Answered step by step

Verified Expert Solution

Question

1 Approved Answer

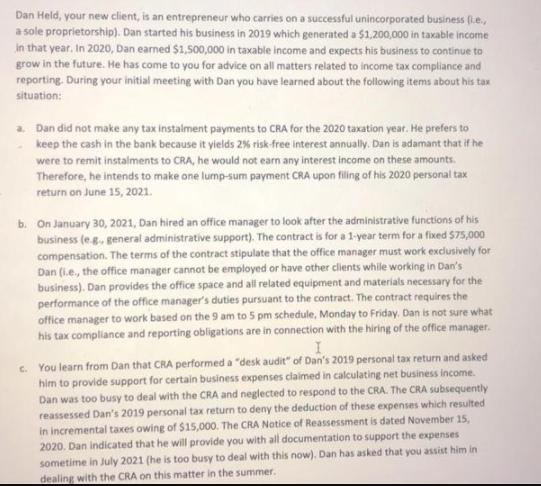

Dan Held, your new client, is an entrepreneur who carries on a successful unincorporated business (le., a sole proprietorship). Dan started his business in

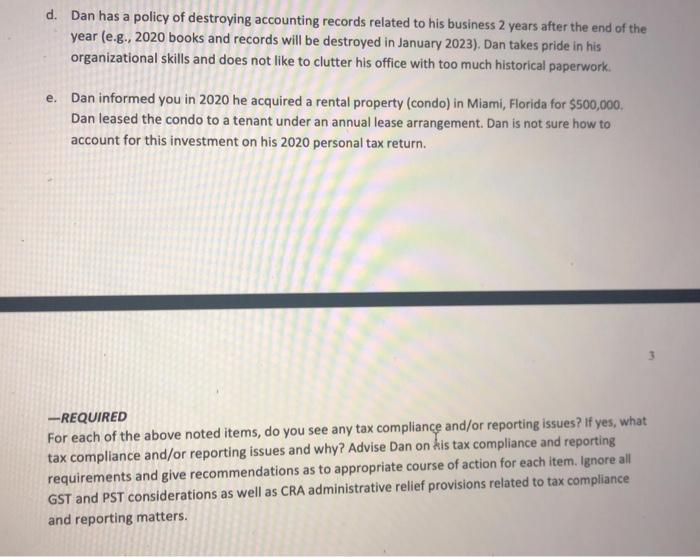

Dan Held, your new client, is an entrepreneur who carries on a successful unincorporated business (le., a sole proprietorship). Dan started his business in 2019 which generated a $1,200,000 in taxable income in that year, In 2020, Dan earned $1,500,000 in taxable income and expects his business to continue to grow in the future. He has come to you for advice on all matters related to income tax compliance and reporting. During your initial meeting with Dan you have learned about the following items about his tax situation: 2. Dan did not make any tax instalment payments to CRA for the 2020 taxation year. He prefers to keep the cash in the bank because it yields 2% risk-free interest annually. Dan is adamant that if he were to remit instalments to CRA, he would not earn any interest income on these amounts. Therefore, he intends to make one lump-sum payment CRA upon filing of his 2020 personal tax return on June 15, 2021. b. On January 30, 2021, Dan hired an office manager to look after the administrative functions of his business (e.g. general administrative support). The contract is for a 1-year term for a fixed 575,000 compensation. The terms of the contract stipulate that the office manager must work exclusively for Dan (i.e., the office manager cannot be employed or have other clients while working in Dan's business). Dan provides the office space and all related equipment and materials necessary for the performance of the office manager's duties pursuant to the contract. The contract requires the office manager to work based on the 9 am to 5 pm schedule, Monday to Friday. Dan is not sure what his tax compliance and reporting obligations are in connection with the hiring of the office manager. C. You learn from Dan that CRA performed a "desk audit" of Dan's 2019 personal tax return and asked him to provide support for certain business expenses claimed in calculating net business income. Dan was too busy to deal with the CRA and neglected to respond to the CRA. The CRA subsequently reassessed Dan's 2019 personal tax return to deny the deduction of these expenses which resulted in incremental taxes owing of $15,000. The CRA Notice of Reassessment is dated November 15, 2020. Dan indicated that he will provide you with all documentation to support the expenses sometime in July 2021 (he is too busy to deal with this now). Dan has asked that you assist him in dealing with the CRA on this matter in the summer. d. Dan has a policy of destroying accounting records related to his business 2 years after the end of the year (e.g., 2020 books and records will be destroyed in January 2023). Dan takes pride in his organizational skills and does not like to clutter his office with too much historical paperwork. Dan informed you in 2020 he acquired a rental property (condo) in Miami, Florida for $500,000. Dan leased the condo to a tenant under an annual lease arrangement. Dan is not sure how to e. account for this investment on his 2020 personal tax return. For each of the above noted items, do you see any tax compliance and/or reporting issues? If yes, what tax compliance and/or reporting issues and why? Advise Dan on kis tax compliance and reporting requirements and give recommendations as to appropriate course of action for each item. Ignore all GST and PST considerations as well as CRA administrative relief provisions related to tax compliance -REQUIRED and reporting matters.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Dan did not make any tax inst al ment payments to CRA for the 2020 taxation year He prefers to keep the cash in the bank because it yields 2 risk free interest annually Dan is adamant that if he wer...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started