Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information for questions I and 2. On June 30, 2020, the Warle, Xin, and Yates partnership had the following fiscal year-end

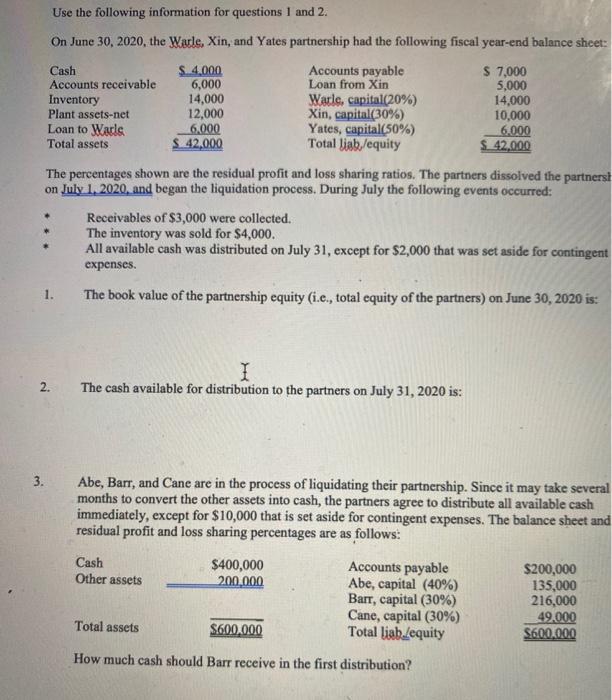

Use the following information for questions I and 2. On June 30, 2020, the Warle, Xin, and Yates partnership had the following fiscal year-end balance sheet: S 7,000 5,000 14,000 10,000 6,000 42,000 Accounts payable Loan from Xin $4.000 6,000 14,000 12,000 6.000 42,000 Cash Accounts receivable Inventory Plant assets-net Loan to Warle Total assets Warle, capital(20%) Xin, capital(30%) Yates, capital(50%) Total ljab,/equity The percentages shown are the residual profit and loss sharing ratios. The partners dissolved the partnerst on July 1, 2020, and began the liquidation process. During July the following events occurred: Receivables of $3,000 were collected. The inventory was sold for $4,000. All available cash was distributed on July 31, except for $2,000 that was set aside for contingent expenses. 1. The book value of the partnership equity (i.e., total equity of the partners) on June 30, 2020 is: The cash available for distribution to the partners on July 31, 2020 is: Abe, Barr, and Cane are in the process of liquidating their partnership. Since it may take several months to convert the other assets into cash, the partners agree to distribute all available cash immediately, except for $10,000 that is set aside for contingent expenses. The balance sheet and residual profit and loss sharing percentages are as follows: 3. Cash $400,000 200.000 Accounts payable Abe, capital (40%) , pital (30%6) Cane, capital (30%) Total liablequity $200,000 135,000 216,000 49.000 $600.000 Other assets Total assets $600.000 How much cash should Barr receive in the first distribution? 2.

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started