Answered step by step

Verified Expert Solution

Question

1 Approved Answer

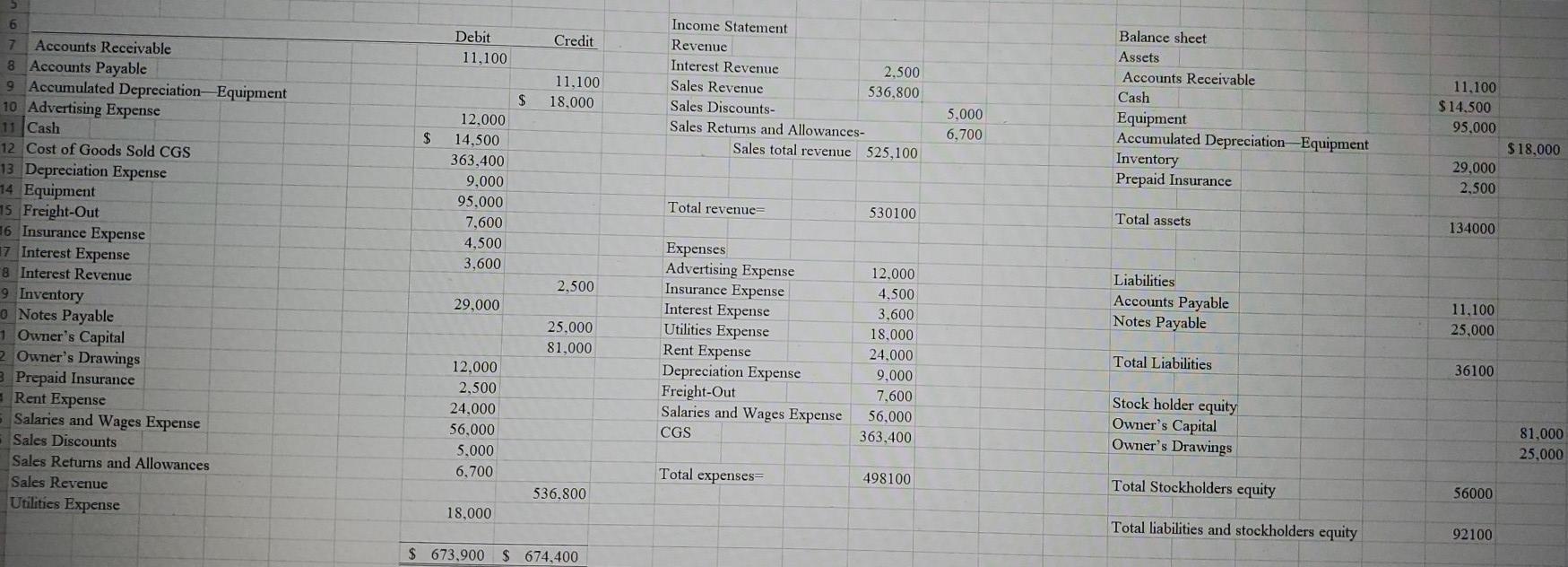

Create a financial statement, that means income statement and balance sheet wright? Income Statement Balance sheet Debit Credit Revenue Assets Accounts Receivable 8 Accounts Payable

Income Statement Balance sheet Debit Credit Revenue Assets Accounts Receivable 8 Accounts Payable 9 Accumulated Depreciation- Equipment 10 Advertising Expense 11 Cash 12 Cost of Goods Sold CGS 13 Depreciation Expense 14 Equipment 15 Freight-Out 16 Insurance Expense 17 Interest Expense 8 Interest Revenue 9 Inventory O Notes Payable 1 Owner's Capital 2 Owner's Drawings B Prepaid Insurance - Rent Expense Salaries and Wages Expense 7. 11,100 Interest Revenue 2,500 Accounts Receivable 11,100 11,100 Sales Revenue 536,800 Cash $14.500 2$ 18,000 Sales Discounts- Equipment Accumulated Depreciation-Equipment Inventory Prepaid Insurance 5,000 95,000 12,000 Sales Returns and Allowances- 6,700 $18,000 $ 14,500 Sales total revenue 525,100 29,000 363,400 2,500 9,000 95,000 Total revenue= 530100 Total assets 134000 7,600 4,500 Expenses Advertising Expense Insurance Expense Interest Expense Utilities Expense Rent Expense Depreciation Expense Freight-Out Salaries and Wages Expense 3,600 12,000 Liabilities 2,500 Accounts Payable Notes Payable 4,500 11,100 29,000 3,600 25,000 25,000 18,000 81,000 24,000 Total Liabilities 36100 12,000 9,000 Stock holder equity Owner's Capital Owner's Drawings 2,500 7,600 24,000 56,000 81,000 56,000 CGS 363,400 25,000 Sales Discounts 5,000 Sales Returns and Allowances 6,700 Total expenses= 498100 Total Stockholders equity 56000 Sales Revenue 536,800 Utilities Expense 18,000 Total liabilities and stockholders equity 92100 $ 673,900 $ 674,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started