2 Income Before Fixed Charges 3 May - October Actual Budget November-April Actual Budget Assignment Assumptions Operating budget Cash Budget ) B Tables A Administration & General Marketing Property Operation & Maintenance Energy Costs Total Income Before Fixed Charges 1 X Financial and Other Expenses 5 Municipal Taxes 6 Insurance 7 Interest 8 Total 36 37 38 9 0 Income Before Depreciation 31 Depreciation 32 33 Income before Income Tax 34 Income Taxes 35 Net Income Point illustrations E48 'Operating budget'!110 + B Assignment Assumptions Operating budget C Cash Budget Add-ins D 44 Points F A Cash, Opening Balance Cash Receipts Revenues Proceeds from any Loans Cash contributions from Owner Total Cash Receipts Cash Disbursements Total Expenses Total Fixed Expenses Cash drawings by Owners Repayment of any debt Total Cash Disbursements Net Cash Flow Cash Closing Balance. Assignment B Towne Motel Cash Flow Budget May-October Budget Actual D November-April Budget Actual Assumptions Operating budget Cash Budget F Annual Budget Actual 30 Points H The Towne Motel has 10 rooms and it open year round. It has no food or beverage facilities. We'll assume you would like to achieve a net after-tax income of approximately $3000 for the year, which is a 10% return on equity of $30,000 The division of your budget into planning periods are best defined as May 1 - October 31 and November 1 - April 30 since the Towne Motel is located in a summer tourist area. The factors and trends expected to affect your business. The Towne Motel has been in business for 10 years and you have developed a solid relationship with your repeat gueats. You do not anticipate any major changes in demand by this market. However, a local motor-inn of comparable facilities has just gone out of business. As a result, you feel your annual occupancy should increase by 5%. The local economy is stable. However, you expect a general increase in prices of 8%. Some rooms will require small renovations $1700 will be spent in June and $1300 will be spent in December Your marketing budget is $650 for May-Oct. and $850 for winter season O Administrative and general expenses are estimated at $ 700 for May- Oct. and $650 for Nov - April 2 Estimate Telephone revenues at $1.50 per occupied room night and Other income at 1% of total reveunes. The owners withdrew $2500 semi annually as drawings from the businessand managed to repay $350 monthly in debt to the local bank Occupied Room Nights May - October November - April Double Occupancy factor May-October November - April Room Rates Single Double Room Revenues May - October November - April Projected 1345 1204 2.0 1.3 $20.00 $. 24.00 =E48 054 75% 68% Last Year 1281 1147 2.0 1.3 $18.00 $ 22.00 70% 63% Room Revenues May-October November - April Total Show your calculations PROJECTED # OF OCCUPIED ROOMS 10 x 183 x.75 10 x 182 x .68 May-Oct Nov-Apr B E48 054 Double Differential Formula A Double Rate x # Rooms Available x # of days in period 24 10 Room Revenue Single Rate x # Rooms Available x # of days in period 20 10 # 1372.5 1237.6 A-B [Double occupied Occupancy x Double (Single Rate x Rooms) + factor-1 Differential) May-Oct 183 183 X 43920 36600 7320 Occupancy %] 8 Points Last Year 1281 1146.6 40260 32940 7320 28182 13070 10 Double Differential Formula A Double Rate x # Rooms Available x # of days in period 24 10 B Single Rate x # Rooms Available x # of days in period 20 10 Room Revenue 3 Points # Nov-Apr A-B [Double occupied Occupancy x Double (Single Rate X Rooms) + factor -1 Differential) May-Oct 183 183 X 43920 36600 7320 Occupancy %] 40260 32940 7320 28182 22029.48 50211.48 1 Assumptions made to prepare Expenses Forecasts 2 Variable expenses are estimated based on projected volumns 3 4 5 Salaries, Wages and Employee Benefits 51 maid @ $11,000 71 grounds keeper (summer student) @ $4000 Owner's Salary is $12,000 annually 9 0 Employee Benefits @ 8% of Salary & Wages 1 2 Other Expenses 3 Room Expenses 4 Other room expenses are 6% of room sales at the Towne Motel 5 Telephone Expense 6 Estimated at 140% of telephone revenues Subtotal 7 Energy Cost 8 Energy cost were $3000 last year. Due to a slight 9 increase in occupancy and an anticipated increase of 0 8% the estimate for next year is $3400. 