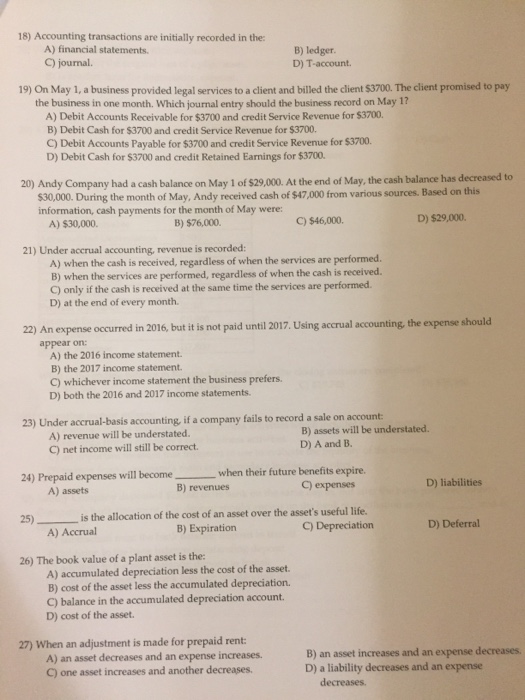

Accounting transactions are initially recorded in the: A) financial statements. B) ledger. C) journal. D) T - account. On May 1, a business provided legal services to a client and billed the client $3700. The client promised to pay the business in one month Which journal entry should the business record on May 1? A) Debit Accounts Receivable for $3700 and credit Service Revenue for $3700. B) Debit Cash for $3700 and credit Service Revenue for $3700. C) Debit Accounts Payable for $3700 and credit Service Revenue for $3700. D) Debit Cash for $3700 and credit Retained earnings for $3700. Andy Company had a cash balance on May 1 of $29,000. At the end of May, the cash balance has decreased to $30,000. During the month of May, Andy received cash of $47,000 from various sources. Based on this information, cash payments for the month of May were: A) $30,000. B) $76,000. C) $46,000.D) $29,000. Under accrual accounting, revenue is recorded: A) when the cash is received, regardless of when the services are performed. B) when the services are performed, regardless of when the cash is received. C) only if the cash is received at the same time the services are performed. D) at the end of every month. An expense occurred in 2016, but it is not paid until 2017. Using accrual accounting, the expense should appear on: A) the 2016 income statement. B) the 2017 income statement. C) whichever income statement the business prefers. D) both the 2016 and 2017 income statements. Under accrual - basis accounting, if a company fails to record a sale on account: A) revenue will be understated. B) assets will be understated. C) net income will still be correct. D) A and B. Prepaid expenses will become ____ when their future benefits expire. A) assets B) revenues C) expenses D) liabilities ____ is the allocation of the cost of an asset over the asset's useful life. A) Accrual B) Expiration C) Depreciation D) Deferral The book value of a plant asset is the: A) accumulated depreciation less the cost of the asset. B) cost of the asset less the accumulated depreciation. C) balance in the accumulated depreciation account. D) cost of the asset. When an adjustment is made for prepaid rent: A) an asset decreases and an expense increases. B) an asset increases and an expense decreases. C) one asset increases and another decreases. D) a liability decreases and an expense decreases