Answered step by step

Verified Expert Solution

Question

1 Approved Answer

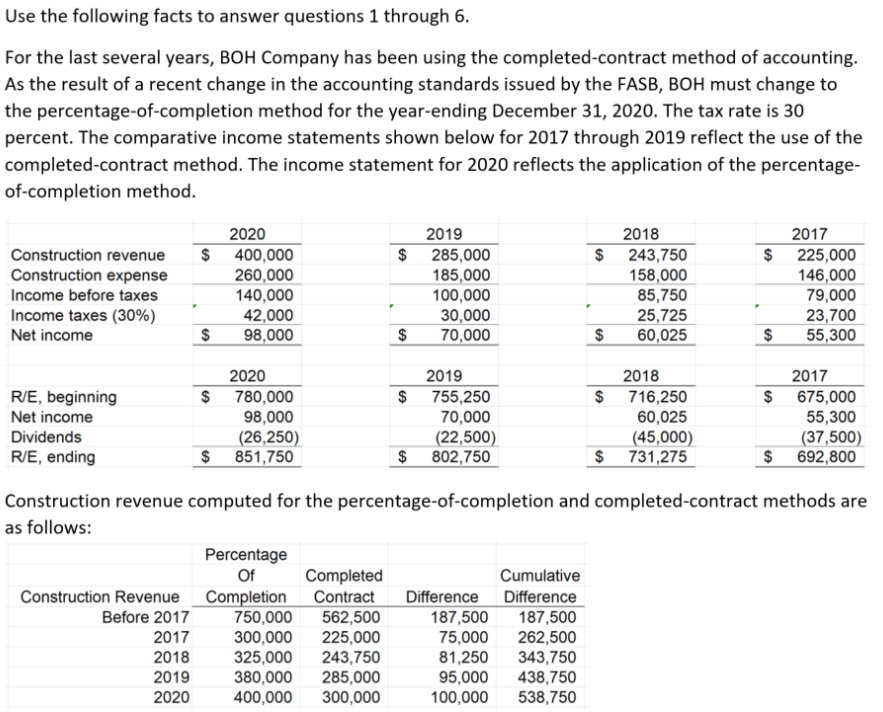

Use the following facts to answer questions 1 through 6. For the last several years, BOH Company has been using the completed-contract method of

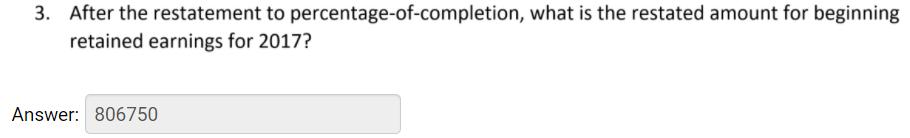

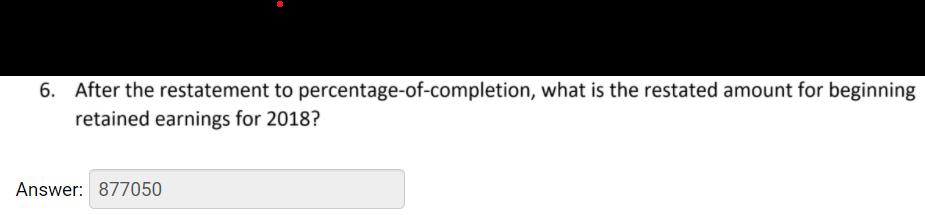

Use the following facts to answer questions 1 through 6. For the last several years, BOH Company has been using the completed-contract method of accounting. As the result of a recent change in the accounting standards issued by the FASB, BOH must change to the percentage-of-completion method for the year-ending December 31, 2020. The tax rate is 30 percent. The comparative income statements shown below for 2017 through 2019 reflect the use of the completed-contract method. The income statement for 2020 reflects the application of the percentage- of-completion method. 2020 2019 2018 2017 400,000 $ 243,750 $ 225,000 146,000 79,000 23,700 55,300 Construction revenue Construction expense $ 260,000 140,000 42,000 285,000 185,000 100,000 30,000 $ 158,000 Income before taxes 85,750 25,725 60,025 Income taxes (30%) Net income 24 98,000 70,000 2020 2019 2018 2017 $ 716,250 60,025 (45,000) 2$ $ 675,000 55,300 (37,500) $ 692,800 $ $ 755,250 70,000 |(22,500) $ R/E, beginning 780,000 Net income Dividends R/E, ending 98,000 (26,250) $ 851,750 802,750 731,275 Construction revenue computed for the percentage-of-completion and completed-contract methods are as follows: Percentage Of Construction Revenue _Completion 750,000 300,000 325,000 380,000 400,000 Completed Contract Cumulative Difference Difference Before 2017 562,500 225,000 243,750 285,000 300,000 187,500 75,000 81,250 95,000 100,000 187,500 262,500 343,750 438,750 538,750 2017 2018 2019 2020 3. After the restatement to percentage-of-completion, what is the restated amount for beginning retained earnings for 2017? Answer: 806750 After the restatement to percentage-of-completion, what is the restated amount for beginning retained earnings for 2018? Answer: 877050

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

3 Begining Retained earnings for 2017 Description Amant Retained E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started