1 35% summer and 65% winter 2 Property Operation and Maintenance 3 If possible, you should cost any planned renovations; Assignment Assumptions Operating budget Cash Budget G May-Oct Nov - Apr A B F increase in occupancy and an anticipated increase of 8% the estimate for next year is $3400. 35% summer and 65% winter D Property Operation and Maintenance If possible, you should cost any planned renovations; in addition. A base amount should be included We have assumed that $1700 was spent in the first period and $1300 was spent in the second period Your marketing budget and Administrative and General Expenses are estimated Financial and Other Expenses Interest expenses are obtained from Mortgage Co. Towne Motel interest charges are $6750 for year 3 Local Insurance estimates premium $750/year Based on CCA and asset values depreciation is projected at $3000 5 Municipal Taxes 5 Estimate based on local municipal tax department $1500 annually The projected income tax that will be applied is 28% 8 Last years closing cash balance was $3000 9 0 1 2 650 700 H 5 Points 850 650 Revenues Guest Rooms Telephone Other Income Total 1 2 Operating Expenses 3 Salaries & Wages Towne Motel Annual Operating budget Period Ending April 30 4 Employee Benefits 5 Direct Operating Expenses 6 Administration & General 7 Marketing 8 Property Operation & Maintenance 9 Energy Costs 0 Total 1 2 Income Before Fixed Charges 3 May - October Actual Budget November-April Actual Budget Assignment Assumptions Operating budget Cash Budget ) B Tables A Administration & General Marketing Property Operation & Maintenance Energy Costs Total Income Before Fixed Charges 1 X Financial and Other Expenses 5 Municipal Taxes 6 Insurance 7 Interest 8 Total 36 37 38 9 0 Income Before Depreciation 31 Depreciation 32 33 Income before Income Tax 34 Income Taxes 35 Net Income Point illustrations E48 'Operating budget'!110 + B Assignment Assumptions Operating budget C Cash Budget Add-ins D 44 Points F A Cash, Opening Balance Cash Receipts Revenues Proceeds from any Loans Cash contributions from Owner Total Cash Receipts Cash Disbursements Total Expenses Total Fixed Expenses Cash drawings by Owners Repayment of any debt Total Cash Disbursements Net Cash Flow Cash Closing Balance. Assignment B Towne Motel Cash Flow Budget May-October Budget Actual D November-April Budget Actual Assumptions Operating budget Cash Budget F Annual Budget Actual 30 Points H The Towne Motel has 10 rooms and it open year round. It has no food or beverage facilities. We'll assume you would like to achieve a net after-tax income of approximately $3000 for the year, which is a 10% return on equity of $30,000 The division of your budget into planning periods are best defined as May 1 - October 31 and November 1 - April 30 since the Towne Motel is located in a summer tourist area. The factors and trends expected to affect your business. The Towne Motel has been in business for 10 years and you have developed a solid relationship with your repeat gueats. You do not anticipate any major changes in demand by this market. However, a local motor-inn of comparable facilities has just gone out of business. As a result, you feel your annual occupancy should increase by 5%. The local economy is stable. However, you expect a general increase in prices of 8%. Some rooms will require small renovations $1700 will be spent in June and $1300 will be spent in December Your marketing budget is $650 for May-Oct. and $850 for winter season O Administrative and general expenses are estimated at $ 700 for May- Oct. and $650 for Nov - April 2 Estimate Telephone revenues at $1.50 per occupied room night and Other income at 1% of total reveunes. The owners withdrew $2500 semi annually as drawings from the businessand managed to repay $350 monthly in debt to the local bank Occupied Room Nights May - October November - April Double Occupancy factor May-October November - April Room Rates Single Double Room Revenues May - October November - April Projected 1345 1204 2.0 1.3 $20.00 $. 