Answered step by step

Verified Expert Solution

Question

1 Approved Answer

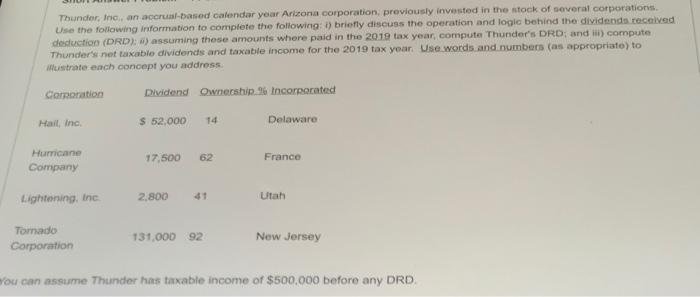

Thunder, Inc., an accrual-based calendar year Arizona oorporation, previously invested in the stock of several corporations. Use the following information to complete the following:

Thunder, Inc., an accrual-based calendar year Arizona oorporation, previously invested in the stock of several corporations. Use the following information to complete the following: ) briefly discuss the operation and logic behind the dividends received deduction (DRD): ) assuming these amounts where paid in the 2019 tax year, compute Thunder's DRD; and i) compute Thunder's net taxable dividends and taxable income for the 2019 tax year. Use.words and.numbers (as appropriate) to llustrate each concept you address Comoration Dividend Ownership % Incorporated $ 52,000 Delaware Hail, Inc. 14 Huricane 62 France 17,500 Company Lightening, Inc. 2,800 41 Utah Tornado 131,000 92 New Jersey Corporation You can assume Thunder has taxable income of $500.000 before any DRD.

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started