Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Green Zebra wants to expand its specialty convenience stores into the Califronia market. While Gz 5 currently holding surplus cash of $7,500,000 to

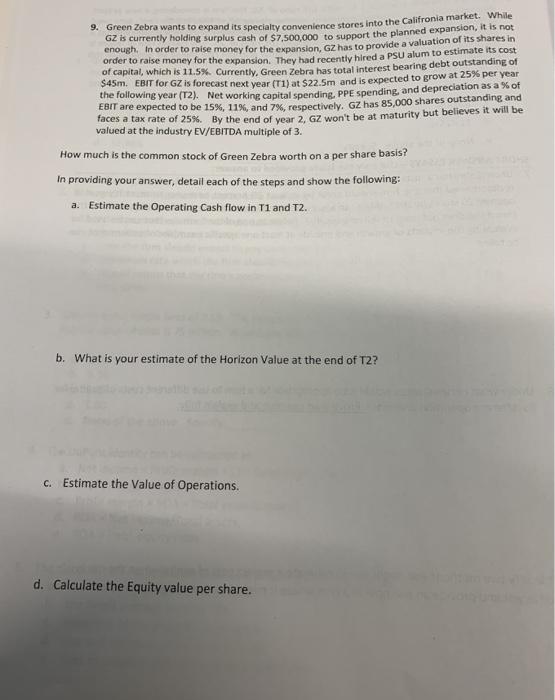

3. Green Zebra wants to expand its specialty convenience stores into the Califronia market. While Gz 5 currently holding surplus cash of $7,500,000 to support the planned expansion, it is not enough. In order to raise money for the expansion, GZ has to provide a valuation of itS shares in order to raise money for the expansion. They had recentty hired a PSU alum to estimate its cost of capital, which is 11.5%. Currently, Green Zebra has total interest bearing debt outstanding of S4sm. EBIT for GZ is forecast next year (T1) at $22.5m and is expected to grow at 25% per year the following year (T2). Net working capital spending, PPE spending, and depreciation as a % of Ean are expected to be 15%, 11%, and 7%, respectively, GZ has 85,000 shares outstanding and faces a tax rate of 25%. By the end of year 2. GZ won't be at maturity but believes it will be valued at the industry EV/EBITDA multiple of 3. How much is the common stock of Green Zebra worth on a per share basis? In providing your answer, detail each of the steps and show the following: a. Estimate the Operating Cash flow in T1 and T2. b. What is your estimate of the Horizon Value at the end of T2? c. Estimate the Value of Operations. d. Calculate the Equity value per share.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

T0 T1 T2 EBIT 225 28125 LessTax at 25 5625 703125 EAT 16875 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started