24.00 =E48 054 75% 68% Last Year 1281 1147 2.0 1.3 $18.00 $ 22.00 70% 63% Room Revenues May-October November - April Total Show your calculations PROJECTED # OF OCCUPIED ROOMS 10 x 183 x.75 10 x 182 x .68 May-Oct Nov-Apr B E48 054 Double Differential Formula A Double Rate x # Rooms Available x # of days in period 24 10 Room Revenue Single Rate x # Rooms Available x # of days in period 20 10 # 1372.5 1237.6 A-B [Double occupied Occupancy x Double (Single Rate x Rooms) + factor-1 Differential) May-Oct 183 183 X 43920 36600 7320 Occupancy %] 8 Points Last Year 1281 1146.6 40260 32940 7320 28182 13070 10 Double Differential Formula A Double Rate x # Rooms Available x # of days in period 24 10 B Single Rate x # Rooms Available x # of days in period 20 10 Room Revenue 3 Points # Nov-Apr A-B [Double occupied Occupancy x Double (Single Rate X Rooms) + factor -1 Differential) May-Oct 183 183 X 43920 36600 7320 Occupancy %] 40260 32940 7320 28182 22029.48 50211.48 1 Assumptions made to prepare Expenses Forecasts 2 Variable expenses are estimated based on projected volumns 3 4 5 Salaries, Wages and Employee Benefits 51 maid @ $11,000 71 grounds keeper (summer student) @ $4000 Owner's Salary is $12,000 annually 9 0 Employee Benefits @ 8% of Salary & Wages 1 2 Other Expenses 3 Room Expenses 4 Other room expenses are 6% of room sales at the Towne Motel 5 Telephone Expense 6 Estimated at 140% of telephone revenues Subtotal 7 Energy Cost 8 Energy cost were $3000 last year. Due to a slight 9 increase in occupancy and an anticipated increase of 0 8% the estimate for next year is $3400. 1 35% summer and 65% winter 2 Property Operation and Maintenance 3 If possible, you should cost any planned renovations; Assignment Assumptions Operating budget Cash Budget G May-Oct Nov - Apr A B F increase in occupancy and an anticipated increase of 8% the estimate for next year is $3400. 35% summer and 65% winter D Property Operation and Maintenance If possible, you should cost any planned renovations; in addition. A base amount should be included We have assumed that $1700 was spent in the first period and $1300 was spent in the second period Your marketing budget and Administrative and General Expenses are estimated Financial and Other Expenses Interest expenses are obtained from Mortgage Co. Towne Motel interest charges are $6750 for year 3 Local Insurance estimates premium $750/year Based on CCA and asset values depreciation is projected at $3000 5 Municipal Taxes 5 Estimate based on local municipal tax department $1500 annually The projected income tax that will be applied is 28% 8 Last years closing cash balance was $3000 9 0 1 2 650 700 H 5 Points 850 650 Revenues Guest Rooms Telephone Other Income Total 1 2 Operating Expenses 3 Salaries & Wages Towne Motel Annual Operating budget Period Ending April 30 4 Employee Benefits 5 Direct Operating Expenses 6 Administration & General 7 Marketing 8 Property Operation & Maintenance 9 Energy Costs 0 Total 1 2 Income Before Fixed Charges 3 May - October Actual Budget November-April Actual Budget Assignment Assumptions Operating budget Cash Budget ) B Tables A Administration & General Marketing Property Operation & Maintenance Energy Costs Total Income Before Fixed Charges 1 X Financial and Other Expenses 5 Municipal Taxes 6 Insurance 7 Interest 8 Total 36 37 38 9 0 Income Before Depreciation 31 Depreciation 32 33 Income before Income Tax 34 Income Taxes 35 Net Income Point illustrations E48 'Operating budget'!110 + B Assignment Assumptions Operating budget C Cash Budget Add-ins D 44 Points F A Cash, Opening Balance Cash Receipts Revenues Proceeds from any Loans Cash contributions from Owner Total Cash Receipts Cash Disbursements Total Expenses Total Fixed Expenses Cash drawings by Owners Repayment of any debt Total Cash Disbursements Net Cash Flow Cash Closing Balance. Assignment B Towne Motel Cash Flow Budget May-October Budget Actual D November-April Budget Actual Assumptions Operating budget Cash Budget F Annual Budget Actual 30 Points H

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Hello Student I ho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started